Key Takeaways

- Accelerated grid upgrades, electrification, and digitalization position the company for margin expansion, improved earnings stability, and agile market engagement amid policy changes.

- Strategic acquisitions and streamlined operations are set to drive fee growth, recurring income, and enhanced profitability as consolidation reshapes the Swiss energy sector.

- Rising climate risks, regulatory changes, and heavy investment needs threaten profitability, cash flow, and earnings stability due to limited geographic diversification and evolving market dynamics.

Catalysts

About Romande Energie Holding- Engages in the production, distribution, and marketing of electrical and thermal energy in Switzerland.

- Analysts broadly agree that the regulatory reforms and future bilateral EU-Swiss energy agreements will moderately support Romande Energie's structural earnings growth, but this view likely understates the extent to which these measures could catalyze margin expansion and grid-related revenue by accelerating cross-border integration, grid upgrade incentives, and granting the company an outsized role in shaping Swiss and European energy policy.

- While consensus expects sustained demand from energy transition and decarbonization policy to boost top-line growth, the market is underappreciating just how rapidly local electrification (especially from EVs and heat pumps) and property energy retrofits will compound, positioning Romande Energie to experience both volume-driven sales growth and structural improvements in earnings visibility and load-factor stability.

- The new executive team-led by a CEO with a proven development record and bolstered by specialists in performance management and innovation-has completed a major reorganization, which could unlock significant operational efficiencies and agile market engagement, generating EBIT margin expansion well above current projections.

- The company's aggressive investment in smart grid infrastructure and digitalization is set to both outperform regulatory rollout targets and materially lower network losses ahead of schedule, which should start to noticeably increase EBITDA and cash conversion within the next two fiscal years.

- Romande Energie's full acquisition of minority interests alongside targeted M&A deals in grids, renewables, and energy services positions the company to re-rate its earnings base, accelerate recurring fee income, and extract synergies, directly supporting double-digit bottom-line growth as consolidation pressures intensify across Swiss energy markets.

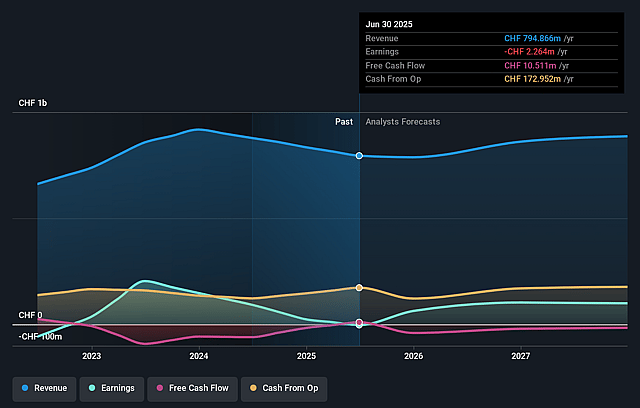

Romande Energie Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Romande Energie Holding compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Romande Energie Holding's revenue will grow by 6.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -0.3% today to 19.0% in 3 years time.

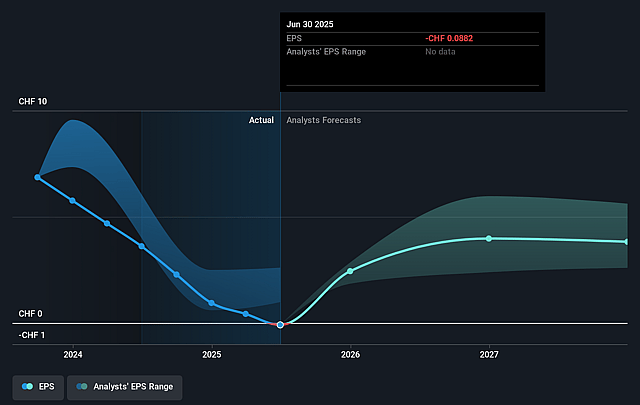

- The bullish analysts expect earnings to reach CHF 181.0 million (and earnings per share of CHF 7.55) by about September 2028, up from CHF -2.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 8.5x on those 2028 earnings, up from -476.0x today. This future PE is lower than the current PE for the GB Electric Utilities industry at 12.8x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 3.82%, as per the Simply Wall St company report.

Romande Energie Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The increasing development and integration of solar energy and distributed generation is raising significant challenges for the grid, requiring substantial investments in upgrades and reinforcement, which could increase operational costs and reduce future net margins.

- Romande Energie experienced a drop in its own electricity production due to mild weather and low rainfall, highlighting climate-related risks tied to hydroelectric generation that threaten long-term revenue stability and earnings consistency.

- Ongoing and accelerating capital expenditures in grid modernization, district heating, smart meters, and property-related decarbonization projects are straining free cash flow and may increase debt, putting pressure on net margins and future earnings.

- Increasing regulatory complexity and changes-including lowering of the weighted average cost of capital (WACC), adjustments to feed-in tariffs, and prospective interventions following new European and Cantonal energy legislation-may constrain allowable profitability and directly impact revenue and EBIT growth.

- The group's limited geographic diversification within western Switzerland exposes it disproportionately to regional economic or regulatory shocks, increasing the risk of revenue volatility and undermining long-term earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Romande Energie Holding is CHF55.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Romande Energie Holding's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF55.0, and the most bearish reporting a price target of just CHF41.3.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be CHF952.7 million, earnings will come to CHF181.0 million, and it would be trading on a PE ratio of 8.5x, assuming you use a discount rate of 3.8%.

- Given the current share price of CHF42.0, the bullish analyst price target of CHF55.0 is 23.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.