Key Takeaways

- Intensifying competition from fintechs and digital rivals, alongside regulatory and ESG pressures, will squeeze BCI's margins and elevate compliance costs.

- Domestic demographic and economic stagnation will dampen long-term loan demand and constrain BCI's capacity for sustained core earnings growth.

- Prudent risk management, digital expansion, strong capital, and successful international diversification are driving improved profitability, resilient growth, and enhanced earnings for Bci.

Catalysts

About Banco de Crédito e Inversiones- Provides various banking products and services in Chile, United States, and Peru.

- As global fintechs and digital-only banks accelerate their expansion throughout Latin America, traditional banks like BCI may face sustained erosion of customer base and fee income, leading to downward pressure on both revenue growth and net margins as the company will be forced to invest heavily in technology to remain competitive.

- BCI's significant domestic exposure leaves it acutely vulnerable to Chile's aging population and slowing population growth, which are likely to mute long-term demand for loans and deposits, constraining the bank's ability to deliver sustained top-line growth and resulting in a structurally lower core earnings trajectory.

- Greater social and regulatory pressure for ESG and sustainability initiatives may drive higher compliance expenses and restrict certain profitable activities over time, increasing BCI's cost base while failing to unlock proportionate new revenue streams, thereby putting persistent pressure on net profitability.

- Persistent low economic dynamism in Chile-with projected trend GDP growth anchored around just 2 percent and high unemployment rates-suggests that household credit demand and mortgage growth will remain subdued for years, limiting BCI's ability to significantly expand its loan book and drive fee income, regardless of near-term gains.

- The ongoing rise of non-bank financial institutions and cross-border digital competitors, combined with new open banking regulations, could erode market share and compress margins for BCI as competitive intensity increases, resulting in longer-term headwinds to revenue growth and weaker operating leverage.

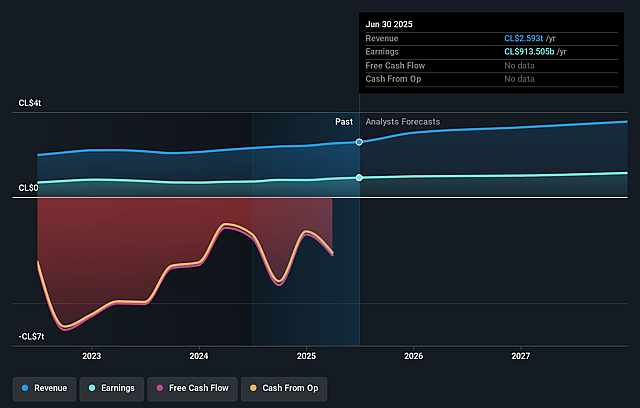

Banco de Crédito e Inversiones Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Banco de Crédito e Inversiones compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Banco de Crédito e Inversiones's revenue will grow by 10.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 35.2% today to 32.9% in 3 years time.

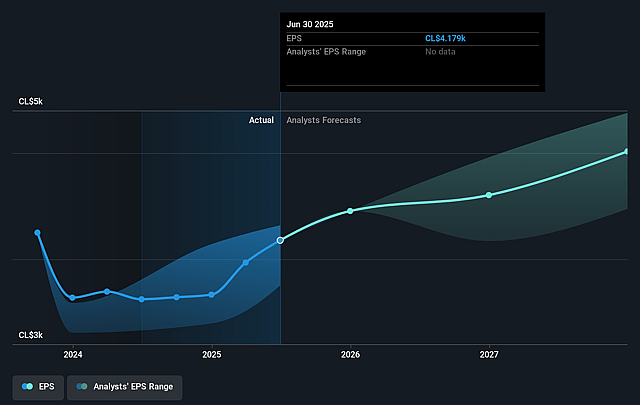

- The bearish analysts expect earnings to reach CLP 1163.6 billion (and earnings per share of CLP 4897.74) by about September 2028, up from CLP 913.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 7.8x on those 2028 earnings, down from 10.1x today. This future PE is lower than the current PE for the CL Banks industry at 11.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.45%, as per the Simply Wall St company report.

Banco de Crédito e Inversiones Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The sustained improvement in asset quality and conservative risk management-evidenced by lowering non-performing loan ratios, significant coverage of NPLs, and prudent provisioning-positions Bci to reduce future credit losses, which in turn could drive higher net income and strengthen overall earnings.

- Ongoing digital transformation, successful cross-selling within the EcoRetail platform, and expansion into digital-first channels such as MACHBANK enable Bci to continually grow its fee income base and lower operational costs, improving both revenue streams and net margins.

- The bank's strong capital position, with CET1 and liquidity ratios consistently above regulatory requirements, provides Bci flexibility to pursue further growth and strategic initiatives, strengthening resilience and supporting long-term profitability and return on equity.

- International diversification through City National Bank of Florida and Bci Peru, both demonstrating robust loan and deposit growth, expanding margins, and substantial contributions to group earnings, reduces risk tied to the Chilean economy and enhances the company's consolidated revenue and profit trajectory.

- Macro trends in Chile and Peru, including gradual economic recovery, anticipated monetary policy easing, and government incentives for mortgage lending, are supporting demand for credit while Bci's leadership in commercial, wholesale, and SME lending segments is driving above-industry loan growth and capturing market share, underpinning revenue and earnings growth in coming years.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Banco de Crédito e Inversiones is CLP30005.65, which represents two standard deviations below the consensus price target of CLP40295.56. This valuation is based on what can be assumed as the expectations of Banco de Crédito e Inversiones's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CLP46000.0, and the most bearish reporting a price target of just CLP29890.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be CLP3538.3 billion, earnings will come to CLP1163.6 billion, and it would be trading on a PE ratio of 7.8x, assuming you use a discount rate of 11.4%.

- Given the current share price of CLP42300.0, the bearish analyst price target of CLP30005.65 is 41.0% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.