Key Takeaways

- Accelerated global fundraising and early-stage infrastructure investments could fuel long-term, recurring revenue growth and structurally higher profit margins beyond market expectations.

- Integration of advanced technologies and aggressive reinvestment strategies position Antin for exponential expansion in fee streams and operating leverage, outpacing sector peers.

- Exposure to shifting investor preferences, increasing competition, macroeconomic risks, and reliance on successful exits and newer segments may constrain sustainable earnings and revenue growth.

Catalysts

About Antin Infrastructure Partners SAS- A private equity firm specializing in infrastructure investments.

- While analyst consensus views Antin's fundraising success as a driver of future growth, they may be underestimating the pace and scale at which the firm's access to global institutional and private wealth capital-especially the rapid expansion in North America and Asia Pacific-can accelerate assets under management well beyond market forecasts, leading to a sustained step-change in long-term recurring revenues and management fees.

- Analysts broadly agree that supportive mega-trends like decarbonization and data growth underpin long-term value creation, but this outlook does not fully capture how Antin's disproportionately large positions in early-stage green energy, hydrogen logistics, and digital infrastructure assets could deliver outsized, inflation-linked and recurring cash flows, structurally boosting future net margins as these infrastructures become more essential to modern economies.

- Antin's aggressive reinvestment of its sizable cash position into launching transformative new organic strategies and geographic platforms-using both M&A and seed funding for new fund vintages-sets the stage for exponential growth in management and performance fee streams, well above current earnings estimates as these new verticals mature.

- The firm's seamless integration of AI, data science, and sustainability-driven performance management across its portfolio companies is already yielding significant operating leverage; as these initiatives scale, they are poised to unlock substantial value, accelerating EBITDA and net income growth in a manner that is not yet reflected in current market valuations.

- Antin's leading share in large-cap infrastructure fundraising and demonstrated ability to secure the largest deals in a market that is rapidly consolidating around a few global giants places it in a winner-take-most scenario, likely ensuring both premium fee rates and elevated carried interest accruals well ahead of sector peers, which the market may be failing to price in.

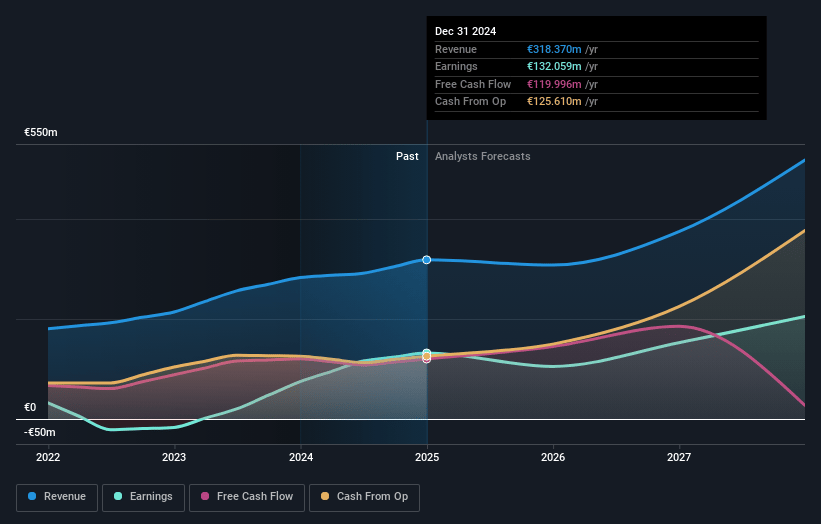

Antin Infrastructure Partners SAS Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Antin Infrastructure Partners SAS compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Antin Infrastructure Partners SAS's revenue will grow by 19.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 41.5% today to 31.0% in 3 years time.

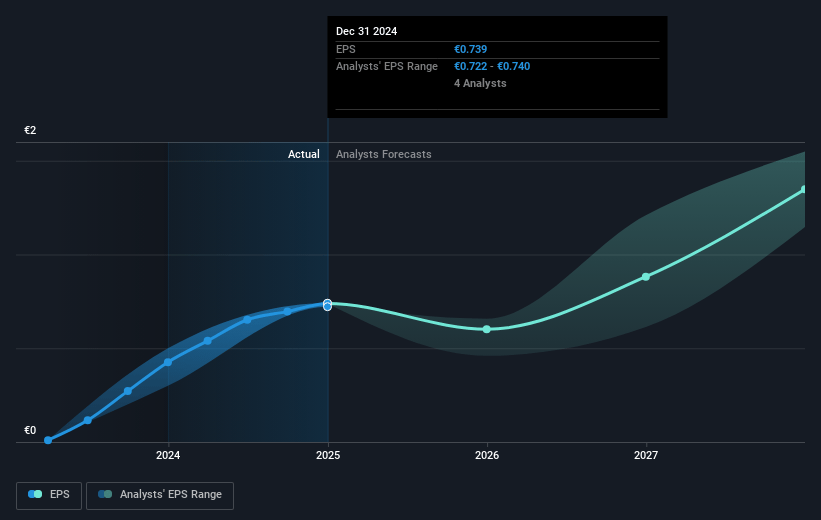

- The bullish analysts expect earnings to reach €169.8 million (and earnings per share of €0.93) by about July 2028, up from €132.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 22.5x on those 2028 earnings, up from 15.6x today. This future PE is lower than the current PE for the FR Capital Markets industry at 23.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.24%, as per the Simply Wall St company report.

Antin Infrastructure Partners SAS Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The firm's reliance on robust fundraising growth creates risk if investor preferences shift to lower-fee passive vehicles or more direct deployment, potentially leading to slower growth in assets under management and putting long-term revenue expansion at risk.

- Secular trends such as rising interest rates and tighter monetary policy may again reappear, raising financing costs for portfolio companies and potentially compressing net margins and investment returns, especially if macro conditions reverse.

- The focus on European mid-market infrastructure leaves Antin exposed to intensifying competition, which may pressure management fees while crowding by public capital or government funding could limit scalable private investment opportunities, ultimately impacting fee income and long-term earnings.

- Heavy recent investments in sustainability-linked and digital infrastructure remain early in their growth trajectory and Antin's limited track record in newer segments like energy transition and digital assets carries risk, as underperformance versus more diversified competitors may constrain future revenue streams.

- A significant portion of near-term dividend and earnings growth depends on successful exits and realization of carried interest, with execution risk if delayed deal-making, macro uncertainty, or changing regulatory environments slow down exits, potentially limiting earnings and cash flow available for shareholder distributions.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Antin Infrastructure Partners SAS is €17.42, which represents two standard deviations above the consensus price target of €13.57. This valuation is based on what can be assumed as the expectations of Antin Infrastructure Partners SAS's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €18.0, and the most bearish reporting a price target of just €11.3.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €547.0 million, earnings will come to €169.8 million, and it would be trading on a PE ratio of 22.5x, assuming you use a discount rate of 7.2%.

- Given the current share price of €11.56, the bullish analyst price target of €17.42 is 33.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.