Key Takeaways

- Legacy reliance on combustion engine components exposes Schaeffler to structural risks as e-mobility and regulatory demands increase operating pressures and shift market dynamics.

- Supply chain regionalization, rising input costs, and intensifying competition in e-mobility threaten profitability, pricing power, and sustained revenue growth.

- Successful pivot to electrification, recurring aftermarket revenue, and operational resilience are driving strong growth, margin improvements, and robust long-term financial stability.

Catalysts

About Schaeffler- Develops, manufactures, and sells components and system for industrial applications in Europe, the Americas, China, and the Asia Pacific.

- The global acceleration toward electric vehicles is triggering a sharp decline in demand for traditional internal combustion engine components, where Schaeffler maintains significant legacy exposure, creating a risk of structural revenue loss that the current pace of e-mobility growth will not offset.

- Intensifying regulatory pressure and increasingly stringent environmental standards will oblige Schaeffler to invest heavily in compliance and adaptation, pushing up operating costs and threatening long-term net margin compression.

- The company continues to face difficulties in rapidly shifting its product mix to achieve critical scale in pure battery electric solutions, while competitors with greater e-mobility and software depth threaten Schaeffler's market share and future sales growth trajectory.

- Rising geopolitical tensions and the trend toward regionalization of supply chains are likely to result in more frequent trade restrictions, tariff risks, and input cost inflation, all of which could erode global competitiveness and further pressure earnings.

- Ongoing industry-wide cost pressure, particularly as OEMs drive for price cuts while integrating more critical components internally, is expected to squeeze Schaeffler's pricing power and profitability, posing a persistent drag on both revenue and long-term earnings growth.

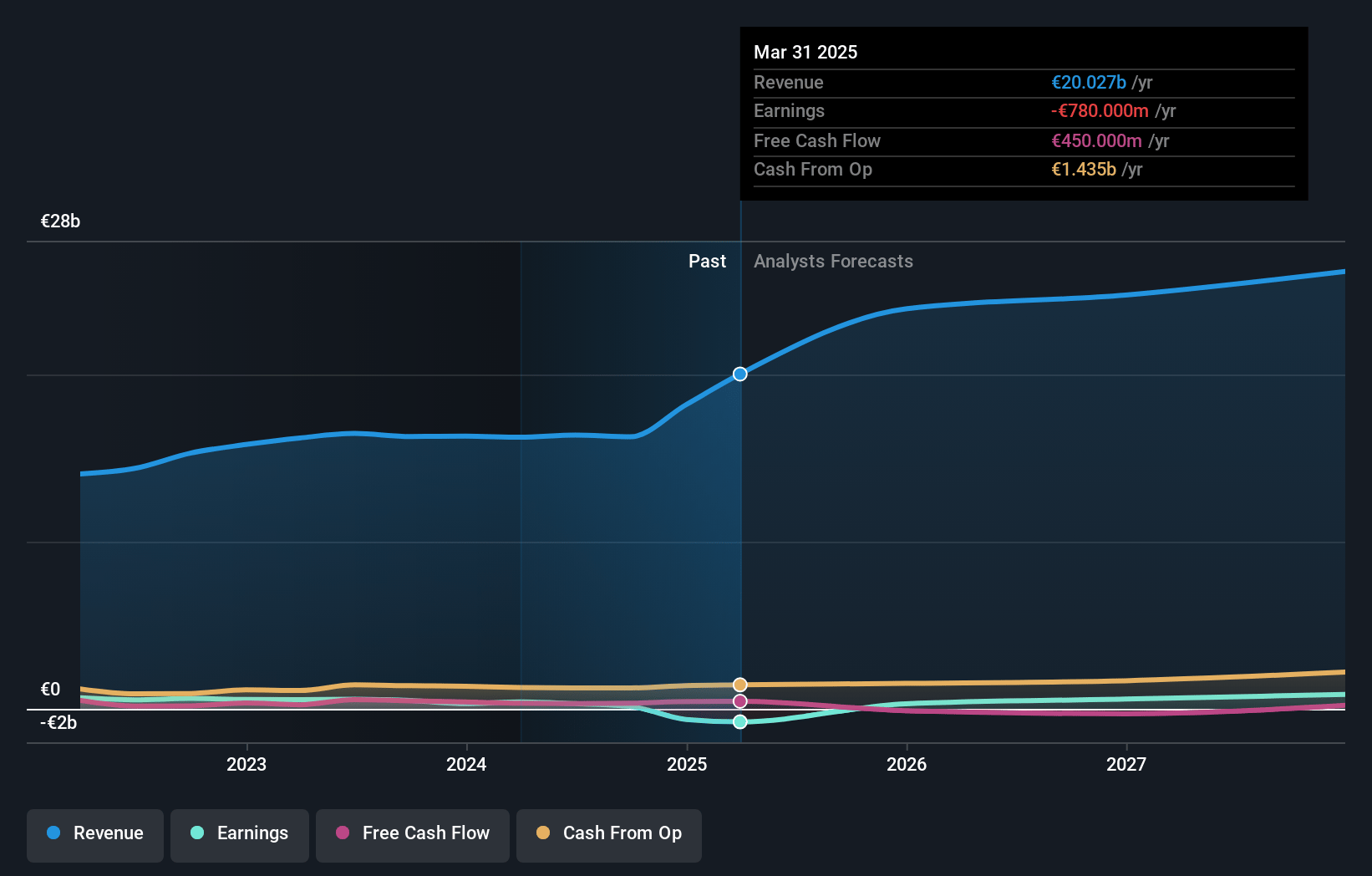

Schaeffler Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Schaeffler compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Schaeffler's revenue will grow by 8.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -3.9% today to 3.2% in 3 years time.

