Key Takeaways

- Addressable market shrinkage and pricing pressures threaten earnings as electric and autonomous vehicle adoption reduces demand for legacy products and recurring sales.

- Reliance on traditional components and delayed diversification leaves SAF-Holland vulnerable to technological shifts, regulatory pressures, and intensified buyer bargaining power.

- Diversified markets, resilient aftermarket revenue, strategic acquisitions, and operational advances position SAF-Holland for sustainable growth and earnings stability despite macroeconomic uncertainty.

Catalysts

About SAF-Holland- Manufactures and sells chassis-related assemblies and components for trailers, trucks, semi-trailers, and buses.

- The accelerating shift to electric and zero-emission commercial vehicles is expected to shrink the addressable market for traditional suspension, axle, and fifth wheel components, which remain the core of SAF-Holland's portfolio; this long-term displacement threatens both revenue growth and limits pricing power, putting sustained pressure on earnings potential.

- Increased adoption of mobility-as-a-service, supply chain innovations, and advancements in autonomous freight could lead to structurally smaller commercial vehicle fleets and less frequent replacement cycles, undermining recurring demand for SAF-Holland's OEM and aftermarket products and impairing long-term top-line expansion.

- The company's heavy reliance on legacy mechanical products, combined with limited diversification into electrified or autonomous-ready solutions, exposes it to secular declines as commercial vehicle manufacturers and fleets prioritize new technology suppliers, risking long-term revenue stagnation or even decline.

- Ongoing consolidation among OEMs and fleet operators may significantly increase buyer bargaining power, leading to tougher contract terms and sustained margin compression; with gross margin gains recently driven by a temporary revenue mix tilt to aftermarket, future profitability improvements are at risk once OEM volumes normalize or contract renewals intensify pricing pressure.

- Growing ESG and regulatory scrutiny will likely force SAF-Holland into substantial investment cycles to upgrade existing manufacturing processes and products for compliance, directly increasing operating expenses and potentially eroding net margins while competitors more focused on next-generation solutions take market share.

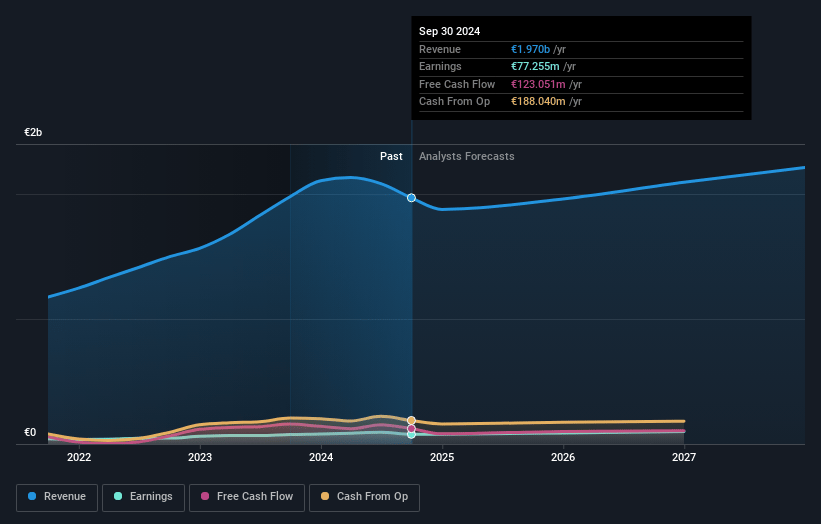

SAF-Holland Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on SAF-Holland compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming SAF-Holland's revenue will grow by 5.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 3.5% today to 5.0% in 3 years time.

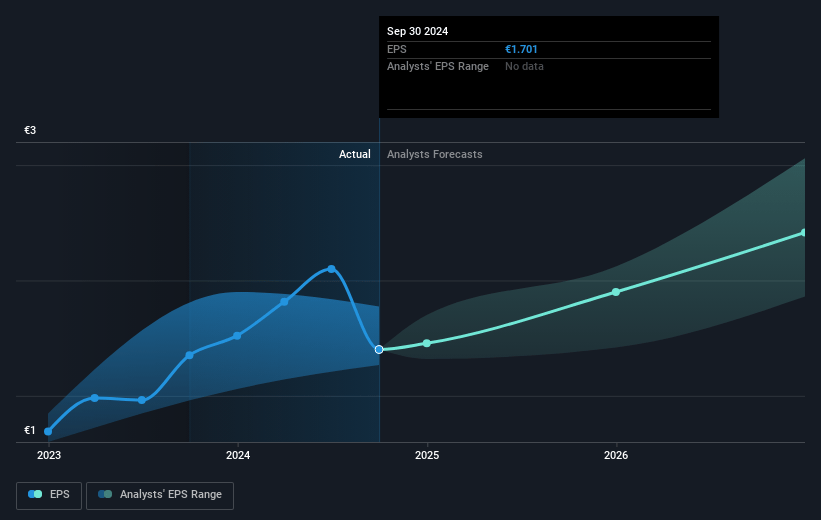

- The bearish analysts expect earnings to reach €107.1 million (and earnings per share of €2.36) by about July 2028, up from €64.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 9.3x on those 2028 earnings, down from 12.6x today. This future PE is lower than the current PE for the GB Auto Components industry at 13.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.27%, as per the Simply Wall St company report.

SAF-Holland Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's robust and growing aftermarket business is proving resilient even during OE market downturns, supporting stable gross margins and providing a steady recurring revenue stream that can cushion earnings during cyclical slowdowns.

- Strategic international acquisitions (such as Haldex, Tecma, and Assali Stefen) are enhancing SAF-Holland's product portfolio, enabling cross-selling and geographic diversification, which could drive longer-term revenue growth and improved net margins as integration synergies are realized.

- SAF-Holland's investments in automation, production modernization, and operational excellence, along with new manufacturing capacity in regions like Texas and Türkiye, are expected to drive higher efficiency, contained cost escalation, and sustainable improvement in profitability.

- The company is successfully adapting its product offering to benefit from secular shifts, including expanding into non-traditional markets like agriculture, mining, construction, and material handling, which broadens the addressable market and creates new avenues for revenue growth.

- Early indications of recovery in key regions-such as fully booked orders in EMEA and stabilizing America and APAC segments-combined with a flexible production footprint and risk mitigation strategies (dual/triple sourcing to offset tariffs and input cost pressures), position SAF-Holland to defend or improve earnings even amid macro uncertainty.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for SAF-Holland is €18.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of SAF-Holland's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €27.6, and the most bearish reporting a price target of just €18.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €2.1 billion, earnings will come to €107.1 million, and it would be trading on a PE ratio of 9.3x, assuming you use a discount rate of 7.3%.

- Given the current share price of €17.78, the bearish analyst price target of €18.0 is 1.2% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.