Key Takeaways

- Strategic excellence in E-Mobility and industrial automation positions Schaeffler for sustained outperformance, margin expansion, and long-term growth insulated from sector volatility.

- Rapidly scaling aftermarket and disciplined investment underpin resilient cash flow, creating a durable competitive moat and supporting rising returns to shareholders.

- Ongoing margin and revenue pressures from EV market lag, low-margin e-commerce expansion, slow structural adaptation, supply chain volatility, and rising technological competition threaten long-term profitability.

Catalysts

About Schaeffler- Develops, manufactures, and sells components and system for industrial applications in Europe, the Americas, China, and the Asia Pacific.

- While analyst consensus expects significant sales and margin improvements from the Vitesco consolidation in E-Mobility, these projections may substantially understate Schaeffler's ability to capture outsize market share as order intake and book-to-bill ratios already far exceed industry peers, potentially translating to revenue and EBIT well beyond current estimates.

- Analysts broadly agree that a strategic pivot to E-Mobility will drive robust volume growth, but the strength and technological leadership in both BEV and hybrid electric drive solutions positions Schaeffler for sustained, multi-year outperformance as global automakers accelerate electrification, indicating the possibility of double-digit compounded revenue growth.

- The ongoing surge in industrial automation and factory digitalization is driving demand for high-precision and mechatronics solutions, and Schaeffler's growing presence in Asia-Pacific and China positions the company for disproportionate benefit, promising long-term margin expansion and diversified earnings streams insulated from auto sector cyclicality.

- Schaeffler's Vehicle Lifetime Solutions division is consistently delivering sales growth far above global car park expansion, with the e-commerce aftermarket platform scaling at over 60 percent per year; this disruptive channel promises a structural uplift to revenue and an enduring competitive moat regardless of new car market volatility.

- Capital discipline and targeted investment in high-growth segments, paired with proven resilience to trade and tariff shocks due to localized production, create a foundation for rapid free cash flow acceleration and increased returns on capital, supporting a sustained uplift in earnings and shareholder value as secular trends enhance product demand.

