Key Takeaways

- Accelerated product launches, cost efficiencies, and disciplined inventory management are set to drive significant gains in market share, revenues, and operational margins.

- Strong performance in direct sales and connected vehicle technologies positions Renault to capture recurring revenues and capitalize on evolving urban mobility trends.

- Ongoing market declines, margin pressures, and execution risks threaten Renault's earnings outlook and ability to invest, underscoring structural vulnerability amid industry transition.

Catalysts

About Renault- Engages in the design, manufacture, sale, repair, maintenance, and leasing of motor vehicles in Europe, Eurasia, Africa, the Middle East, the Asia Pacific, and the Americas.

- Analyst consensus believes Renault's product launches and brand realignment will modestly boost market share in electrification, but with a robust pipeline of seven launches and two facelifts within a single year and high factory utilization rates, Renault could significantly outpace industry volume growth in both EVs and hybrids, substantially accelerating revenue and market share gains in the coming cycles.

- While analysts broadly expect cost efficiency initiatives to improve net margins, the combination of immediate cost-cutting on SG&A, deeper R&D and manufacturing savings, and rapidly improving working capital discipline could drive operational margins well above seven percent on a sustained, multi-year basis, supporting material upside to both free cash flow and earnings.

- Renault's high exposure to the retail sales segment-where it already outpaces peers by 15 points-positions the company to leverage the global shift in consumer preferences toward direct, digital and subscription models, potentially unlocking new high-margin, recurring revenues as urban mobility evolves.

- By maintaining two months of forward sales in its order book and sharply managing inventory, Renault is ideally positioned to rapidly scale flexible manufacturing and tailor output to high-demand, higher-margin models, supporting both near-term earnings recovery and long-term capital efficiency.

- Industry-leading advances in connected vehicle technology and over-the-air update capabilities embedded in new Renault models stand to open substantial new revenue streams from mobility services, software, and in-car digital subscriptions, unlocking long-term top-line growth and margin expansion beyond traditional vehicle sales.

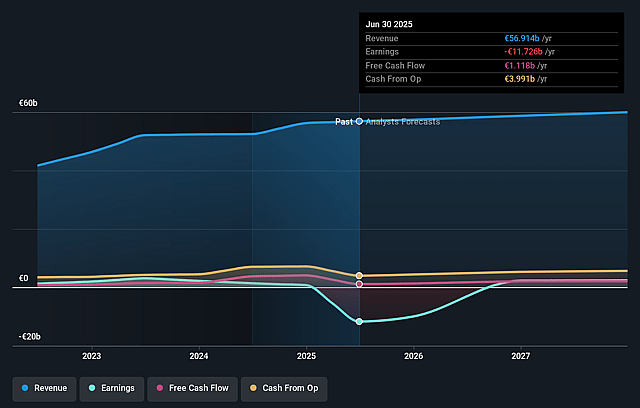

Renault Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Renault compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Renault's revenue will grow by 4.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -20.6% today to 8.5% in 3 years time.

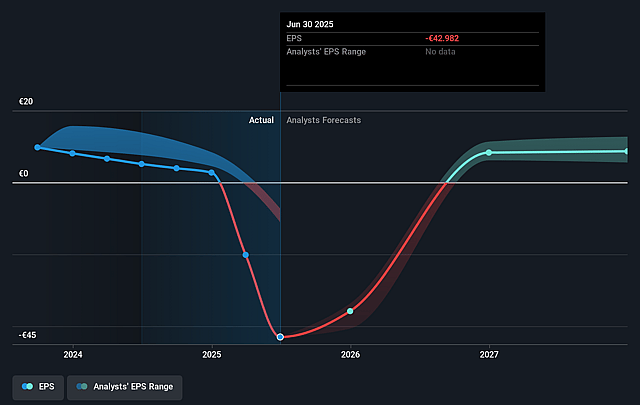

- The bullish analysts expect earnings to reach €5.4 billion (and earnings per share of €20.01) by about September 2028, up from €-11.7 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 4.3x on those 2028 earnings, up from -0.8x today. This future PE is lower than the current PE for the GB Auto industry at 9.4x.

- Analysts expect the number of shares outstanding to grow by 0.27% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.1%, as per the Simply Wall St company report.

Renault Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The continued decline in the European retail car market, especially in France where Renault holds greater market share, poses a risk to ongoing revenue growth and indicates underlying challenges in consumer demand.

- Intensifying commercial pressure and increasing competition, highlighted by weaker volumes and underperformance in the light commercial vehicle segment, are likely to suppress pricing power and further compress operating margins.

- Despite Renault's push into new vehicle launches and upcoming facelifts, ongoing concerns about the profitability of electric vehicles and over-reliance on LCV recovery reveal execution risks and could delay improvements in net earnings.

- Lowered guidance for both operating margin and free cash flow-now targeting a margin of 6.5 percent (down from above 7 percent) and 2025 free cash flow of 1 to 1.5 billion euros (down from above 2 billion euros)-reflects sustained challenges in operational efficiency and points to diminished future cash generation.

- The need for accelerated cost reductions and manufacturing efficiencies, as well as reliance on immediate SG&A cuts, signals persistent exposure to the high capital intensity of the automotive transition, potentially limiting Renault's ability to invest in innovation and eroding its long-term earnings power.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Renault is €60.77, which represents two standard deviations above the consensus price target of €46.78. This valuation is based on what can be assumed as the expectations of Renault's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €63.7, and the most bearish reporting a price target of just €38.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €63.9 billion, earnings will come to €5.4 billion, and it would be trading on a PE ratio of 4.3x, assuming you use a discount rate of 12.1%.

- Given the current share price of €34.09, the bullish analyst price target of €60.77 is 43.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.