Key Takeaways

- Expansion into scalable, high-margin sectors and sustained investment in automation position Deutsche Post for strong revenue growth and outsized margin gains.

- Leadership in sustainable logistics and last-mile innovation creates barriers to entry and enables persistent market share gains and superior profitability.

- Technological disruption, regulatory pressures, geopolitical risks, intense competition, and structural cost challenges threaten Deutsche Post's profitability and long-term operational stability.

Catalysts

About Deutsche Post- Operates as a mail and logistics company in Germany, rest of Europe, the Americas, the Asia Pacific, the Middle East, and Africa.

- Analysts broadly agree that Deutsche Post's growth strategy through targeted acquisitions in life sciences and healthcare will drive future revenue, but this may be understated-as these specialist capabilities are rapidly scalable globally, there is potential for outsized long-term revenue generation and a structural shift toward resilient, high-margin segments.

- While consensus expects global e-commerce and complex supply chain demand to support steady margin improvement, current market volatility and trade policy disruptions are accelerating customer supply chain reconfiguration, positioning Deutsche Post to capture incremental volumes and premium pricing well above expectations, translating to stronger net margin expansion.

- Deutsche Post's sustained investment in digitalization and automation-ranging from AI-driven network optimization to robotics-will drive industry-leading operational efficiency gains that have the potential to materially lower the company's cost base and deliver outsized margin expansion and earnings resilience into the next economic cycle.

- The group's early-mover leadership in electrification and sustainable logistics gives Deutsche Post a significant edge as regulatory and consumer scrutiny on emissions rises, opening access to preferred partnerships, green procurement contracts, and cost advantages, ultimately translating into revenue acceleration and stronger free cash flow.

- As urbanization intensifies and instant delivery becomes standard, Deutsche Post's scale, global last-mile infrastructure, and expanding premium service mix create barriers to entry and operational leverage that enable it to continuously capture share and extract higher unit economics, resulting in persistent revenue and EBIT outperformance.

