Key Takeaways

- Rapidly maturing portfolio companies and co-investment with major institutional investors could drive earlier and stronger growth in carried interest and management fee revenues.

- Strategic expansion into capital-light, high-growth sectors and ongoing internal investments position Antin for outperformance in both organic growth and earnings quality.

- Currency fluctuations, delayed exits, rising costs, and industry competition all threaten Antin's revenue growth, earnings momentum, and long-term profitability.

Catalysts

About Antin Infrastructure Partners SAS- A private equity firm specializing in infrastructure investments.

- Analyst consensus expects carried interest and exit-driven earnings acceleration in 2026–2027, but this may understate Antin's optionality: with several mature companies, a snapback in FX or market conditions could trigger outsized carried interest recognition much sooner and at higher levels, driving a step change in net income greater and earlier than current forecasts.

- Analysts broadly agree that Antin's scale (e.g., flagship Fund V) and global reach support long-term management fee growth, but this overlooks the game-changing co-investment opportunities now possible with sovereign wealth funds and mega-LPs; these large-ticket investments could rapidly expand fee-paying AUM and management revenue far beyond current growth rates.

- Antin's disciplined platform-building approach, evidenced by nearly 20% EBITDA growth in underlying portfolio companies, creates sustained and compounding long-term value: as these platforms mature, value creation aligns with accelerating exit multiples and produces higher realized gains, boosting carried interest and earnings quality substantially over time.

- Expansion into capital-light and high-growth segments such as smart mobility, digital infrastructure, and renewables positions Antin at the nexus of ongoing urbanization and energy transition, unlocking new revenue streams and significantly enhancing both AUM growth and long-term profit margins.

- Antin's existing strong cash position and continued investment in team scaling and new strategies provide substantial latent capacity for high-ROIC organic growth and strategic M&A, creating an overlooked catalyst for both top-line and bottom-line outperformance over the next 3-5 years.

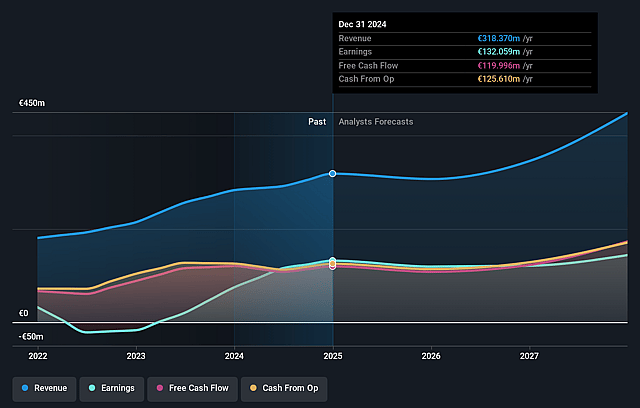

Antin Infrastructure Partners SAS Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Antin Infrastructure Partners SAS compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Antin Infrastructure Partners SAS's revenue will grow by 16.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 41.5% today to 33.6% in 3 years time.

- The bullish analysts expect earnings to reach €169.8 million (and earnings per share of €0.93) by about September 2028, up from €132.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 22.6x on those 2028 earnings, up from 14.5x today. This future PE is greater than the current PE for the FR Capital Markets industry at 19.5x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.47%, as per the Simply Wall St company report.

Antin Infrastructure Partners SAS Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's earnings and revenue growth are vulnerable to foreign exchange volatility, as recent U.S. dollar depreciation against the euro significantly reduced asset values and prevented recognition of carried interest, highlighting an ongoing risk that could continue to dampen reported earnings and pressure net margins.

- The slower pace of capital deployment and uncertainty in realizing portfolio exits, exacerbated by a volatile macroeconomic and geopolitical environment, may delay new fundraising cycles and the recognition of performance fees, putting both revenue and future earnings growth at risk.

- Lower market-wide distributions to investors (DPI) are limiting investors' ability and appetite to allocate more capital to new funds, which could restrict Antin's future assets under management growth, slow management fee increases, and put pressure on topline revenue.

- The company's increasing operational expenses, particularly from personnel growth and expansion into the U.S., combined with the need to invest ahead of fundraising and deployment cycles, could outpace revenue growth and compress net margins if fund-raising or exits underperform expectations.

- Sector-wide and long-term competitive pressures-including rising competition among infrastructure fund managers and heightened regulatory and ESG requirements-risk compressing management and performance fees while increasing compliance costs, collectively threatening profitability and sustainable long-term earnings for Antin.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Antin Infrastructure Partners SAS is €17.38, which represents two standard deviations above the consensus price target of €13.54. This valuation is based on what can be assumed as the expectations of Antin Infrastructure Partners SAS's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €18.0, and the most bearish reporting a price target of just €11.3.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €505.2 million, earnings will come to €169.8 million, and it would be trading on a PE ratio of 22.6x, assuming you use a discount rate of 7.5%.

- Given the current share price of €10.74, the bullish analyst price target of €17.38 is 38.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.