Key Takeaways

- Stricter environmental regulation, digitalization, and industry overcapacity are set to increase costs and squeeze margins for Deutsche Post.

- Shifting trade dynamics, declining mail volumes, and tech-driven competition threaten the stability and growth potential of core revenue streams.

- Strategic expansion, cost discipline, and investments in growth sectors position Deutsche Post for resilient margins, diversified revenue, and stable earnings amid e-commerce and supply chain shifts.

Catalysts

About Deutsche Post- Operates as a mail and logistics company in Germany, rest of Europe, the Americas, the Asia Pacific, the Middle East, and Africa.

- Intensifying environmental regulation and global decarbonization efforts are expected to significantly increase operational costs for Deutsche Post, as the company faces escalating carbon taxes and regulatory pressures while still heavily reliant on non-electric fleets, directly putting long-term net margins and free cash flow at risk.

- The ongoing structural decline of physical mail volumes in Germany and Europe, driven by accelerating digital communication adoption, will continue to erode a core profit pool for Deutsche Post and could undermine baseline revenues and earnings reliability despite recent price increases and temporary election-related boosts.

- Rising geopolitical fragmentation, increasing protectionism, and the trend towards domestic reshoring threaten to permanently reduce cross-border trade volumes and disrupt the growth of international shipping revenues, which have historically underpinned network scale and future top-line expansion.

- Overcapacity across the global logistics and e-commerce delivery infrastructure, spurred by a prolonged boom in e-commerce, is likely to result in sustained industry price competition and yield compression; this threatens Deutsche Post's ability to maintain pricing discipline and will put long-term downward pressure on revenue per shipment and group EBIT.

- Large-scale industry adoption of advanced automation and platform technologies may allow new tech entrants to rapidly scale and price aggressively, leaving Deutsche Post burdened with high stranded labor costs and reduced competitive agility-a dynamic that could structurally compress operating margins and erode profitability over the long run.

