Last Update27 Aug 25Fair value Increased 4.05%

Despite a deterioration in consensus revenue growth forecasts, a modest improvement in net profit margin has supported a slight increase in Bavarian Nordic's fair value, with the target price rising from DKK234.50 to DKK244.00.

What's in the News

- Nordic Capital and Permira have proposed to acquire Bavarian Nordic for DKK 18.1 billion (DKK 233 per share), a 21% premium to the prior closing price; board and management have agreed to tender their shares, and a delisting is planned upon completion, subject to customary conditions.

- Bavarian Nordic raised full-year 2025 revenue guidance to DKK 5.7–6.7 billion, with improved outlooks for both Travel Health and Public Preparedness, and secured contracts ensuring the lower end of the range.

- Health Canada has accepted Bavarian Nordic’s CHIKV VLP chikungunya vaccine candidate for regulatory review, potentially supporting approval in early 2026; the vaccine has already received US, EU, and UK approvals based on strong phase 3 data.

- Bavarian Nordic secured a contract worth over DKK 200 million to supply smallpox/mpox vaccines to a European country, contributing to a total 2025 Public Preparedness business secured contract value slightly above DKK 3,000 million.

Valuation Changes

Summary of Valuation Changes for Bavarian Nordic

- The Consensus Analyst Price Target has risen slightly from DKK234.50 to DKK244.00.

- The Consensus Revenue Growth forecasts for Bavarian Nordic has significantly fallen from -2.7% per annum to -3.5% per annum.

- The Net Profit Margin for Bavarian Nordic has risen slightly from 15.37% to 15.82%.

Key Takeaways

- Heavy reliance on short-term vaccine demand and a narrow product mix poses risks to revenue stability and earnings predictability as conditions normalize.

- Rising pricing pressures, market access limitations, and regulatory uncertainties threaten profit margins and could undermine optimistic growth expectations.

- Strategic expansion, product revitalization, and new vaccine launches position Bavarian Nordic for sustained growth, enhanced margins, and increased resilience amid rising global health demand.

Catalysts

About Bavarian Nordic- Develops, manufactures, and supplies life-saving vaccines.

- The company's recent revenue surge and margin strength are heavily anchored in exceptional short-term demand for travel health and public preparedness vaccines, which may be unsustainable as contract wins and outbreak-based orders normalize; this could lead to a flattening or decline in revenues and/or increased volatility in future earnings as pandemic and epidemic fears subside.

- Rising global pressures on drug pricing-especially for vaccines provided to governments-create real risk that profit margins will compress, even as Bavarian Nordic expands volumes; investors expecting current margins to persist may be overestimating future net earnings.

- Bavarian Nordic remains reliant on a concentrated product mix (notably rabies, TBE, smallpox/monkeypox vaccines), so any new competing vaccines, regulatory price controls, or waning disease attention from governments could lead to sudden drops in revenue and lower earnings predictability.

- While the ongoing shift toward more government stockpiling has been a growth driver, supply chain frictions, regionalization of pharmaceutical production, and geopolitical risks could lift costs or limit market access, eroding operating margins and affecting the company's ability to meet future revenue guidance.

- The market is currently assigning high value to pipeline expansion and geographic launches (e.g., Chikungunya), but regulatory delays, post-market study dependencies, and the uncertain pace of disease outbreak or spread may delay or diminish expected top-line growth, negatively impacting forward revenue and margin projections.

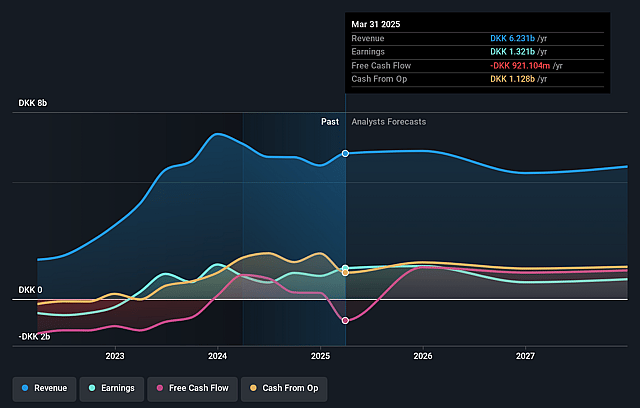

Bavarian Nordic Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Bavarian Nordic's revenue will decrease by 3.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 22.0% today to 15.8% in 3 years time.

- Analysts expect earnings to reach DKK 918.6 million (and earnings per share of DKK 11.67) by about August 2028, down from DKK 1.4 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.3x on those 2028 earnings, up from 13.0x today. This future PE is greater than the current PE for the GB Biotechs industry at 11.0x.

- Analysts expect the number of shares outstanding to decline by 0.6% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.92%, as per the Simply Wall St company report.

Bavarian Nordic Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Bavarian Nordic has demonstrated robust revenue growth across multiple vaccine products (notably rabies and tick-borne encephalitis) and expanded market share in strategic regions, suggesting a sustainable growth trajectory that could support future revenue and margin expansion.

- The company's successful acquisition and revitalization of previously underperforming assets (such as rabies and TBE vaccines), coupled with accelerated manufacturing output to meet surging demand, positions Bavarian Nordic for continued earnings resilience and improved gross margins.

- Approval and initial launches of the Chikungunya vaccine in key markets, combined with growing global outbreaks and heightened awareness, establish a new, potentially significant long-term growth driver for both the travel health portfolio and top-line revenues.

- The completion of technology transfer for TBE and the transition to in-house, end-to-end rabies manufacturing, with anticipated margin improvement from 2026 onwards, signals stronger control over production costs and enhanced profitability in the medium to long term.

- Long-term secular trends-such as rising global infectious disease threats, expanding government stockpiling, and increasing public health awareness-align with Bavarian Nordic's portfolio strengths, providing durable demand and greater revenue predictability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of DKK244.0 for Bavarian Nordic based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be DKK5.8 billion, earnings will come to DKK918.6 million, and it would be trading on a PE ratio of 23.3x, assuming you use a discount rate of 4.9%.

- Given the current share price of DKK237.6, the analyst price target of DKK244.0 is 2.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.