Last Update 12 Dec 25

Fair value Increased 17%BCI: Cross Border Synergies And Florida Expansion Will Support Steady Outlook

Analysts have raised their price target for Banco de Crédito e Inversiones from CLP 46,000 to CLP 54,000, citing expectations of slightly faster revenue growth, modestly higher profit margins, and a richer future earnings multiple despite a marginally higher discount rate.

What's in the News

- Banco de Crédito e Inversiones hosted an Analyst and Investor Day focused on City National Bank of Florida, highlighting its U.S. growth strategy and integration progress (Key Developments)

- Management used the event to update investors on profitability trends and capital allocation priorities within the City National Bank of Florida franchise (Key Developments)

- The Analyst and Investor Day reinforced the bank's narrative around cross border synergies between its Chilean operations and City National Bank of Florida (Key Developments)

Valuation Changes

- The consensus analyst price target has risen significantly from CLP 46,000 to CLP 54,000, reflecting higher expected earnings and valuation multiples.

- The discount rate has increased slightly from 11.45% to 11.95%, indicating a modestly higher perceived risk or required return.

- Revenue growth assumptions have risen slightly from 15.41% to 15.74%, signaling a marginally stronger top line outlook.

- Net profit margin expectations have increased slightly from 31.00% to 31.40%, pointing to a modest improvement in operating efficiency or mix.

- The future P/E multiple has risen meaningfully from 11.24x to 12.57x, suggesting investors are willing to pay more per unit of expected earnings.

Key Takeaways

- Rapid international and digital expansion is transforming revenue streams, customer acquisition, and margin growth, with outperformance in US and Peruvian operations and the MACH digital ecosystem.

- Strong risk management and capital position enable Bci to capture new market share, pursue fintech opportunities, and sustain superior asset quality compared to peers.

- Heavy reliance on the Chilean market, digital transformation challenges, and regulatory burdens threaten BCI's growth, profitability, and ability to adapt to rising financial sector risks.

Catalysts

About Banco de Crédito e Inversiones- Provides various banking products and services in Chile, United States, and Peru.

- While analyst consensus recognizes the benefit of international expansion via City National Bank of Florida and Bci Peru, the pace and scale of these units' performance are exceeding expectations-with City National Bank's NIM and ROE outpacing guidance and commercial loans growing at almost double the system-indicating a much larger medium-term uplift to consolidated revenue and net income as U.S. and Peru operations scale faster than anticipated.

- Analyst consensus expects MACH digital bank and the digital ecosystem to drive fee and volume growth, but this likely understates the upside-rapid digital onboarding of younger, digitally native customers and seamless cross-selling across Bci, Lider, and MACH are transforming client acquisition costs, powering structural margin expansion and an accelerating shift to annuity-like, high-margin fee income streams.

- Bci's leadership in SME and commercial lending, underpinned by specialized multibank platforms and dominance in factoring and foreign trade, positions it to disproportionately benefit from the rising middle class and deepening economic integration across Latin America, supporting superior loan growth and fee revenue versus peers for many years to come.

- The company's prudent risk management, reflected in sector-beating declines in NPLs and cost of risk, puts it in a rare position to aggressively capture share in a recovering consumer and mortgage market while maintaining best-in-class asset quality, significantly lifting net earnings durability and allowing for more efficient capital deployment into higher-yielding segments.

- Bci's robust capital and liquidity levels, including CET1 ratios well above regulatory minimums and strong deposit growth, create capacity for outsized, accretive fintech partnerships and potential M&A, which could accelerate scale, bring future-ready technology in-house, and unlock step-changes in both top-line and operating leverage.

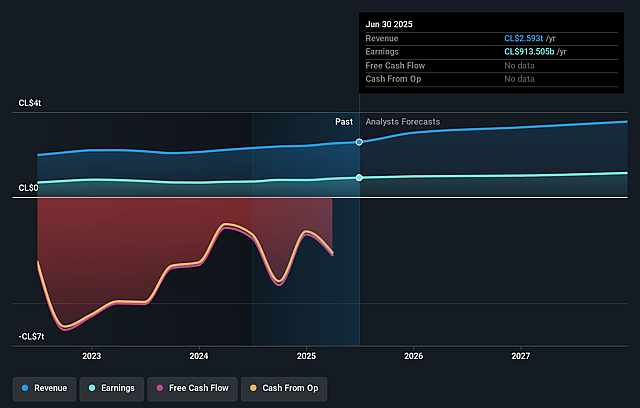

Banco de Crédito e Inversiones Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Banco de Crédito e Inversiones compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Banco de Crédito e Inversiones's revenue will grow by 15.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 35.2% today to 31.0% in 3 years time.

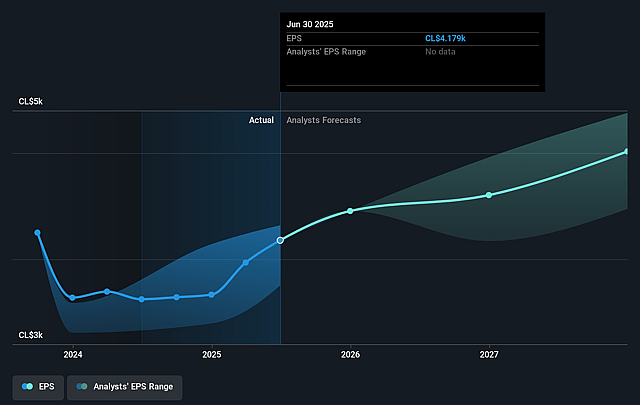

- The bullish analysts expect earnings to reach CLP 1235.3 billion (and earnings per share of CLP 5641.47) by about September 2028, up from CLP 913.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 11.2x on those 2028 earnings, up from 10.2x today. This future PE is greater than the current PE for the CL Banks industry at 11.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.45%, as per the Simply Wall St company report.

Banco de Crédito e Inversiones Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- BCI's significant dependence on the Chilean market exposes the bank to both concentration risk and sluggish long-term growth, as evidenced by macroeconomic projections of only 2% GDP growth, undermining sustainable lending growth and revenue expansion.

- The accelerating shift to digital banking and intensified fintech competition threatens BCI's ability to retain younger, digitally native customers, while its ongoing investment in legacy IT systems and slower digital transformation may result in sustained operational cost disadvantages and compressed net margins.

- Persistently high unemployment and a sluggish labor market in Chile, combined with consumer credit quality stress, increase the likelihood of stagnant or deteriorating household consumption and credit demand, potentially impacting loan volumes, asset quality, and thus top-line revenue growth.

- Regulatory tightening around anti-money laundering and new compliance burdens, including climate risk disclosures and data privacy, will raise compliance expenses and operating complexity, thereby pressuring BCI's cost-to-income efficiency and eroding net margins over time.

- The ongoing trend of rising indebtedness among households and corporates in Chile and the region increases the risk of future spikes in non-performing loans and higher provisioning requirements, which may drive earnings volatility and negatively impact overall profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Banco de Crédito e Inversiones is CLP46000.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Banco de Crédito e Inversiones's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CLP46000.0, and the most bearish reporting a price target of just CLP29890.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be CLP3985.8 billion, earnings will come to CLP1235.3 billion, and it would be trading on a PE ratio of 11.2x, assuming you use a discount rate of 11.4%.

- Given the current share price of CLP42498.0, the bullish analyst price target of CLP46000.0 is 7.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Banco de Crédito e Inversiones?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.