Key Takeaways

- Strong execution in asset rotation, renewables, and digitalization is likely to drive margin expansion and resilient free cash flow ahead of industry peers.

- Feedstock optimization and a flexible refining system position the company to benefit from both biofuel demand and potential oil market dislocations.

- Accelerating energy transition, regulatory pressures, delayed renewables investment, and geopolitical exposure together threaten Repsol's core profitability, cash flow stability, and future financial flexibility.

Catalysts

About Repsol- Operates as a multi-e energy company in Spain, Peru, the United States, Portugal, and internationally.

- While analyst consensus expects efficiency gains from the U.K. upstream merger, the $1 billion in projected synergies could be a floor rather than a ceiling, with the potential for further upside as advanced digitalization and automation are implemented, driving even greater reductions in operating costs and boosting future margins and cash flow.

- Analysts broadly agree that asset rotations and CapEx discipline will support resilient free cash flow, but the company's demonstrated ability to rapidly monetize renewable assets in both Spain and the U.S., even during market volatility, suggests Repsol could unlock value well ahead of peers, accelerating EPS growth and allowing for above-guidance shareholder distributions.

- Repsol's aggressive expansion into renewable energy and biofuels positions it to capture outsized upside from rising decarbonization incentives and regulatory mandates, supporting secular revenue growth and expanding EBITDA from low-carbon operations at a faster rate than the market expects.

- The proactive optimization of feedstock through acquisitions such as Bunge Iberia is set to structurally lower input costs for biofuel production, enhancing operational leverage and driving sustained improvement in net margins as demand for advanced fuels grows worldwide.

- Persistent underinvestment in global upstream supply and a structurally flexible, technologically advanced refining system provide Repsol with unique exposure to potential supply shocks, meaning the company could realize higher-than-expected refining margins and revenue if oil markets tighten, while maintaining operational resilience even in downturns.