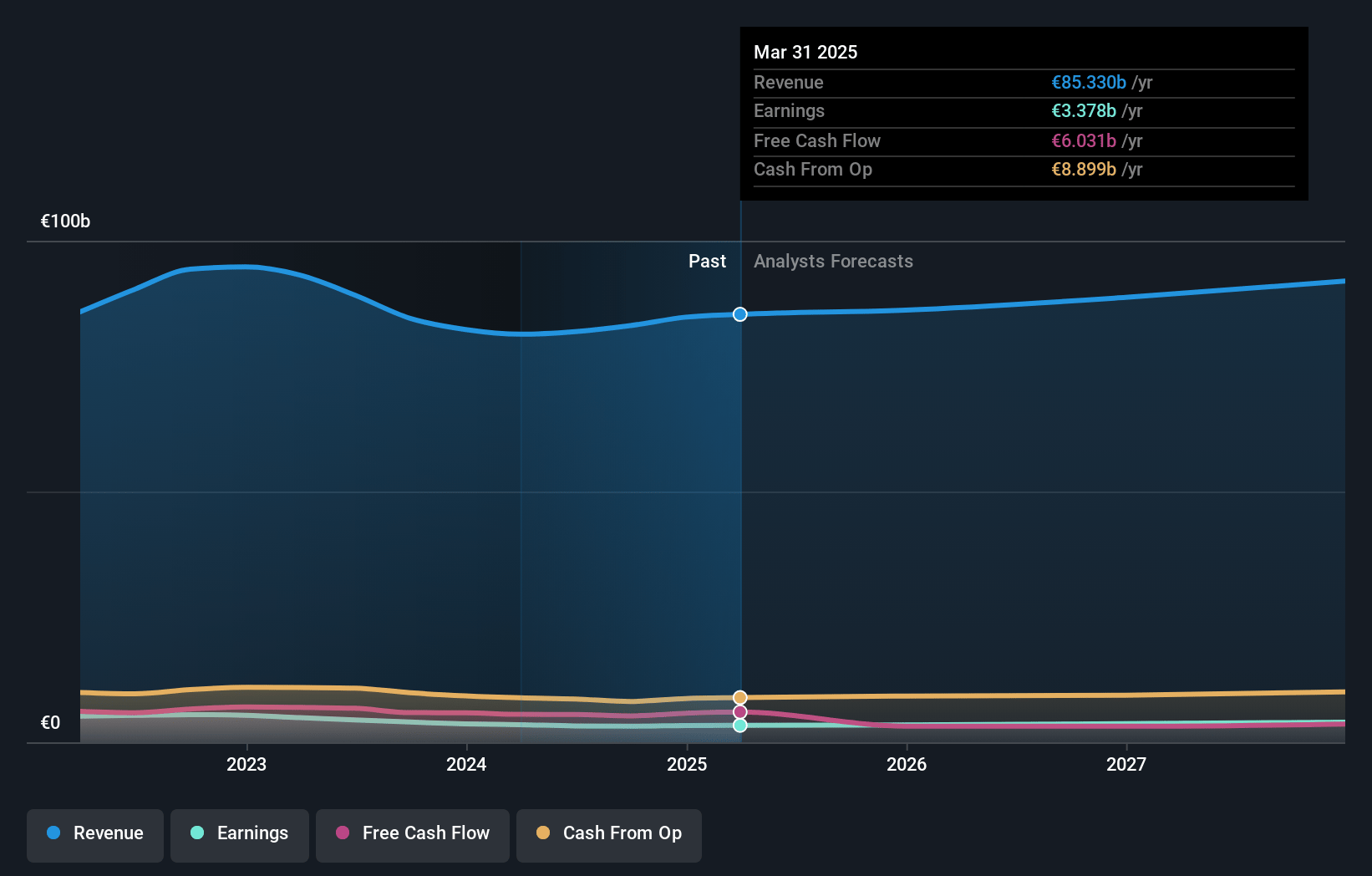

Deutsche Post Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Deutsche Post compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Deutsche Post's revenue will grow by 1.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 4.0% today to 4.4% in 3 years time.

