Key Takeaways

- Regulatory changes and favorable policies are creating new growth avenues in decarbonization, grid modernization, and energy renovation, supporting sustained revenue and margin expansion.

- Smart meter deployment, digital innovation, operational efficiencies, and strategic investments in renewables and acquisitions are strengthening profitability and future earnings stability.

- Rising capital needs, regulatory risks, limited diversification, partner dependency, and potential innovation shortfalls threaten profitability, stability, and growth in a rapidly evolving energy landscape.

Catalysts

About Romande Energie Holding- Engages in the production, distribution, and marketing of electrical and thermal energy in Switzerland.

- Legislative and policy changes in Switzerland and the EU (such as the New Canton of Vaud Energy Act and upcoming EU-Swiss electricity agreements) are expected to unlock new opportunities for grid upgrades, decarbonized heating, and building energy renovations, likely boosting medium

- and long-term revenue growth as regulatory barriers ease and subsidies flow.

- The accelerated roll-out of smart meters and digital platforms-on track to reach Swiss targets two years early-positions Romande Energie to drive operational efficiency and enhance customer value propositions, improving net margins through cost reductions and potential for new digital service revenues.

- Strong order intake and continued demand for energy retrofits and decarbonization services, reinforced by societal and political momentum for net-zero buildings, underpin recurring revenue growth and margin expansion in energy services and property-related business segments.

- Ongoing investments in renewable generation and grid reinforcements, including strategic acquisitions (such as Centrale Hydroélectrique de Bar and Swiss overhead line specialist), expand Romande Energie's asset base and unlock higher, more stable future earnings from regulated returns and renewable energy sales.

- Implementation of a groupwide efficiency plan and management restructuring, with new leadership focused on KPIs and cost discipline, is already translating to improved profitability metrics (EBITDA up 9%, EBIT up 10%); further margin upside is likely as these operational improvements mature and cost savings are realized.

Romande Energie Holding Future Earnings and Revenue Growth

Assumptions

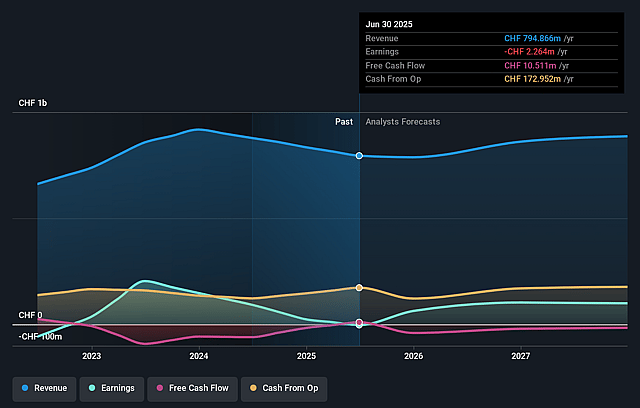

How have these above catalysts been quantified?- Analysts are assuming Romande Energie Holding's revenue will grow by 3.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.3% today to 11.5% in 3 years time.

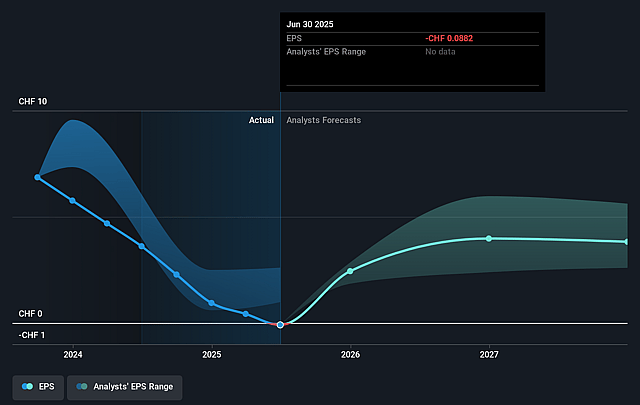

- Analysts expect earnings to reach CHF 101.4 million (and earnings per share of CHF 4.44) by about September 2028, up from CHF -2.3 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting CHF144.8 million in earnings, and the most bearish expecting CHF83.6 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.7x on those 2028 earnings, up from -482.8x today. This future PE is lower than the current PE for the GB Electric Utilities industry at 12.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 3.82%, as per the Simply Wall St company report.

Romande Energie Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company faces rising capital expenditure demands for grid reinforcement and upgrades due to rapid solar energy expansion and new regulatory requirements, which could put sustained pressure on free cash flow and strain future net margins and earnings.

- Regulatory uncertainty and frequent legislative changes at both Swiss and European levels (new Energy Acts, shifting WACC, pending EU electricity deal and referendums) pose risks of increased compliance costs and unpredictable shifts in pricing or margins, potentially impacting long-term revenue and earnings stability.

- Romande Energie's renewed focus on core business after retreating from prior diversification may limit revenue growth opportunities, and continued geographic and market concentration in Western Switzerland could expose the company to local economic and weather volatility, affecting revenue and net profit variability.

- Dependency on external associates like Alpiq introduces additional earnings volatility, as outages and operational disruptions (like the offline plant) significantly reduce contribution to Romande Energie's net profit, adding uncertainty to profitability forecasts.

- The accelerating pace of decentralization and distributed solar power in the region requires proactive grid solutions-if innovation or digital transformation lags, Romande Energie risks falling behind more nimble competitors and technology disruptors, eroding both market share and long-term top-line revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CHF46.067 for Romande Energie Holding based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF55.0, and the most bearish reporting a price target of just CHF41.2.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CHF884.6 million, earnings will come to CHF101.4 million, and it would be trading on a PE ratio of 12.7x, assuming you use a discount rate of 3.8%.

- Given the current share price of CHF42.6, the analyst price target of CHF46.07 is 7.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.