Key Takeaways

- Rapid growth in lending, improved asset quality, and digital transformation are driving structurally higher earnings, efficiency, and sustainable long-term revenue expansion.

- Strategic diversification into asset management and cross-border partnerships positions Unicaja Banco for industry-leading fee growth and resilient profitability.

- Heavy reliance on slow-growing regions, digital lag, sector consolidation, and rising regulatory pressures threaten Unicaja Banco's future profitability and competitiveness.

Catalysts

About Unicaja Banco- Engages in the retail banking business in Spain.

- While analyst consensus anticipates strong loan growth and improved net income from new lending, the current pace and breadth of recovery-evidenced by a 44% year-on-year surge in private sector lending, double-digit growth in multiple loan segments, and consistently rising new business-suggest that Unicaja Banco is on track for structurally higher multi-year revenue and earnings expansion than the market currently prices in.

- Analysts broadly agree that improvements in asset quality and profitability will boost net margins, but recent data show a step change: non-performing assets dropped 22% year-on-year with coverage ratios rising to historically conservative levels, setting up Unicaja Banco not just for lower loan loss provisions, but for the potential to sustainably operate with cost of risk below sector averages, driving persistent outperformance in bottom-line earnings.

- The rapid shift of customer funds toward off-balance sheet products, highlighted by a 22% year-on-year increase in mutual funds and sharply improving net inflows, positions Unicaja Banco to become a leading provider of asset and wealth management to Spain's growing and diversifying population, creating enduring growth in fee-based revenues with higher return on capital.

- Accelerated digital transformation-spanning investments in data analytics, digital platforms, and automation-has not only driven down the cost-to-income ratio to best-in-class levels, but is enabling superior client acquisition and retention at scale, which is likely to further expand net margins and compress operating costs in the medium-to-long term.

- Deepening integration within European financial markets and regulatory emphasis on cross-border harmonization, coupled with Unicaja Banco's robust capital base and solvency ratios, provide new avenues for product innovation and cross-market partnerships, unlocking incremental earnings opportunities less sensitive to the domestic Spanish lending cycle and supporting sustainable long-term growth.

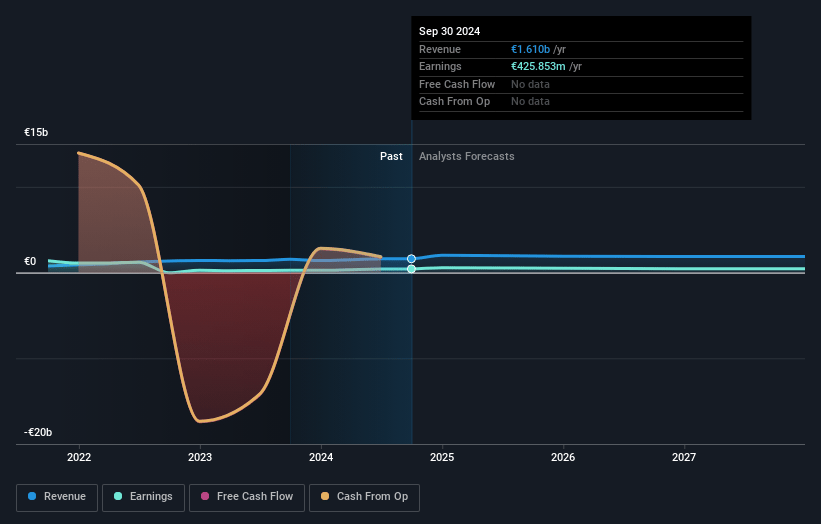

Unicaja Banco Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Unicaja Banco compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Unicaja Banco's revenue will grow by 2.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 30.7% today to 27.3% in 3 years time.

