Last Update 16 Dec 25

Fair value Increased 11%BAVA: Mpox Preparedness Contracts Will Underpin Stronger Long Term Earnings Power

Analysts have raised their price target on Bavarian Nordic from approximately $225 to about $250. This reflects a higher justified valuation multiple despite expectations for softer revenue growth and margins.

What's in the News

- Officials in Southern California have confirmed the first local community spread of the more virulent clade 1 mpox strain, highlighting ongoing global demand for smallpox and mpox countermeasures (NBC).

- Bavarian Nordic won a new joint procurement contract with the European Commission through HERA, enabling European countries to purchase up to 8 million doses of its MVA-BN smallpox and mpox vaccine over up to four years.

- An initial order for 750,000 MVA-BN doses under the new HERA framework will be delivered in 2026, adding to existing BARDA orders and supporting the company’s goal of building a DKK 1.5 to 2 billion preparedness revenue base for 2026.

- Topline data from a pediatric trial showed that immune responses to MVA-BN in children aged 2 to 11 were non inferior and in fact 2.5 times higher than in adults, with a comparable safety profile, paving the way for a planned EMA submission in 2026 to expand the vaccine’s label to younger age groups.

- The planned DKK 18.1 billion takeover of Bavarian Nordic by Nordic Capital and Permira, at a best and final offer price of DKK 250 per share, was ultimately cancelled after acceptances reached only 60 percent, below the revised minimum threshold of 66 2/3 percent.

Valuation Changes

- Fair Value: increased from DKK 225 to DKK 250. This reflects a modest upward revision in the long-term valuation.

- Discount Rate: risen slightly from 4.90 percent to about 5.16 percent, implying a marginally higher required return and risk assessment.

- Revenue Growth: downgraded from approximately minus 4.17 percent to around minus 7.01 percent, indicating a more pronounced expected contraction in top line performance.

- Net Profit Margin: reduced from about 14.35 percent to roughly 10.98 percent, signalling expectations for weaker profitability.

- Future P/E: increased significantly from roughly 24.4x to about 36.8x, pointing to a higher valuation multiple despite softer growth and margin assumptions.

Key Takeaways

- Reliance on government contracts and a few high-value vaccines makes future revenues vulnerable to shifting spending priorities and competitive pressures.

- Manufacturing, regulatory, and demand uncertainties could cause volatile earnings and prevent expected margin improvements, despite efforts to diversify and scale operations.

- Heavy reliance on core products, high R&D costs, intense competition, and uncertain demand create risks for sustainable growth, profitability, and long-term revenue stability.

Catalysts

About Bavarian Nordic- Develops, manufactures, and supplies life-saving vaccines.

- While Bavarian Nordic benefits from expanding demand for vaccines due to rising global mobility and the spread of infectious diseases, their growth trajectory relies heavily on maintaining and expanding public preparedness contracts with governments; this exposes their future revenue to risk if government health spending priorities shift or if they lose key contracts to competitors.

- Although the company's entry into the rapidly growing Travel Health segment-with significant contributions from rabies, TBE, and Chikungunya vaccines-supports long-term top-line growth, this area's true underlying demand could be overstated due to recent wholesaler stocking, and any market normalization or temporary bulge in orders could lead to volatile revenues in subsequent quarters.

- Despite anticipated material improvements in gross margins from tech transfer and internalization of vaccine production, profitability remains sensitive to manufacturing yields and potential delays or setbacks in technology transfer, which could prevent expected improvements from fully materializing and compress net margins longer than projected.

- While Bavarian Nordic's pipeline expansion (e.g., upcoming Lyme and Epstein-Barr virus vaccine candidates) and recent approvals offer diversification and opportunities for innovation-driven growth, the company remains exposed to increased global regulatory scrutiny and post-approval trial commitments that could delay commercialization and create sustained higher R&D and compliance costs, directly pressuring future earnings.

- Although the company stands to benefit from the long-term trend of increased government investment in biopreparedness, its dependence on a small number of high-value vaccines and ongoing challenges in scaling or capturing share against larger established players in new markets heightens the risk of revenue shortfalls if new products do not achieve widespread adoption or if competitive pressures intensify.

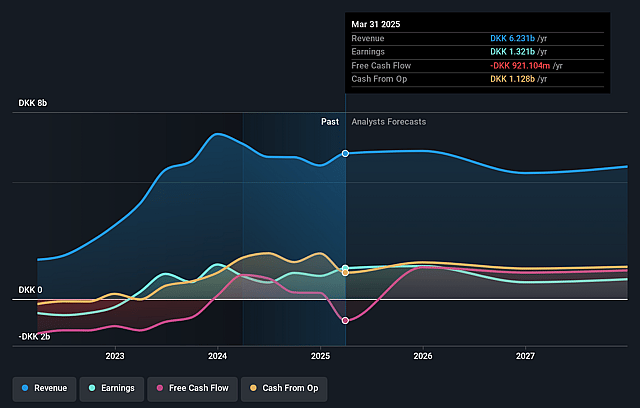

Bavarian Nordic Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Bavarian Nordic compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Bavarian Nordic's revenue will decrease by 4.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 21.2% today to 14.4% in 3 years time.

- The bearish analysts expect earnings to reach DKK 787.2 million (and earnings per share of DKK 9.84) by about July 2028, down from DKK 1.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 24.4x on those 2028 earnings, up from 11.3x today. This future PE is greater than the current PE for the GB Biotechs industry at 11.3x.

- Analysts expect the number of shares outstanding to decline by 1.63% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.9%, as per the Simply Wall St company report.

Bavarian Nordic Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Bavarian Nordic remains heavily dependent on a handful of core products, particularly in the Public Preparedness segment, meaning that any reduction in government demand or contract losses could introduce significant revenue volatility in future years and undermine longer-term revenue stability.

- The company's R&D commitments are substantial, with costs back-end loaded for the year and further regulatory studies pending for new vaccines like Vimkunya, raising the risk of persistent high operating expense and potential net margin pressure if clinical or regulatory setbacks occur.

- Competition from larger and well-capitalized pharmaceutical companies remains intense-especially as Bavarian Nordic expands products like rabies and TBE vaccines and launches new vaccines such as Vimkunya-potentially eroding pricing power and squeezing overall earnings and future profitability.

- Indicators such as wholesaler stocking and seasonal effects in the Travel Health segment introduce uncertainty as to whether recent growth rates are sustainable, increasing the risk that revenues and margins could underperform expectations if actual end-user demand does not match early distribution momentum.

- While management is confident regarding future public contracts and regulatory approvals, increased regulatory scrutiny and the evolving standards for vaccine trial designs-particularly in the U.S. and Europe-could delay time to market for pipeline candidates, raise compliance costs, and negatively affect both revenue growth and net margins over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Bavarian Nordic is DKK225.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Bavarian Nordic's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be DKK5.5 billion, earnings will come to DKK787.2 million, and it would be trading on a PE ratio of 24.4x, assuming you use a discount rate of 4.9%.

- Given the current share price of DKK192.05, the bearish analyst price target of DKK225.0 is 14.6% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Bavarian Nordic?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.