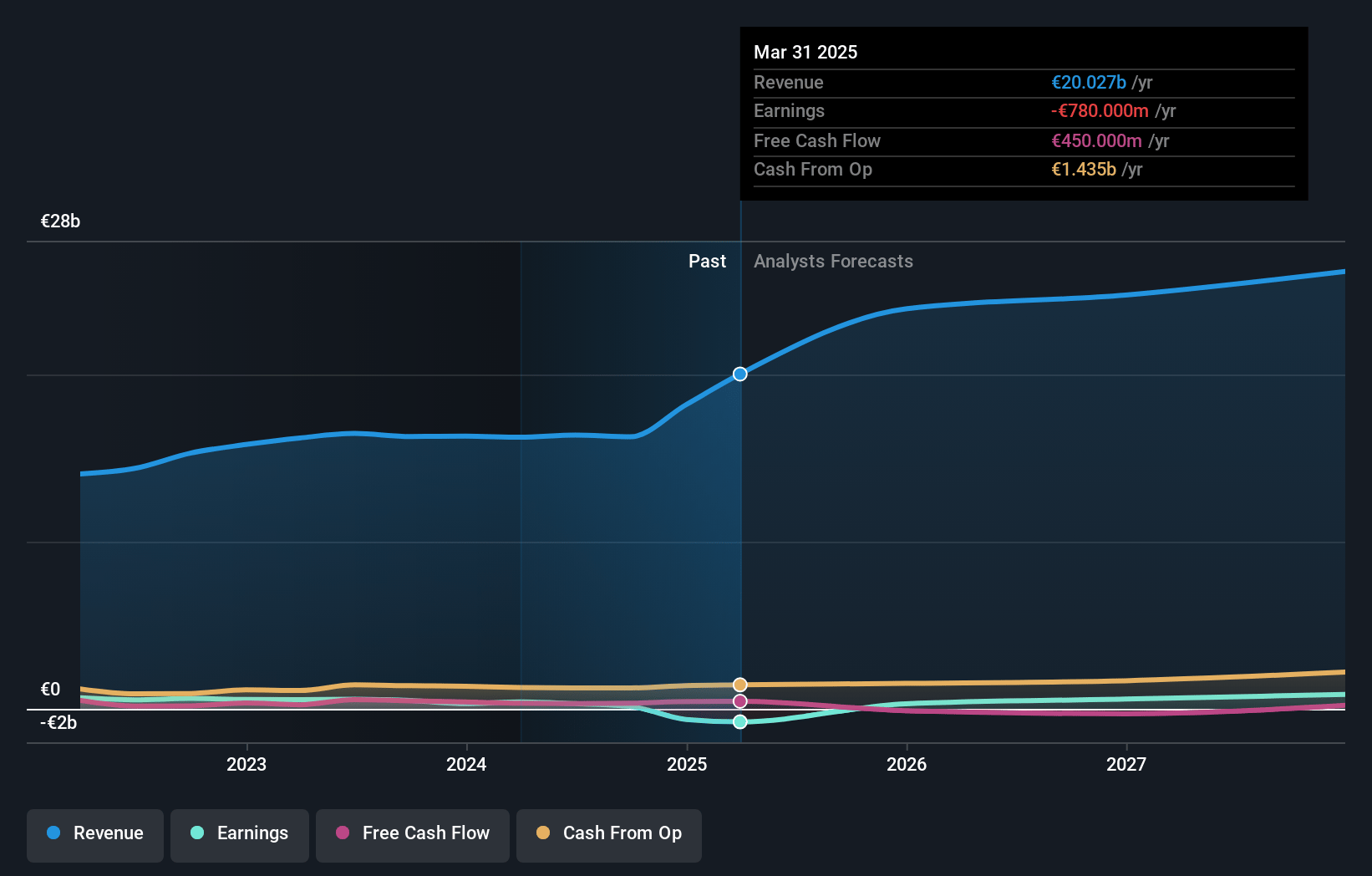

Schaeffler Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Schaeffler compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Schaeffler's revenue will grow by 12.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -3.9% today to 5.3% in 3 years time.

