Last Update 16 Sep 25

Fair value Decreased 1.56%Embracing Electrification And Data Growth Will Expand Future Infrastructure Investments

Consensus revenue growth forecasts for Antin Infrastructure Partners SAS have significantly decreased, partially offset by an improvement in projected net profit margin, resulting in a slight downward revision of the analyst price target from €13.54 to €13.33.

What's in the News

- Antin Infrastructure Partners approved an interim dividend of €0.36 per share, totaling €64.5 million, to be paid in cash, in line with its policy of distributing the majority of earnings in two installments per year.

- Walid Damou was appointed Group Chief Financial Officer, effective February 2026, succeeding Patrice Schuetz. Damou brings significant experience from CVC Capital Partners and Morgan Stanley, including work on Antin’s IPO.

- The board meeting also reviewed first-half 2025 performance and confirmed key dates for the dividend payment.

Valuation Changes

Summary of Valuation Changes for Antin Infrastructure Partners SAS

- The Consensus Analyst Price Target remained effectively unchanged, moving only marginally from €13.54 to €13.33.

- The Consensus Revenue Growth forecasts for Antin Infrastructure Partners SAS has significantly fallen from 11.0% per annum to 9.6% per annum.

- The Net Profit Margin for Antin Infrastructure Partners SAS has risen from 33.04% to 35.67%.

Key Takeaways

- Antin's strategic focus on electrification, decarbonization, and data growth aligns with long-term trends, enhancing infrastructure investment returns and revenue streams.

- Successful fundraising and expansion into North America and Asia Pacific boost capital deployment ability and create substantial growth opportunities for earnings and margins.

- High dividend payout may limit reinvestment, while fundraising misalignment and rising costs could pressure future earnings and margins amidst geopolitical and regulatory challenges.

Catalysts

About Antin Infrastructure Partners SAS- A private equity firm specializing in infrastructure investments.

- Antin Infrastructure Partners is well-positioned to leverage supportive secular trends such as electrification, decarbonization, and the exponential growth of data, which are expected to drive long-term growth in its infrastructure investments, potentially leading to increased revenue streams.

- With successful fundraising efforts for Flagship Fund V, now the largest infrastructure fund closed globally in 2024, Antin's increasing ability to deploy capital effectively could enhance future earnings growth and profitability.

- The company is set to expand its investor base, notably within the North American and Asia Pacific markets, providing additional growth opportunities that could positively impact revenue and earnings.

- Antin's focus on performance improvement through AI and data science, alongside sustainability initiatives, positions its portfolio companies to capitalize on growth initiatives, potentially improving net margins and overall value creation.

- The imminent launch of Mid Cap Fund II and the potential acceleration of exit activity, including planned exits in 2025 and 2026, are expected to enhance carried interest revenue and augment their earnings trajectory.

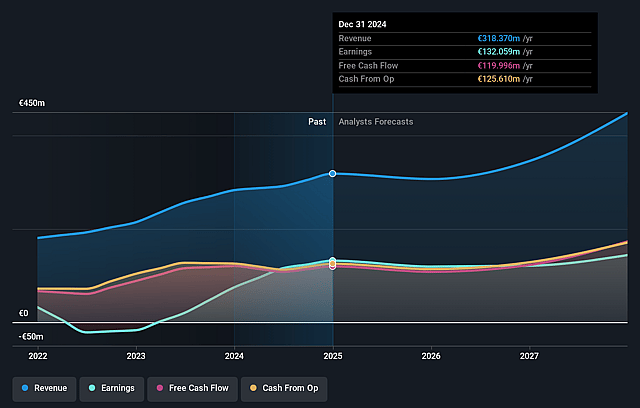

Antin Infrastructure Partners SAS Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Antin Infrastructure Partners SAS's revenue will grow by 11.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 41.5% today to 33.0% in 3 years time.

- Analysts expect earnings to reach €143.9 million (and earnings per share of €0.8) by about September 2028, up from €132.1 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €168 million in earnings, and the most bearish expecting €105.0 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.8x on those 2028 earnings, up from 15.3x today. This future PE is greater than the current PE for the FR Capital Markets industry at 19.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.4%, as per the Simply Wall St company report.

Antin Infrastructure Partners SAS Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Despite strong financial performance, the plan to maintain the dividend at €0.71 per share and the high payout ratio of 93% might limit reinvestment opportunities, potentially affecting future earnings growth.

- With several funds near full deployment but next fundraising cycles planned for 2026, there could be a temporary misalignment between investments and fundraising, which might impact revenue.

- Prolonged holding periods due to uncertain market conditions can delay exits, affecting the realization of carried interest expected from funds like Fund III-B, thus impacting earnings projections.

- Rising operating expenses, including compensation increases and the hiring of senior personnel, may pressure net margins if not offset by proportional revenue growth.

- The geopolitical environment and potential regulatory changes, especially in renewables and U.S. investments, can introduce valuation uncertainties, impacting fund performance and subsequent exit strategies.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €13.544 for Antin Infrastructure Partners SAS based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €18.0, and the most bearish reporting a price target of just €11.3.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €435.5 million, earnings will come to €143.9 million, and it would be trading on a PE ratio of 20.8x, assuming you use a discount rate of 7.4%.

- Given the current share price of €11.28, the analyst price target of €13.54 is 16.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.