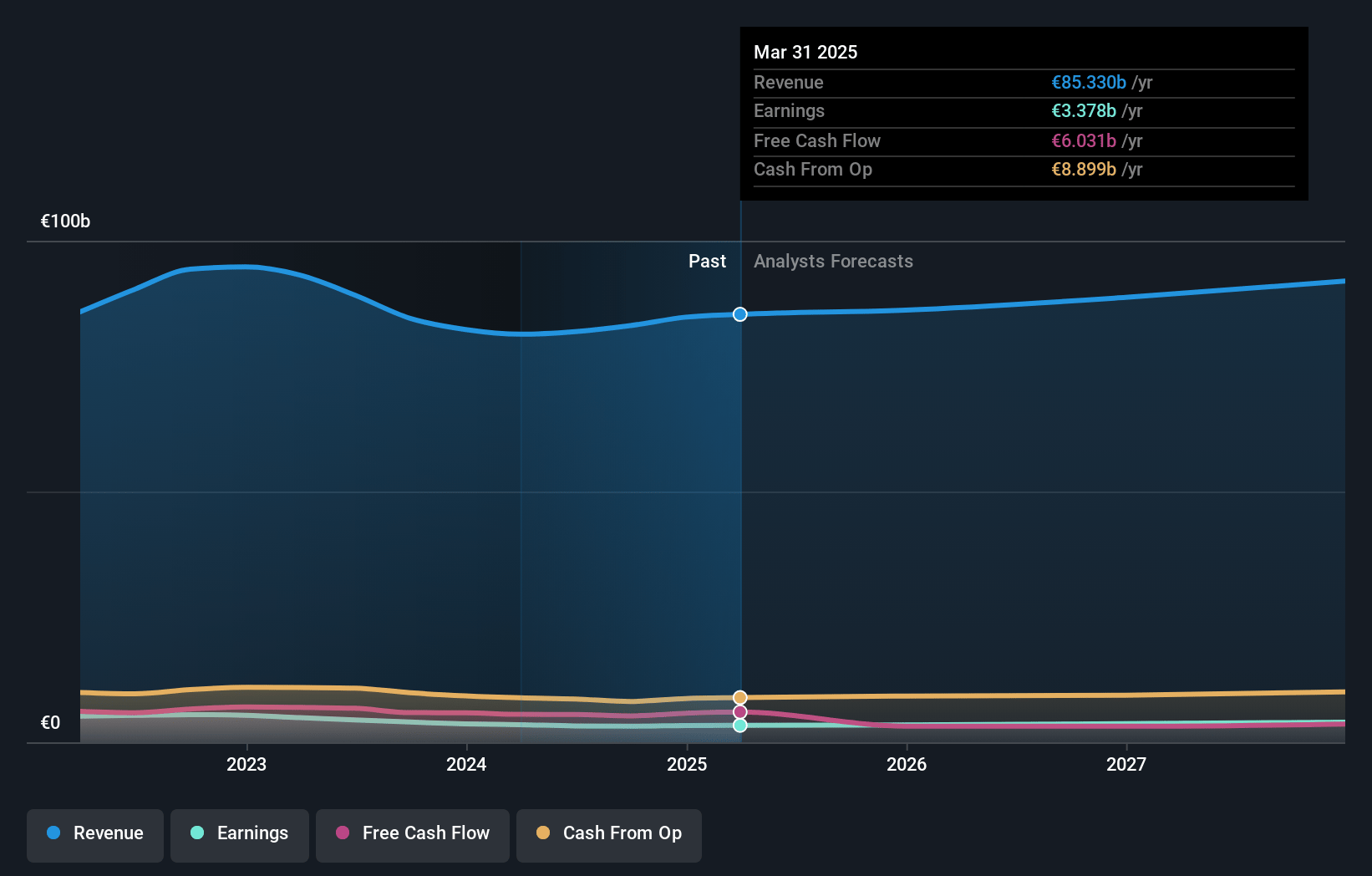

Deutsche Post Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Deutsche Post compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Deutsche Post's revenue will grow by 4.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.0% today to 4.5% in 3 years time.

