Key Takeaways

- Stringent regulatory changes and operational cost pressures are expected to limit profitability while weakening UBS's ability to return capital to shareholders.

- Integration risks, legal overhang from Credit Suisse, demographic challenges, and competition from digital entrants threaten organic growth and undermine fee-based revenue models.

- Strong execution on Credit Suisse integration, wealth management growth, and technology investment is driving profitability, efficiency, and diversified long-term revenue opportunities.

Catalysts

About UBS Group- Provides financial advice and solutions to private, institutional, and corporate clients worldwide.

- The proposed overhaul of Swiss bank capital regulation would require UBS to hold at least $24 billion, and potentially up to $42 billion, in additional capital at the parent bank and group level, materially depressing returns on equity and limiting the company's ability to distribute capital to shareholders over the long term.

- UBS faces growing operational challenges and cost inflation from increased global regulatory scrutiny, especially around tax transparency, anti-money laundering, and ESG compliance, which are expected to structurally raise operational expenses and constrain net margins on a multi-year horizon.

- The integration of Credit Suisse exposes UBS to significant execution risks, including IT migrations, cultural clashes, and protracted restructuring, while legacy legal and reputational issues from Credit Suisse could result in unpredictable legal costs and one-off charges that will drag on convertible net earnings for years.

- Secular demographic headwinds in core European markets, where the population of high-net-worth individuals is stagnating or declining due to aging, suggest that organic revenue growth from UBS's largest and most mature geographies will structurally decelerate, making recurring fee growth less reliable.

- Rising competition from fintechs, Big Tech, and digital banks, as well as the continued emergence of decentralized finance and cryptocurrencies, threaten to erode UBS's traditional wealth management and banking fee models, putting long-term pressure on revenue and making UBS's high-margin advice and transaction platforms vulnerable to margin compression.

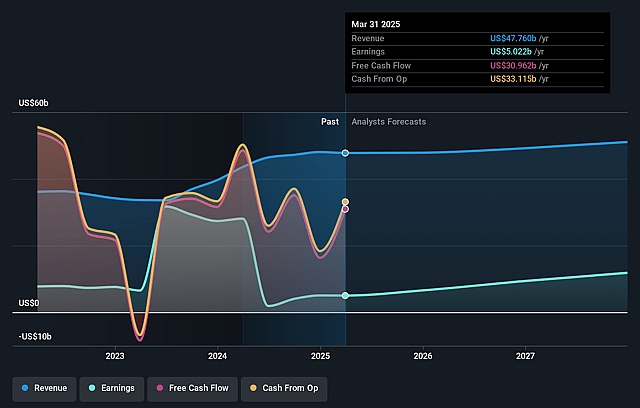

UBS Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on UBS Group compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming UBS Group's revenue will grow by 2.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 13.4% today to 23.0% in 3 years time.

- The bearish analysts expect earnings to reach $11.7 billion (and earnings per share of $4.18) by about September 2028, up from $6.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 9.9x on those 2028 earnings, down from 20.0x today. This future PE is lower than the current PE for the GB Capital Markets industry at 16.0x.

- Analysts expect the number of shares outstanding to decline by 0.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.87%, as per the Simply Wall St company report.

UBS Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- UBS is generating strong profitability and capital, underpinned by a return on CET1 capital above 13%, increasing tangible book value per share, and maintaining a robust CET1 ratio of 14.4%, all of which support higher net earnings, dividend growth, and share buybacks.

- The integration of Credit Suisse is progressing ahead of schedule, leading to significant cost savings, operational synergies, and strengthened market positioning, which can drive long-term improvement in net margins and earnings as cost/income ratios decline.

- UBS's global Wealth Management franchise is attracting strong net new asset inflows across all regions, especially in growth markets like Asia-Pacific and the Americas, supporting long-term recurring revenue growth and enhanced fee generation.

- Continued investments in technology and AI, such as digitalizing client experience and automating internal processes, are poised to improve operational efficiency, reduce costs, and enable margin expansion, positively impacting long-term profitability.

- Secular trends including the rise in global high-net-worth individuals, increasing intergenerational wealth transfer, and growing demand for sustainable investment and alternative assets are fueling asset growth and higher-margin advisory business, supporting revenue resilience and diversification over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for UBS Group is CHF23.21, which represents two standard deviations below the consensus price target of CHF32.13. This valuation is based on what can be assumed as the expectations of UBS Group's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF39.5, and the most bearish reporting a price target of just CHF21.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $50.7 billion, earnings will come to $11.7 billion, and it would be trading on a PE ratio of 9.9x, assuming you use a discount rate of 8.9%.

- Given the current share price of CHF31.82, the bearish analyst price target of CHF23.21 is 37.1% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.