Last Update 18 Sep 25

Fair value Decreased 1.17%Despite a notable upgrade in consensus revenue growth forecasts for Renault, the analyst price target saw a marginal decline to €46.78, indicating only a slight cooling in fair value expectations.

What's in the News

- Renault acquired Nissan's remaining 51% stake in their joint Chennai plant, becoming sole owner and fully consolidating RNAIPL; this supports an expanded India strategy including a new design center and five upcoming vehicle launches.

- François Provost, previously Chief Procurement, Partnerships and Public Affairs Officer, was appointed CEO of Renault S.A. for a four-year term, succeeding interim CEO Duncan Minto.

- Renault collaborated with Cooper Standard on the eco-conscious Embleme demo car, introducing recyclable FlexiCore thermoplastic body seals and FlushSeal systems for lighter weight, lower CO2 emissions, and greater design flexibility.

- Duncan Minto, former CFO, served as interim CEO ahead of Provost's appointment to ensure management continuity.

Valuation Changes

Summary of Valuation Changes for Renault

- The Consensus Analyst Price Target remained effectively unchanged, moving only marginally from €47.33 to €46.78.

- The Consensus Revenue Growth forecasts for Renault has significantly risen from 1.7% per annum to 2.5% per annum.

- The Future P/E for Renault remained effectively unchanged, moving only marginally from 7.39x to 7.26x.

Key Takeaways

- Strategic brand realignment and product innovation drive Renault's competitiveness in the EV and hybrid market, potentially boosting revenue and improving net margins.

- Operational efficiency, strategic partnerships, and model expansions aim to enhance market penetration and financial health through cost synergies and increased market reach.

- Renault faces revenue unpredictability from volatile markets, regulatory cost pressures on margins, and strategic risks from joint ventures and negative associate contributions.

Catalysts

About Renault- Engages in the design, manufacture, sale, repair, maintenance, and leasing of motor vehicles in Europe, Eurasia, Africa, the Middle East, the Asia Pacific, and the Americas.

- Renault is leveraging its brand realignment and product innovation to capture market share in the EV and hybrid market, with a focus on making these vehicles more affordable and appealing to consumers. This strategy is expected to boost revenue and potentially improve net margins through enhanced product mix.

- The significant reduction in development time and costs due to the Ampere initiative allows Renault to bring competitive EVs to market more rapidly. This operational efficiency should contribute positively to earnings by decreasing production costs while maintaining high product quality.

- Renault's strategic partnerships, such as those with Geely and Aramco, are designed to enhance scale and competitiveness, particularly in regions where Renault seeks greater market penetration. These alliances are expected to enhance earnings through cost synergies and expanded market reach.

- The introduction of new models, such as the Renault 5 and Twingo, and the expansion into segments like C-segment SUVs and smaller urban vehicles are positioned to tap into unmet consumer demand, which should drive revenue growth.

- Renault is positioning itself for operational agility in a volatile market, with plans for cost reductions and productivity enhancements, such as shrinking fixed costs in collaboration with partners. This will likely support net margins and bolster free cash flow, ensuring robust financial health.

Renault Future Earnings and Revenue Growth

Assumptions

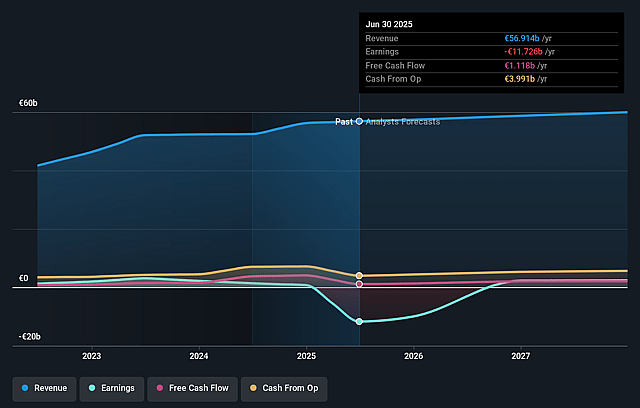

How have these above catalysts been quantified?- Analysts are assuming Renault's revenue will grow by 1.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from -20.6% today to 4.1% in 3 years time.

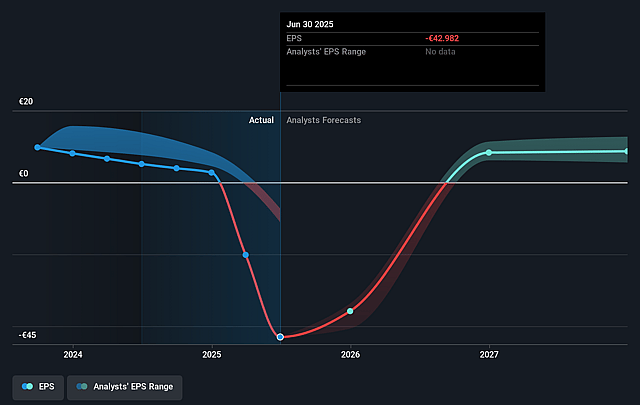

- Analysts expect earnings to reach €2.5 billion (and earnings per share of €8.92) by about September 2028, up from €-11.7 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €3.5 billion in earnings, and the most bearish expecting €1.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.4x on those 2028 earnings, up from -0.7x today. This future PE is lower than the current PE for the GB Auto industry at 9.4x.

- Analysts expect the number of shares outstanding to grow by 0.27% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.1%, as per the Simply Wall St company report.

Renault Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Renault's reliance on volatile markets such as Argentina and Turkey, with negative currency impacts from the Argentinian peso and Turkish lira devaluations, could affect revenue unpredictably, impacting the company's financial results.

- The company's need to incentivize EV sales to meet the strict CAFE (Corporate Average Fuel Economy) regulations in 2025 may lead to lower profit margins due to potential price cuts, thereby impacting net margins.

- Renault's joint ventures and partnerships, especially the reliance on Geely for certain platforms, may expose it to strategic risks, including integration challenges and potential for disagreements, which could affect earnings.

- The necessity to meet stringent regulatory requirements like CAFE within a short timeline could lead to increased costs, affecting Renault's ability to maintain robust net margins.

- Negative contributions from associated companies, like Nissan, and impairments, such as those on Nissan shares, might continue to impact Renault's net earnings if this does not stabilize.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €47.333 for Renault based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €63.7, and the most bearish reporting a price target of just €38.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €59.9 billion, earnings will come to €2.5 billion, and it would be trading on a PE ratio of 7.4x, assuming you use a discount rate of 12.1%.

- Given the current share price of €32.56, the analyst price target of €47.33 is 31.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.