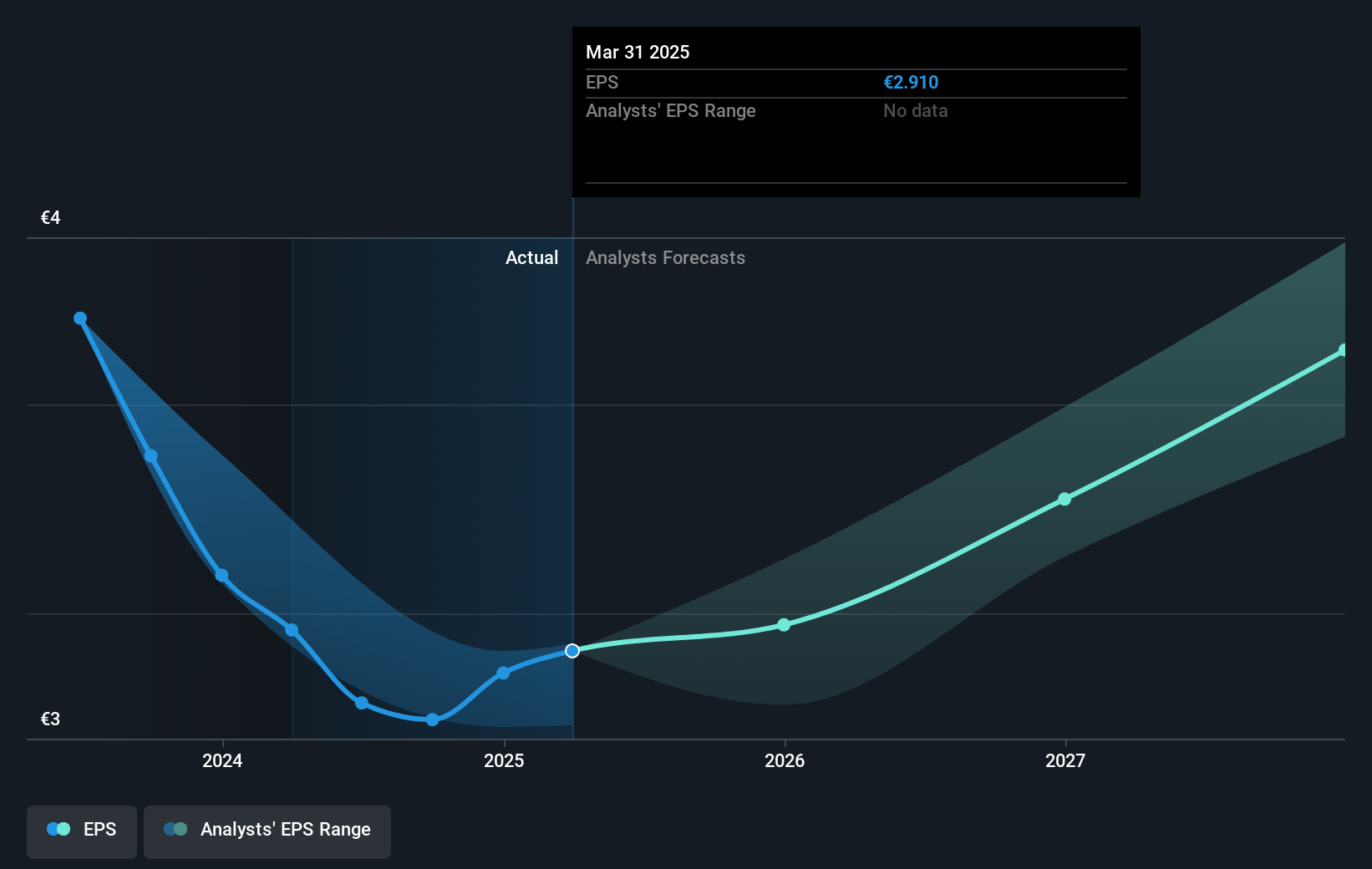

- The bearish analysts expect earnings to reach €3.9 billion (and earnings per share of €3.56) by about July 2028, up from €3.4 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.4x on those 2028 earnings, down from 13.0x today. This future PE is lower than the current PE for the GB Logistics industry at 11.6x.

- Analysts expect the number of shares outstanding to decline by 1.51% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.52%, as per the Simply Wall St company report.

Deutsche Post Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent global e-commerce growth and Deutsche Post's continued organic investment in this sector could drive sustained parcel volume and revenue expansion, supporting long-term top line growth despite mail declines.

- The company's strategic expansion in high-growth regions such as Southeast Asia and countries identified as GT20 positions it to capture growing trade flows and diversify its revenue base, which could underpin higher earnings over time.

- Ongoing cost discipline and structural efficiency programs such as Fit for Growth, along with the company's successful track record of scaling automation and optimizing capacity, enhance margin resilience and could result in improved profitability.

- The company's broad global footprint, leadership in integrated logistics solutions, and ability to flex network capacity enable Deutsche Post to capitalize on global supply chain complexity and shifts in trade lanes, supporting stable or growing recurring revenues even in volatile environments.

- Sustained investments and capability-driven acquisitions in life sciences, healthcare, and specialized logistics give Deutsche Post exposure to secular growth verticals, which can provide higher-margin revenue streams and enhance long-term earnings visibility.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Deutsche Post is €34.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Deutsche Post's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €60.0, and the most bearish reporting a price target of just €34.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €89.1 billion, earnings will come to €3.9 billion, and it would be trading on a PE ratio of 11.4x, assuming you use a discount rate of 6.5%.

- Given the current share price of €38.57, the bearish analyst price target of €34.0 is 13.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.