Key Takeaways

- Rising decarbonization pressures, regulatory burdens, and slow renewable diversification threaten core revenues, profitability, and long-term growth prospects.

- Aging, high-cost assets and geopolitical risks compound operational volatility, increasing costs and undermining financial stability.

- Diversification, efficiency gains, and disciplined capital management support Repsol's resilience and stable shareholder returns despite market volatility and energy transition pressures.

Catalysts

About Repsol- Operates as a multi-e energy company in Spain, Peru, the United States, Portugal, and internationally.

- Intensifying global decarbonization and electrification efforts are expected to suppress long-term demand for oil and gas, directly threatening Repsol's core revenue streams and placing sustained downward pressure on net margins and earnings as regulatory pressure and consumer preferences shift away from fossil fuels.

- Europe's rising regulatory burdens and escalating carbon pricing are set to significantly increase future compliance and operating costs for traditional energy suppliers like Repsol, compressing profitability and limiting the ability to generate excess cash flow in the long run.

- Repsol continues to lag international peers in diversifying its revenue base into renewables, and recent statements indicate further delays or deprioritization of new renewable project investments in a volatile macroeconomic environment, jeopardizing forward growth options and exposing the company to a shrinking total addressable market as global hydrocarbon use wanes.

- The company is anchored to a high-cost, aging asset base in refining and upstream operations, and increasing capital expenditure requirements for maintenance will further erode net margins and restrict improvement in free cash flow, especially as lower cost competitors ramp up global supply and undercut Repsol in key markets.

- Ongoing exposure to volatile and politically unstable regions such as Libya and Venezuela raises the risk of abrupt production interruptions, asset write-downs, and geopolitical disruptions, leading to unpredictable revenue volatility and a persistent premium on operational risk that will detract from Repsol's long-term earnings and financial stability.