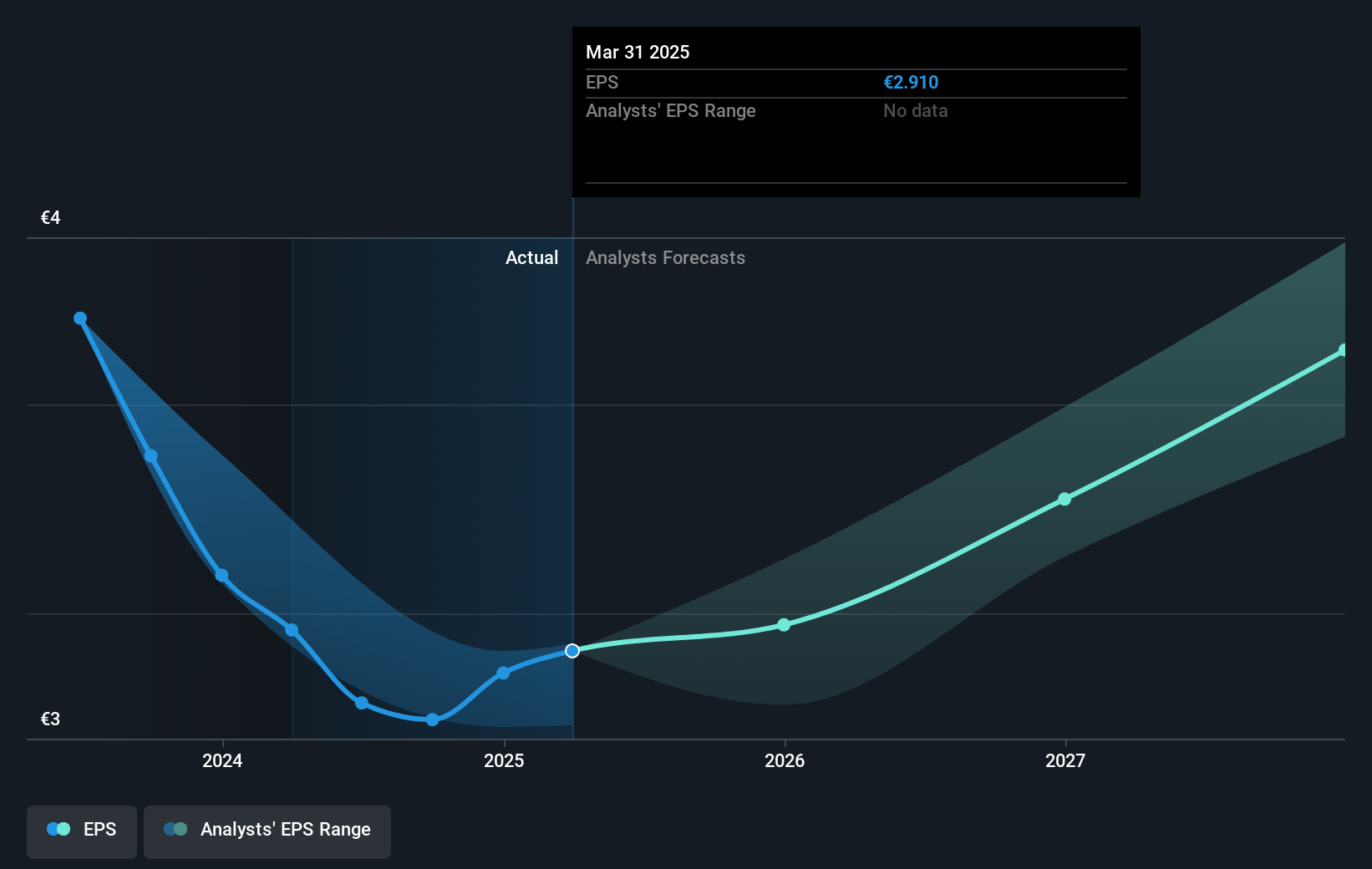

- The bullish analysts expect earnings to reach €4.4 billion (and earnings per share of €4.05) by about July 2028, up from €3.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 16.4x on those 2028 earnings, up from 13.5x today. This future PE is greater than the current PE for the GB Logistics industry at 11.4x.

- Analysts expect the number of shares outstanding to decline by 1.51% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.52%, as per the Simply Wall St company report.

Deutsche Post Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rapid rise in automation, AI, and digital logistics platforms threatens to disrupt Deutsche Post's traditional business lines, which could erode their long-term competitiveness and put sustained pressure on net margins and overall earnings if the company fails to keep pace with innovation.

- Stricter sustainability regulations and the global push for decarbonization may drive up operating costs for Deutsche Post due to its legacy fleets and infrastructure, which could directly compress margins and reduce profitability over the coming years.

- Heightened protectionism, continued volatility in trade policy, and the trend toward global economic fragmentation could weaken cross-border trade volumes, negatively affecting Deutsche Post's international express and freight revenues.

- The competitive intensity in e-commerce logistics remains high, with pressure on pricing and the risk of major e-commerce players like Amazon further developing in-house logistics, both of which could erode Deutsche Post's share and force acceptance of lower pricing, reducing future revenues and EBIT.

- The company faces persistent structural challenges in its European land freight and mail operations, including high labor costs, union-related wage pressures, and the need for significant CapEx in transformation, which together threaten to inflate personnel expenses and capital expenditures, impacting both operating earnings and free cash flow in the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Deutsche Post is €55.52, which represents two standard deviations above the consensus price target of €43.76. This valuation is based on what can be assumed as the expectations of Deutsche Post's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €60.0, and the most bearish reporting a price target of just €34.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €98.5 billion, earnings will come to €4.4 billion, and it would be trading on a PE ratio of 16.4x, assuming you use a discount rate of 6.5%.

- Given the current share price of €40.29, the bullish analyst price target of €55.52 is 27.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.