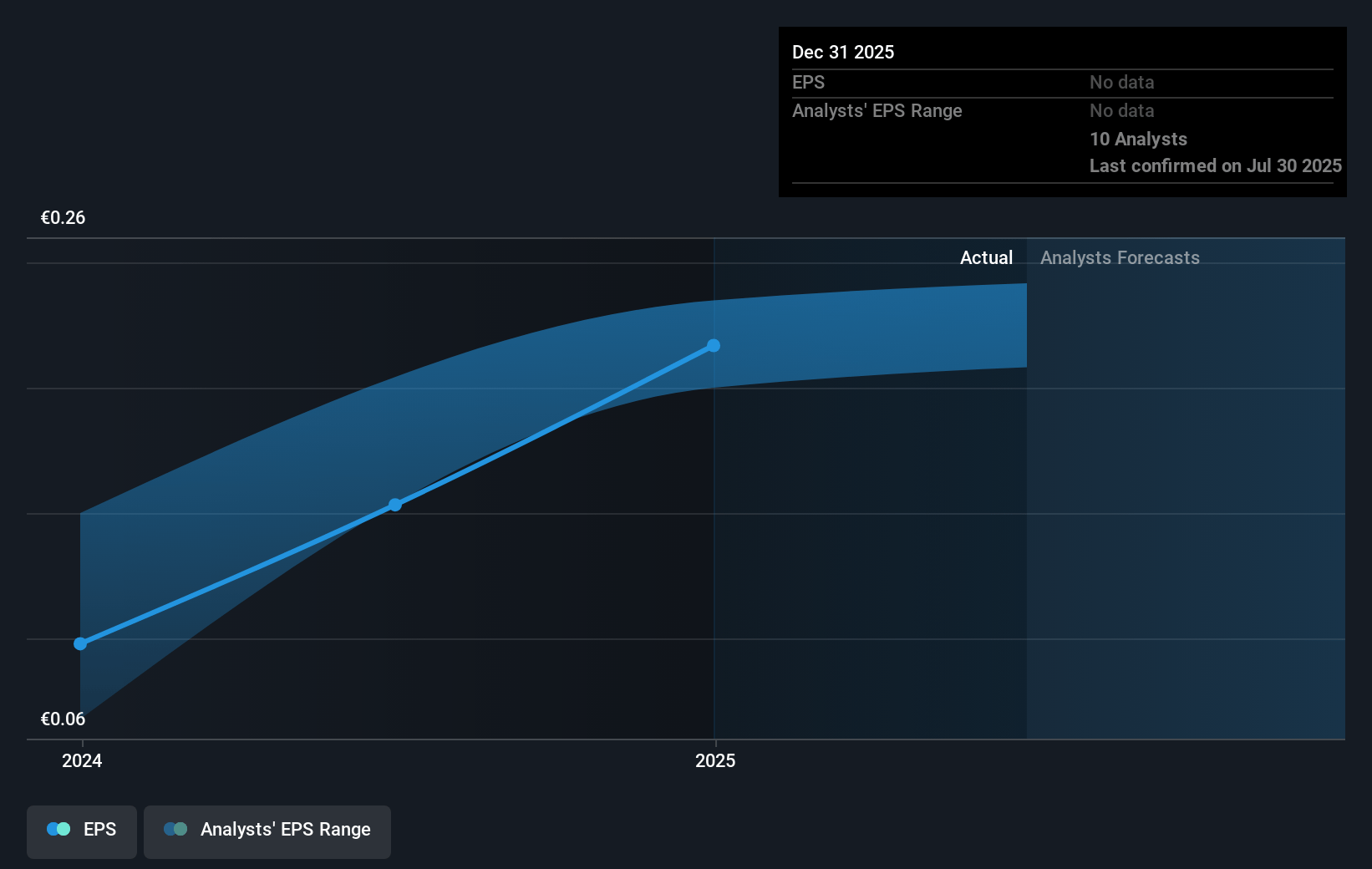

- The bullish analysts expect earnings to reach €580.4 million (and earnings per share of €0.24) by about July 2028, down from €613.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.6x on those 2028 earnings, up from 8.5x today. This future PE is greater than the current PE for the GB Banks industry at 8.5x.

- Analysts expect the number of shares outstanding to decline by 1.86% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.09%, as per the Simply Wall St company report.

Unicaja Banco Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Unicaja Banco's continued reliance on slow-growing regional markets, particularly in Andalusia and Castile and León, exposes it to weaker economic and demographic trends, which may limit future loan growth and leave the company vulnerable to higher credit risk, putting pressure on both future revenues and earnings.

- Despite recent improvements, the slow pace of digital innovation compared to larger peers puts Unicaja at risk of losing customers to more technologically advanced competitors, potentially compressing net margins and reducing fee income over time.

- The persistent low or normalized interest rate environment in the Eurozone, combined with customer spread compression and a reliance on repricing for short-term net interest income boosts, threatens to structurally limit the bank's net interest income and thus profitability in the long run.

- Ongoing consolidation in the Spanish banking sector could put smaller, regionally focused banks such as Unicaja Banco at risk of being forced into mergers or acquisitions, which can result in shareholder dilution, integration risks, and stagnant growth, negatively impacting both share price and return on equity.

- Rising regulatory pressures and new banking taxes, as well as looming Basel IV requirements, may tighten capital constraints, increase compliance costs, and restrict risk-taking, all of which can erode long-term profitability and dampen net income growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Unicaja Banco is €2.5, which represents two standard deviations above the consensus price target of €1.91. This valuation is based on what can be assumed as the expectations of Unicaja Banco's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €2.8, and the most bearish reporting a price target of just €1.55.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €2.1 billion, earnings will come to €580.4 million, and it would be trading on a PE ratio of 13.6x, assuming you use a discount rate of 9.1%.

- Given the current share price of €2.03, the bullish analyst price target of €2.5 is 18.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.