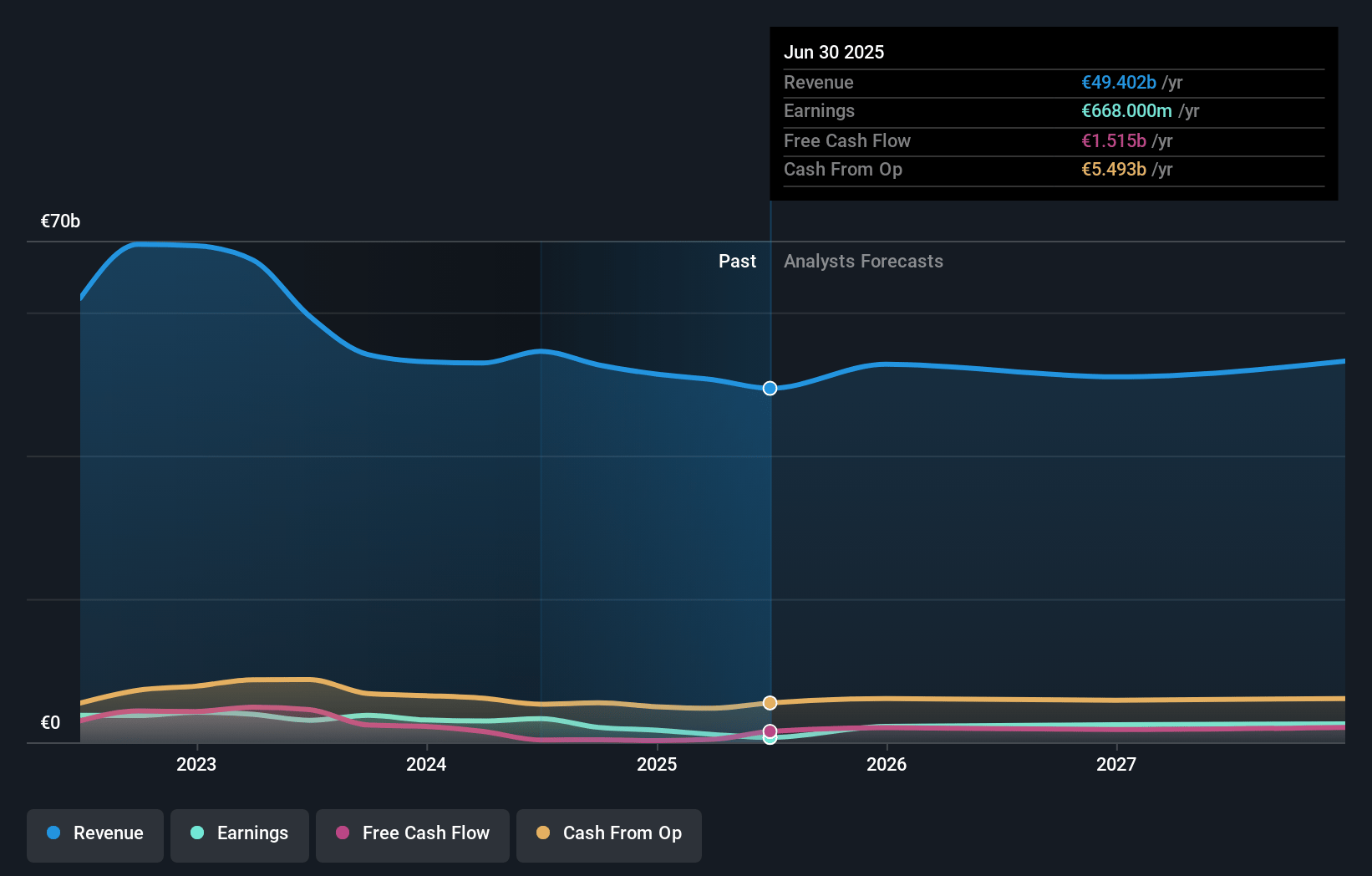

Repsol Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Repsol compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Repsol's revenue will decrease by 15.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 2.2% today to 6.9% in 3 years time.

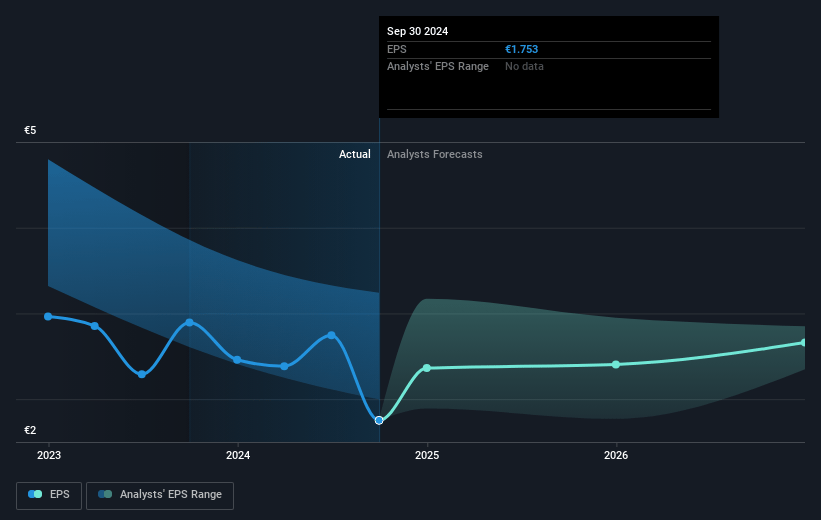

- The bearish analysts expect earnings to reach €2.1 billion (and earnings per share of €2.34) by about July 2028, up from €1.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 7.6x on those 2028 earnings, down from 13.6x today. This future PE is lower than the current PE for the GB Oil and Gas industry at 13.7x.

- Analysts expect the number of shares outstanding to decline by 0.55% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.73%, as per the Simply Wall St company report.

Repsol Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Repsol's demonstrated ability to maintain cash flow and shareholder distributions even in a stressed macro scenario, supported by their flexible CapEx budgeting and €450 million efficiency program, suggests that net earnings and distributions are likely to remain resilient even in challenging market conditions.

- Continued growth and asset rotations in renewables, including positive asset sales in Spain and the US despite market volatility, highlight the increasing diversification of Repsol's revenue base, which could support long-term earnings and margin stability as the energy transition progresses.

- The successful optimization and efficiency improvements in upstream operations-such as the UK joint venture with NEO Energy, new low-breakeven projects coming online, and prudent hedging of gas prices-are enabling Repsol to enhance upstream margins and cash flows, counterbalancing the risk of commodity price downward cycles.

- Growth in the Customer division, with expanding multi-energy offerings, double-digit increases in renewable fuel stations, and a rising digital client base, is driving improved revenue, EBITDA, and long-term customer retention, cushioning against cyclical volatility in core hydrocarbon businesses.

- Robust capital discipline, a strong asset rotation model, and a commitment to maintaining net debt control and shareholder returns, even under stress, demonstrate financial resilience and flexibility, which reduces downside risk to earnings and dividends over the long run.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Repsol is €10.9, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Repsol's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €15.75, and the most bearish reporting a price target of just €10.9.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €30.4 billion, earnings will come to €2.1 billion, and it would be trading on a PE ratio of 7.6x, assuming you use a discount rate of 8.7%.

- Given the current share price of €12.84, the bearish analyst price target of €10.9 is 17.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.