Key Takeaways

- Expansion of distributed renewables and regulatory pressures threaten traditional grid revenue streams and could compress profitability margins over time.

- Regional concentration and volatility in energy prices increase risks to earnings stability and investment capacity.

- Strategic expansion in renewables, innovation in smart technologies, and a strong regional monopoly underpin Romande Energie Holding's stable growth and resilience during the energy transition.

Catalysts

About Romande Energie Holding- Engages in the production, distribution, and marketing of electrical and thermal energy in Switzerland.

- The ongoing acceleration of distributed renewable energy sources, particularly residential solar and home batteries, threatens to erode demand for Romande Energie's traditional grid services, resulting in declining electricity volumes and putting significant pressure on long-term revenue growth.

- Intensifying regulatory scrutiny and the tightening of environmental standards across Switzerland and Europe are likely to impose meaningfully higher compliance and operational costs on the company, leading to structural margin compression and weaker net profitability over time.

- Continued geographic and operational concentration in Western Switzerland exposes Romande Energie to disproportionate risks from local economic downturns or demographic stagnation, which could dampen customer growth and decrease group earnings resilience.

- Persistent volatility in energy prices, partly driven by a sharp rise in intermittent renewable supply and the challenges of grid balancing, heightens the likelihood of material swings in Romande Energie's earnings, creating uncertainty for future cash flows and capital planning.

- Rising interest rates and increased capital expenditure requirements for essential grid modernization and smart meter deployment are expected to raise financing costs and strain the company's ability to sustain current levels of investment, ultimately threatening further margin erosion and net income deterioration.

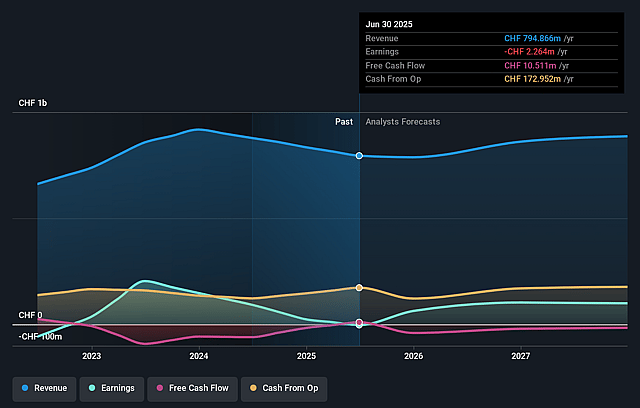

Romande Energie Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Romande Energie Holding compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Romande Energie Holding's revenue will grow by 2.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -0.3% today to 12.0% in 3 years time.

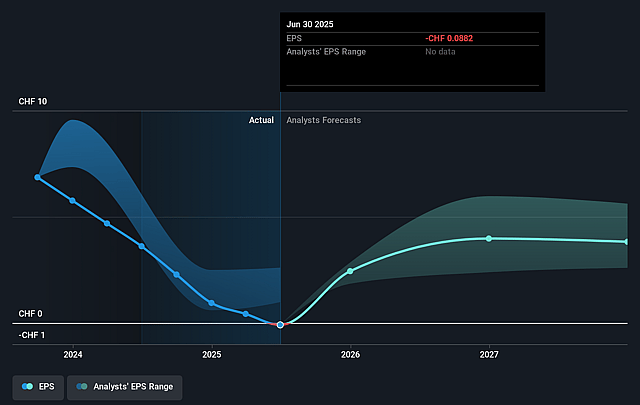

- The bearish analysts expect earnings to reach CHF 102.0 million (and earnings per share of CHF 4.52) by about September 2028, up from CHF -2.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.3x on those 2028 earnings, up from -482.8x today. This future PE is lower than the current PE for the GB Electric Utilities industry at 12.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 3.82%, as per the Simply Wall St company report.

Romande Energie Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating decarbonization and energy transition policies across Switzerland and the EU are leading to substantial demand for grid reinforcement and building renovations, which creates growth opportunities for Romande Energie Holding and could support higher long-term revenue and resilient cash flows.

- Romande Energie is strategically expanding its renewable generation portfolio through investments in hydropower, solar, and district heating, positioning itself as a key contributor to regional clean energy goals, which may help protect and expand gross margins even as regulatory frameworks evolve.

- The company is actively investing in smart grid technologies, digitalization, and customer-facing innovation (such as smart meters and advanced customer portals), which are expected to improve operational efficiency and generate new value-added service revenues, supporting net margin expansion.

- Romande Energie benefits from a strong regional monopoly in Western Switzerland and a robust regulated asset base, offering stable, predictable earnings and lowering the risk of sudden drops in net profit, which can make its dividend and financial outlook more resilient.

- The company's proactive adaptation to shifting regulations-such as preparing for new feed-in tariffs, taking controlling interests in growth assets, and implementing efficiency measures-demonstrates agility in a challenging sector and supports ongoing EBITDA growth and strong operating cash flow generation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Romande Energie Holding is CHF41.2, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Romande Energie Holding's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF55.0, and the most bearish reporting a price target of just CHF41.2.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be CHF848.3 million, earnings will come to CHF102.0 million, and it would be trading on a PE ratio of 11.3x, assuming you use a discount rate of 3.8%.

- Given the current share price of CHF42.6, the bearish analyst price target of CHF41.2 is 3.4% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.