Key Takeaways

- Leadership in affordable EVs and digital initiatives is challenged by falling demand, high spending, and margin pressures due to intensified competition and regulatory demands.

- Structural declines in traditional car ownership and the rise of shared mobility threaten Renault's long-term growth despite product strengths and efficiency improvement efforts.

- Weak European demand, heightened competition, funding pressures, and leadership uncertainty may challenge Renault's ability to sustain margins, recover growth, and maintain investor confidence.

Catalysts

About Renault- Engages in the design, manufacture, sale, repair, maintenance, and leasing of motor vehicles in Europe, Eurasia, Africa, the Middle East, the Asia Pacific, and the Americas.

- Although Renault's leadership in cost-effective electric vehicles and new launches could help boost sales volumes in growing EV markets, persistent commercial pressure and declining retail market demand in key European regions threaten sustained revenue growth and could cap near-term top-line improvements.

- While accelerating investments in digital mobility and Renault's ongoing strategic alliances with technology partners have the potential to open new recurring revenue streams and improve margin mix, high and rising capital expenditure requirements for electrification and digitalization may continue to weigh on free cash flow and keep net margins under pressure.

- Even as urbanization trends and the demand for compact, affordable vehicles align with Renault's product strengths, the broader structural decline in Western European car ownership rates and the shift toward shared mobility services may erode Renault's long-term addressable market, limiting opportunities for volume growth and revenue expansion.

- Despite demonstrated momentum in streamlining through the Ampere spin-off and executing on immediate cost reduction plans, intensifying competition-particularly from cost-competitive Chinese entrants-risks driving down industry prices and compressing Renault's profitability, making it harder to achieve and sustain structural margins above 6 percent.

- While tighter emissions regulations create an environment favorable to automakers with advanced EV lineups, Renault's underperformance in light commercial vehicles and lingering operational challenges could result in continued margin volatility and increased risk to future earnings targets.

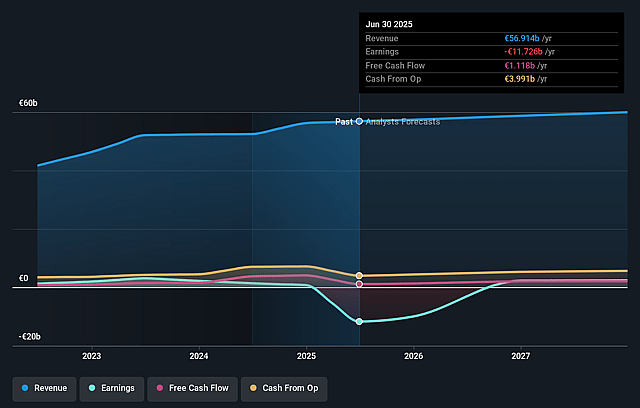

Renault Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Renault compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Renault's revenue will decrease by 0.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -20.6% today to 4.1% in 3 years time.

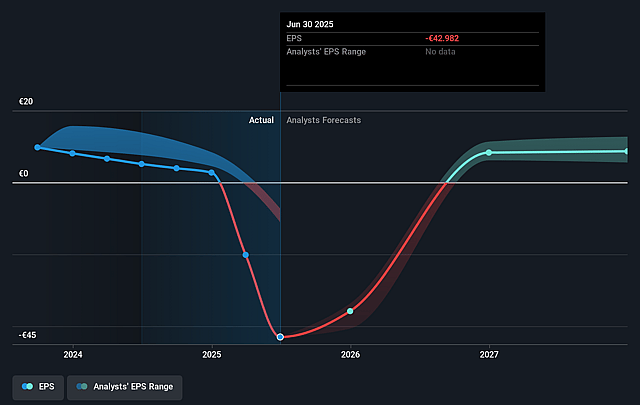

- The bearish analysts expect earnings to reach €2.4 billion (and earnings per share of €8.74) by about September 2028, up from €-11.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 6.1x on those 2028 earnings, up from -0.8x today. This future PE is lower than the current PE for the GB Auto industry at 9.4x.

- Analysts expect the number of shares outstanding to grow by 0.27% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.1%, as per the Simply Wall St company report.

Renault Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained weakness and decline in the European retail auto market, especially in France where Renault holds a higher retail market share, could continue to erode core revenues and pressure margins in the coming years.

- Intensifying commercial pressure and competitive pricing from rivals, alongside underperformance in the light commercial vehicle segment, may result in lowered operating margins and revenue growth risks if Renault cannot recover market share or pricing power.

- Lower-than-expected free cash flow generation and persistent negative changes in working capital requirements suggest Renault may struggle to internally finance its ongoing electrification and technology transition, potentially weighing on future earnings and increasing reliance on external funding.

- The need for continued aggressive cost-cutting, especially in SG&A and manufacturing, might signal structural profitability challenges that could limit long-term margin expansion and dampen earnings growth, especially if the broader automotive market remains subdued.

- Recent leadership changes and the interim CEO appointment in a period of market underperformance could prolong uncertainty and affect investor confidence, raising the company's cost of capital and heightening the risk of earnings volatility into the future.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Renault is €38.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Renault's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €63.7, and the most bearish reporting a price target of just €38.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €57.3 billion, earnings will come to €2.4 billion, and it would be trading on a PE ratio of 6.1x, assuming you use a discount rate of 12.1%.

- Given the current share price of €34.09, the bearish analyst price target of €38.0 is 10.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.