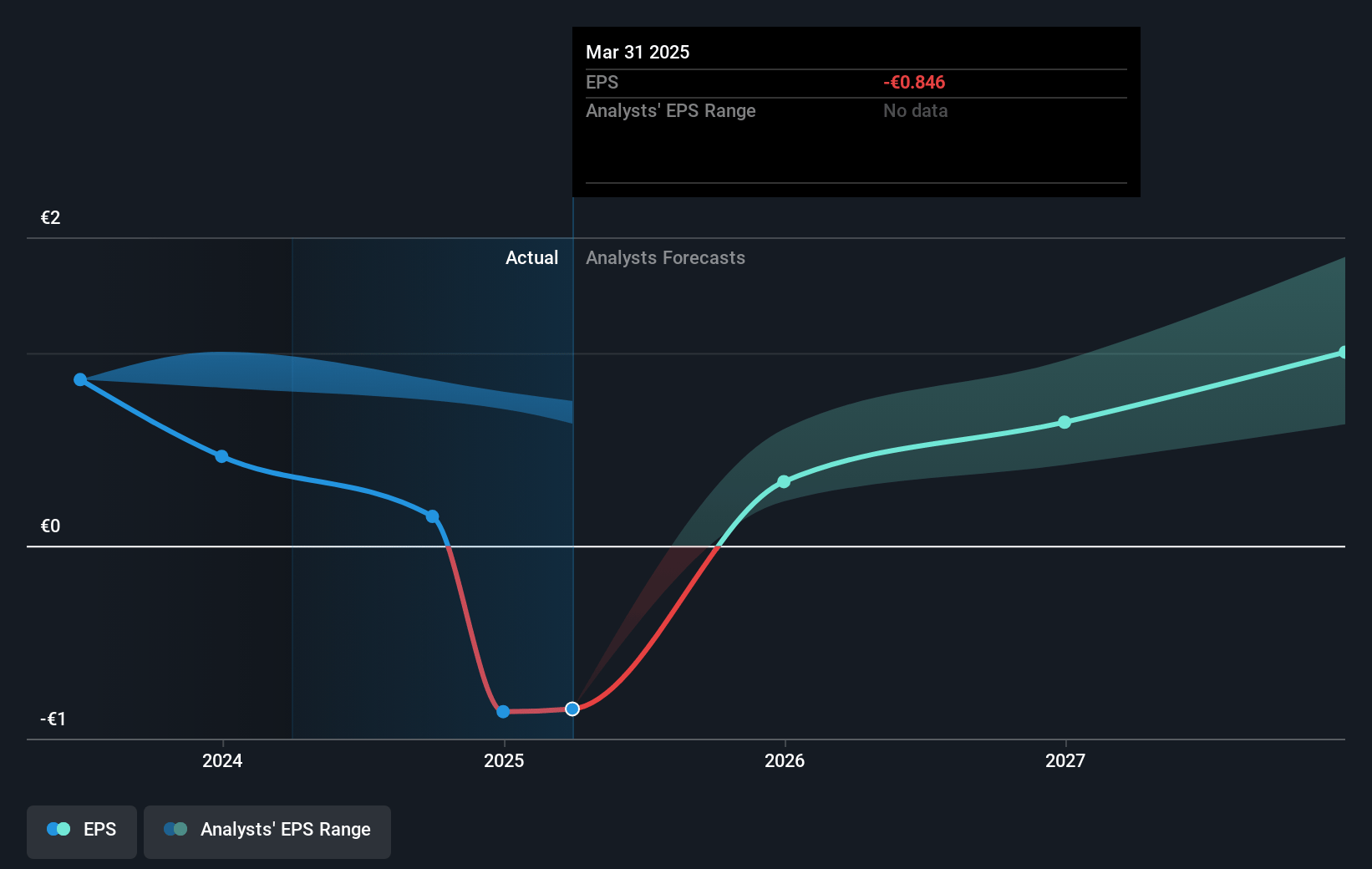

- The bearish analysts expect earnings to reach €828.6 million (and earnings per share of €0.87) by about July 2028, up from €-780.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 7.1x on those 2028 earnings, up from -5.8x today. This future PE is lower than the current PE for the GB Auto Components industry at 13.1x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.23%, as per the Simply Wall St company report.

Schaeffler Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company continues to deliver strong growth and margin improvements in its E-Mobility and Vehicle Lifetime Solutions divisions, both showing high single or double-digit sales growth and gross margin gains, which points to a successful pivot toward vehicle electrification and recurring aftermarket revenue streams supporting revenue and earnings in the long term.

- A robust order intake, especially in E-Mobility (€3 billion in a single quarter) leading to a high book-to-bill ratio, indicates strong future demand and backlog, which should translate into resilient top-line growth and improved earnings visibility.

- The company's hedge strategy-balancing ICE, hybrid, and EV powertrain exposure; combining OEM and aftermarket; and maintaining a significant industrial bearings segment-creates operational resilience and helps smooth earnings volatility, thereby protecting both revenue and margins from automotive sector cycles.

- Ongoing operational efficiency improvements, shop floor corrective actions, and targeted capital allocation are driving higher gross margins and stable or improving EBIT margins, indicating the company's ability to manage costs and sustain profitability even in challenging environments.

- Schaeffler maintains a strong liquidity position and has proactively refinanced upcoming debt maturities, limiting financial risk and supporting the ability to fund growth initiatives, ensuring stable or improving net margins and free cash flow over the medium to long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Schaeffler is €4.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Schaeffler's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €7.5, and the most bearish reporting a price target of just €4.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €25.7 billion, earnings will come to €828.6 million, and it would be trading on a PE ratio of 7.1x, assuming you use a discount rate of 8.2%.

- Given the current share price of €4.75, the bearish analyst price target of €4.0 is 18.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.