Key Takeaways

- Accelerated manufacturing and strong travel health performance suggest margins and revenues may surpass expectations, signaling potential for significant long-term upside.

- Unique vaccine capabilities and expanding portfolio position the company to benefit from global health trends and increasing market opportunities, driving superior operational and financial growth.

- Heavy reliance on a narrow vaccine portfolio, costly R&D, pricing pressures, and new technologies threaten revenue, margin stability, and long-term competitiveness.

Catalysts

About Bavarian Nordic- Develops, manufactures, and supplies life-saving vaccines.

- While analyst consensus expects tech transfer of rabies and TBE vaccines to deliver a 15% to 20% gross margin improvement by 2026, current manufacturing outperformance and accelerated inventory turnover suggest that full margin benefits could materialize earlier, and with higher impact on net margins and EBITDA than currently modeled.

- Analyst consensus projects Travel Health growth at about 10% to 12% per year, but robust Q1 performance (62% total revenue growth and significant market share gains) plus market data showing potential for 20% annualized growth indicate that revenue from Travel Health may far exceed published forecasts, supporting long-term top-line upside.

- Market underappreciation of the significant endemic expansion in diseases like tick-borne encephalitis and Chikungunya, along with the launch of Vimkunya into an increasingly urgent global health environment, positions Bavarian Nordic to capture outsized recurring revenues as outbreaks become more frequent and awareness grows.

- Bavarian Nordic's unique control of cell-based manufacturing for smallpox/monkeypox vaccines and ongoing innovation in vaccine technology may enable it to secure fast-tracked procurement and pandemic preparedness contracts with governments, leading to years of elevated public preparedness revenue streams and enhanced operational leverage.

- The company is poised to benefit disproportionately from rising healthcare investments and expanding vaccine access in emerging markets due to its growing portfolio and proven ability to rapidly scale (both commercially and in manufacturing), driving sustained high revenue growth, higher margins through scale, and premium valuation relative to peers.

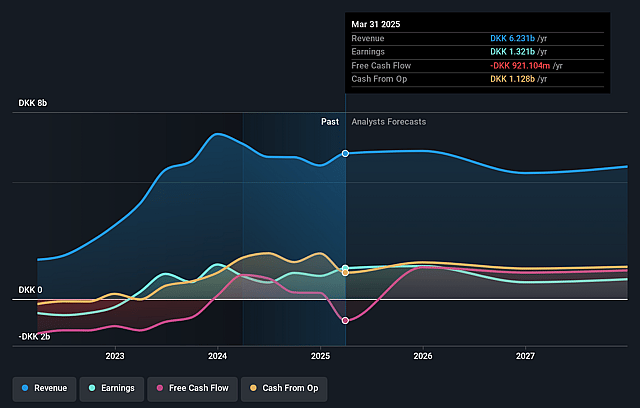

Bavarian Nordic Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Bavarian Nordic compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Bavarian Nordic's revenue will decrease by 2.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 21.2% today to 14.5% in 3 years time.

- The bullish analysts expect earnings to reach DKK 840.1 million (and earnings per share of DKK 10.5) by about July 2028, down from DKK 1.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 24.8x on those 2028 earnings, up from 11.3x today. This future PE is greater than the current PE for the GB Biotechs industry at 11.3x.

- Analysts expect the number of shares outstanding to decline by 1.63% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.9%, as per the Simply Wall St company report.

Bavarian Nordic Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Bavarian Nordic's strong current growth is largely driven by its limited product portfolio, especially smallpox/monkeypox and selected travel health vaccines, creating a risk of revenue volatility and long-term earnings pressure if government stockpiling priorities shift or competitors gain ground.

- The company is investing heavily in R&D, with costs expected to remain high and upcoming trials on Chikungunya and pipeline products slated for later-stage studies; sustained lack of late-stage pipeline success or delays in commercialization could compress net margins and earnings for years.

- Secular industry trends, such as increased global government pricing pressure and healthcare cost containment policies, threaten vaccine pricing and could erode Bavarian Nordic's gross margins and profitability over the long term.

- The emergence of next-generation vaccine technologies, particularly mRNA platforms, presents the risk of technological obsolescence for Bavarian Nordic's viral-like particle and traditional vaccine processes, potentially necessitating costly reinvestment and threatening both revenue and profit margins.

- Heightened geopolitical tensions, regulatory changes, and supply chain fragmentation may disrupt Bavarian Nordic's operations or distribution networks, raising SG&A and operating costs and potentially impacting revenue stability and growth prospects in non-core markets.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Bavarian Nordic is DKK244.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Bavarian Nordic's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be DKK5.8 billion, earnings will come to DKK840.1 million, and it would be trading on a PE ratio of 24.8x, assuming you use a discount rate of 4.9%.

- Given the current share price of DKK192.05, the bullish analyst price target of DKK244.0 is 21.3% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Bavarian Nordic?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.