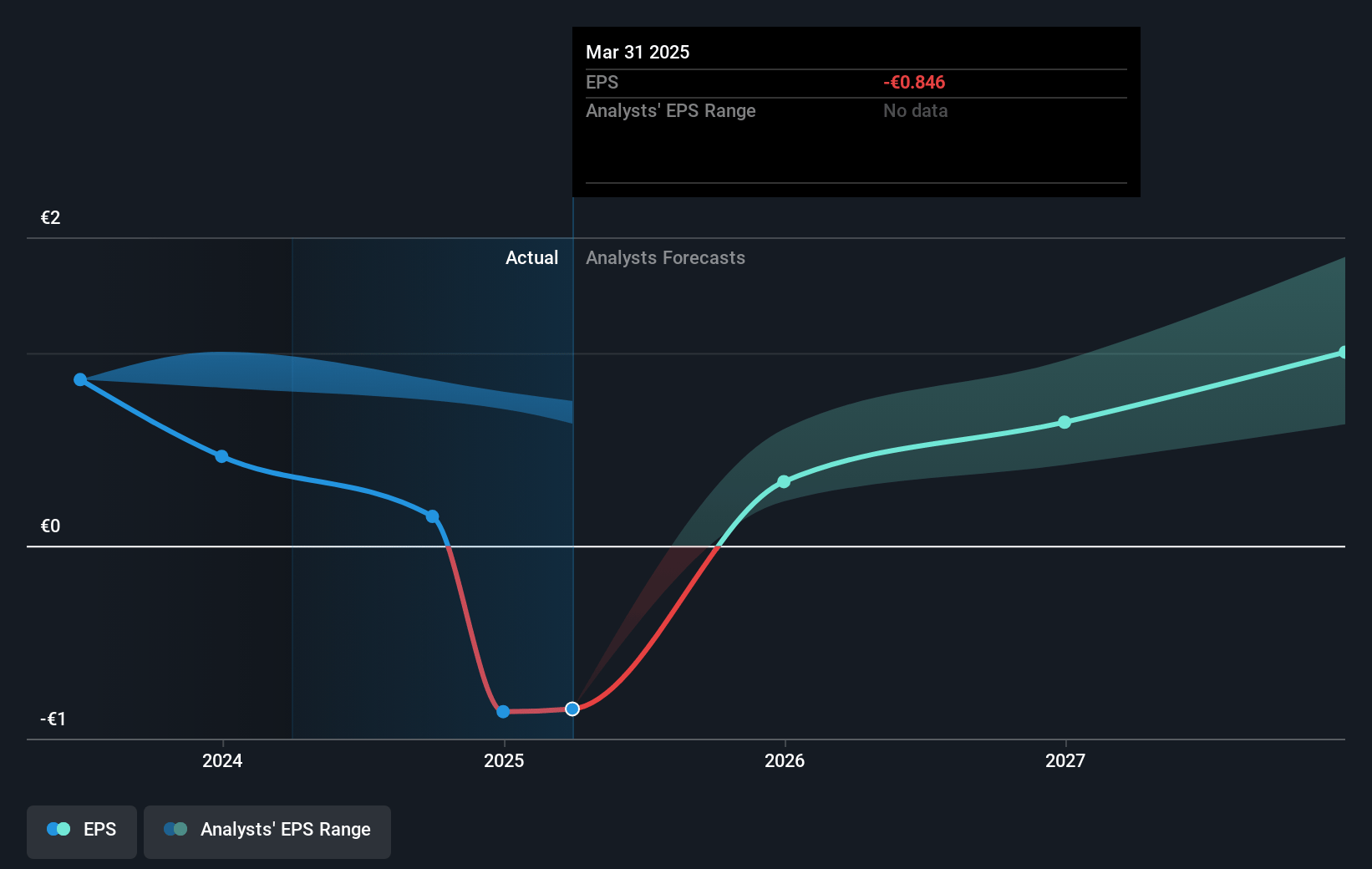

- The bullish analysts expect earnings to reach €1.5 billion (and earnings per share of €2.07) by about July 2028, up from €-780.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 7.4x on those 2028 earnings, up from -5.9x today. This future PE is lower than the current PE for the GB Auto Components industry at 13.3x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.24%, as per the Simply Wall St company report.

Schaeffler Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerated global shift to electric vehicles and the statement that Schaeffler's E-Mobility growth in China was down nearly 20 percent, while competition in China remains intense on both price and technology, signal a risk that Schaeffler's historically strong business in conventional powertrains and lagging performance in key EV markets could drive long-term revenue stagnation or decline.

- There is ongoing margin pressure anticipated from the growth of the Vehicle Lifetime Solutions division's low-margin e-commerce platforms in India and China, where rapid growth is expected to dilute the overall divisional and group-level earnings, potentially undermining net margin improvement despite headline sales growth.

- The results highlight Schaeffler's continued reliance on established manufacturing footprints and legacy cost structures, particularly in Europe, and mention only gradual progress from cost improvement programs, suggesting difficulty in adapting rapidly and efficiently to structural shifts in automotive demand, posing risks to long-term profitability and operational margin expansion.

- Industry-wide global supply chain realignment and heightened trade volatility-evidenced by ongoing tariff uncertainties and shifting trade flows between the US, China, and Europe-create an environment of unpredictable input costs and possible disruption, which can directly impact both revenue stability and the ability to sustain forecasted earnings.

- Intensifying competition from lower-cost and highly innovative Asian suppliers, as well as OEMs' increasing vertical integration in core EV components and the growing substitution of traditional mechanical components with digital and mechatronic solutions, could erode Schaeffler's customer base and necessitate high R&D and capital investments, putting long-term pressure on both revenue and required returns on capital employed.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Schaeffler is €7.5, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Schaeffler's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €7.5, and the most bearish reporting a price target of just €3.9.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €28.5 billion, earnings will come to €1.5 billion, and it would be trading on a PE ratio of 7.4x, assuming you use a discount rate of 8.2%.

- Given the current share price of €4.83, the bullish analyst price target of €7.5 is 35.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.