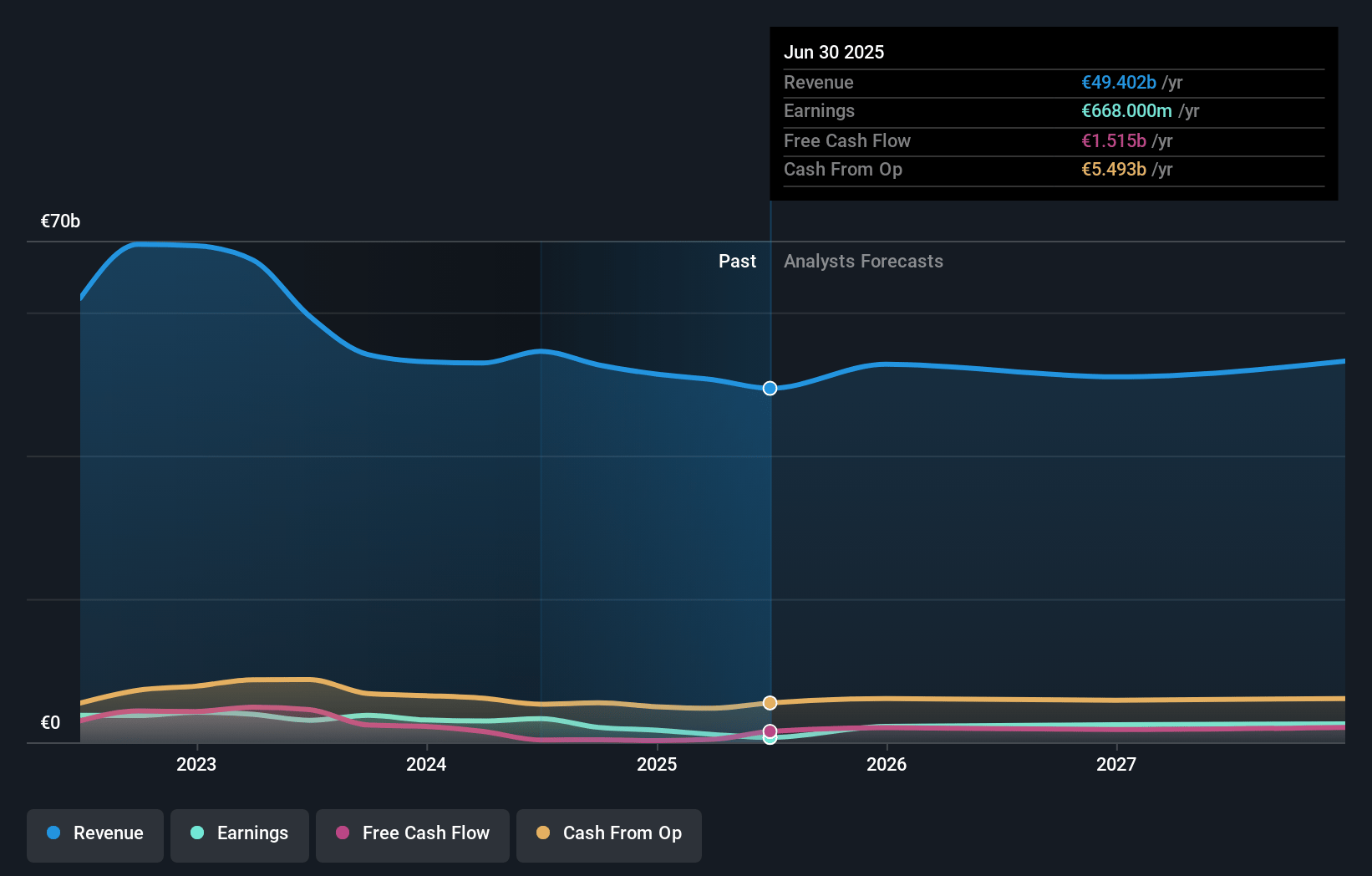

Repsol Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Repsol compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Repsol's revenue will grow by 8.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 2.2% today to 5.2% in 3 years time.

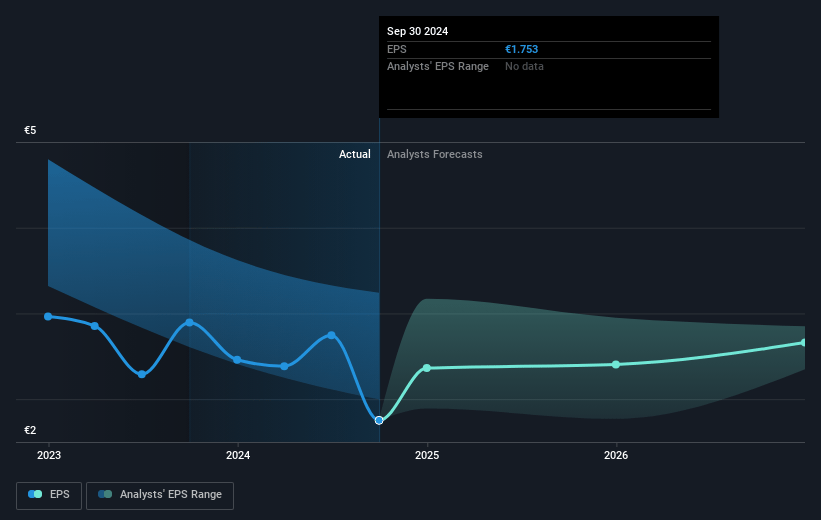

- The bullish analysts expect earnings to reach €3.3 billion (and earnings per share of €3.23) by about July 2028, up from €1.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 7.0x on those 2028 earnings, down from 13.8x today. This future PE is lower than the current PE for the GB Oil and Gas industry at 13.8x.

- Analysts expect the number of shares outstanding to decline by 0.55% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.74%, as per the Simply Wall St company report.

Repsol Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating global energy transition toward renewables and stricter decarbonization policies pose a risk for Repsol's hydrocarbon core, as volatile oil prices and falling demand were already visible in the first quarter with oil prices at the lowest point in four years, threatening long-term revenue streams and profit margins.

- Intensified regulatory uncertainty and potential increases in carbon costs, especially in Europe, could drive up compliance and operating expenses for Repsol's refining and upstream businesses, impacting earnings and overall net margin.

- Delays or underperformance in ramping up Repsol's low-carbon and renewables ventures, as suggested by the company's decision to defer new final investment decisions in renewables amid global volatility, could undermine its diversification efforts and create renewed earnings volatility and weak free cash flow.

- Persistently high dividend and buyback commitments, even during periods of rising net debt and volatile cash flow, constrains Repsol's ability to reinvest or deleverage and elevates long-term financial risk, potentially impacting future net earnings stability.

- Exposure to resource nationalism, political instability, and environmental litigation-particularly regarding operations in regions like Venezuela and Libya, as well as growing global activism around fossil fuels-raises the risk of supply disruptions, unpredictable liabilities, and potential asset write-downs that could hurt both revenues and net asset values.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Repsol is €15.75, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Repsol's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €15.75, and the most bearish reporting a price target of just €10.9.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €63.9 billion, earnings will come to €3.3 billion, and it would be trading on a PE ratio of 7.0x, assuming you use a discount rate of 8.7%.

- Given the current share price of €12.99, the bullish analyst price target of €15.75 is 17.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.