Key Takeaways

- Early and robust order intake, paired with rising demand for fleet modernization, positions the company for outsized revenue and margin growth ahead of consensus expectations.

- Expansion into new industries and digital product offerings is set to unlock previously unrealized, higher-margin growth opportunities and enhance long-term earnings clarity.

- Heavy dependence on traditional customers, limited tech investment, regulatory pressures, and rising competition threaten SAF-Holland's margins, growth prospects, and long-term market position.

Catalysts

About SAF-Holland- Manufactures and sells chassis-related assemblies and components for trailers, trucks, semi-trailers, and buses.

- While analyst consensus expects EMEA trailer market recovery starting in late 2025, actual order intake in April and May is already robust, with SAF-Holland fully booked earlier than anticipated, suggesting a much stronger and earlier rebound that could meaningfully boost revenues and profitability in 2025 and beyond.

- Analysts broadly agree that government infrastructure spending and regulations may benefit SAF-Holland, but this view understates the company's ability to win share as customers accelerate fleet modernization and component upgrades to comply with stricter emission standards, providing potential for outsized revenue growth and upward margin expansion as secular trends favor SAF's advanced product portfolio.

- SAF-Holland's strategic push beyond commercial vehicles into related industries like agriculture, mining, construction, and material handling is set to unlock new, underappreciated growth drivers, increasing total addressable market and providing incremental revenues with likely higher margin profiles.

- Investment in digitalization and connected trailer solutions positions SAF-Holland to capitalize on the surging demand for smart and sensor-equipped chassis; this not only creates new premium revenue streams but opens the door to recurring aftermarket services, materially improving long-term earnings visibility.

- The company's scalable global manufacturing footprint, supported by successful integrations of recent acquisitions and ongoing automation initiatives, is driving operational leverage-meaning even moderate demand recovery could disproportionately lift earnings and net margins relative to consensus expectations.

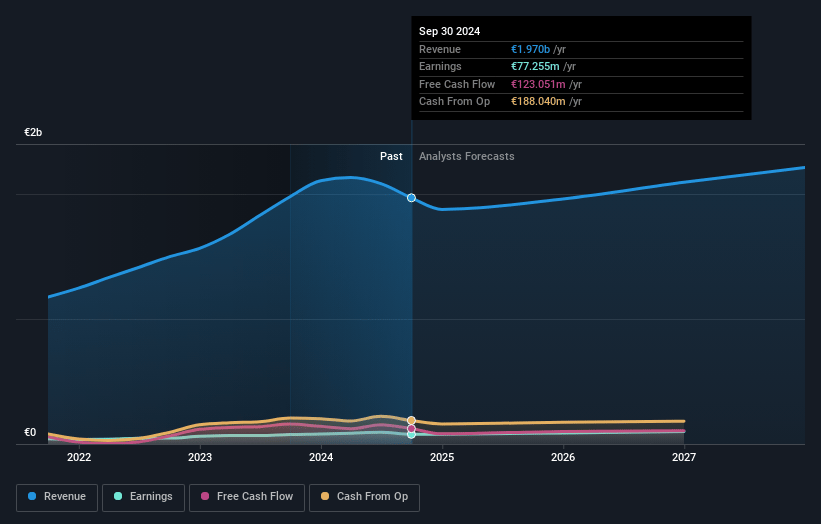

SAF-Holland Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on SAF-Holland compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming SAF-Holland's revenue will grow by 7.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 3.5% today to 5.1% in 3 years time.

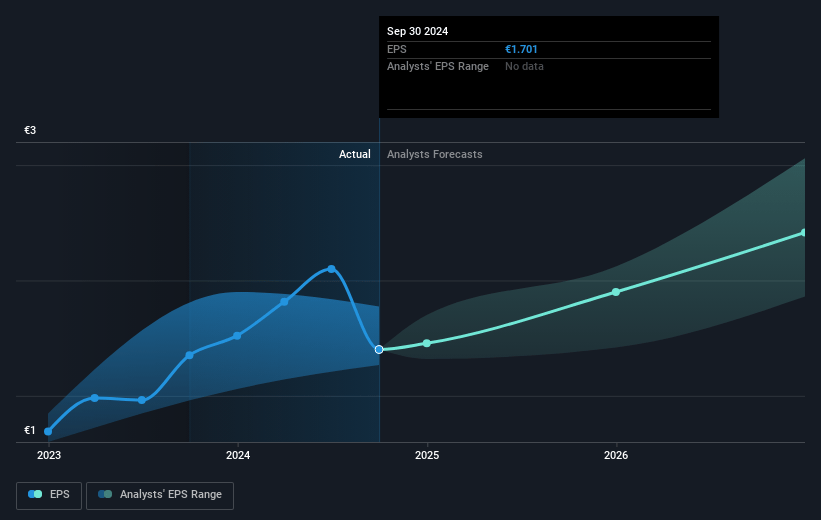

- The bullish analysts expect earnings to reach €114.3 million (and earnings per share of €2.52) by about July 2028, up from €64.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.4x on those 2028 earnings, up from 12.8x today. This future PE is greater than the current PE for the GB Auto Components industry at 13.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.22%, as per the Simply Wall St company report.

SAF-Holland Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- SAF-Holland's heavy reliance on traditional commercial vehicle OEMs exposes it to cyclicality and softness in core truck and trailer markets, as evidenced by the recent 14% organic sales decline, thus making its future revenues vulnerable during prolonged economic downturns.

- Limited visible progress or investment in advanced e-mobility, telematics, or autonomous vehicle technologies risks leaving the company behind as the industry shifts, potentially eroding long-term market share and constraining revenue growth in a transforming mobility landscape.

- Ongoing global supply chain disruptions, geopolitical uncertainties, and input cost inflation could hamper margin recovery and operational predictability, pressuring net margins and earnings stability over time.

- Increasingly stringent decarbonization and emissions regulations for drivetrains may require higher regulatory and capital expenditures to comply, possibly resulting in margin compression and reduced profitability if legacy products remain dominant.

- The trend toward consolidation among OEMs and growing competition from lower-cost Asian component suppliers may lead to structural pricing pressure, threatening SAF-Holland's ability to defend margins and maintain earnings strength in its core business lines.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for SAF-Holland is €27.6, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of SAF-Holland's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €27.6, and the most bearish reporting a price target of just €18.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €2.2 billion, earnings will come to €114.3 million, and it would be trading on a PE ratio of 13.4x, assuming you use a discount rate of 7.2%.

- Given the current share price of €18.04, the bullish analyst price target of €27.6 is 34.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.