Key Takeaways

- Accelerated integration of Credit Suisse, technology investments, and expansion in key regions are driving higher margins and rapid growth for UBS.

- UBS is well-positioned to benefit from industry consolidation, rising demand for alternatives, and stricter regulations, securing leadership and resilient profitability.

- Regulatory pressures, integration risks, and digital disruption threaten UBS Group's earnings stability, operational efficiency, and future revenue growth across global markets.

Catalysts

About UBS Group- Provides financial advice and solutions to private, institutional, and corporate clients worldwide.

- While analyst consensus highlights substantial cost synergies from the Credit Suisse integration, there is clear evidence UBS is moving at a much faster pace than expected, having already achieved 70% of its $13 billion cost savings goal and now positioned to exceed this target, driving meaningful outperformance in net margins and earnings.

- Analysts broadly agree that robust net new inflows are a tailwind for future growth, but they may be underestimating UBS's ability to accelerate global asset gathering-UBS is leveraging its dominant presence in high-growth regions such as APAC and the Americas, allowing it to capture outsized market share as global and intergenerational wealth rapidly expands, catalyzing double-digit revenue growth.

- UBS's technology investments in AI adoption and infrastructure are showing signs of compounding productivity improvements and at-scale digital client engagement, making UBS a frontrunner in digital wealth servicing and creating powerful operating leverage set to boost earnings and net margins beyond current market expectations.

- The ongoing global shift toward alternative assets, sustainable finance, and passive product innovation aligns perfectly with UBS's expanded alternatives business and ESG focus, supporting higher fee margins and opening up recurring, high-margin revenue streams.

- With industry consolidation and increasingly stringent regulatory barriers squeezing out weaker competitors, UBS's fortified balance sheet, global reach, and proven risk management position it not only as a survivor but as the primary beneficiary of future capital market flows and resilient profitability over the next decade.

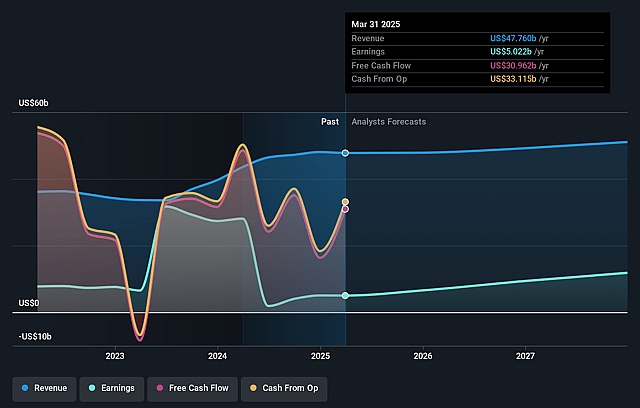

UBS Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on UBS Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming UBS Group's revenue will grow by 5.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 13.4% today to 27.1% in 3 years time.

- The bullish analysts expect earnings to reach $14.9 billion (and earnings per share of $5.16) by about September 2028, up from $6.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 13.4x on those 2028 earnings, down from 20.2x today. This future PE is lower than the current PE for the GB Capital Markets industry at 16.6x.

- Analysts expect the number of shares outstanding to decline by 0.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.87%, as per the Simply Wall St company report.

UBS Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The proposed changes to the Swiss capital regime would require UBS Group to hold up to 42 billion dollars of additional capital, with 24 billion dollars directly at the parent bank, putting significant pressure on return on equity, capital allocation, and ultimately shareholder distributions and earnings over the long term.

- The ongoing integration of Credit Suisse introduces execution and operational risks, with potential for unexpected restructuring costs, cultural misalignment, and client attrition, which could threaten both operational efficiency and earnings stability for several years.

- Secular trends such as increasing adoption of digital financial services and fintech disruptors may erode UBS Group's traditional wealth management and private banking revenue streams as clients increasingly seek alternative platforms, dampening revenue growth potential.

- Rising global regulatory pressures and compliance burdens, especially related to anti-money laundering, tax transparency, and sustainability expectations, will continue to drive up compliance costs and may compress net margins as regulatory demands become more stringent across jurisdictions.

- Increasing economic nationalism, de-globalization trends, and ongoing macroeconomic and geopolitical uncertainties-manifesting in delayed client execution, reduced cross-border activity, and volatile international capital flows-could negatively impact UBS Group's international client base, fee income, and revenue diversification.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for UBS Group is CHF39.5, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of UBS Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF39.5, and the most bearish reporting a price target of just CHF21.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $55.1 billion, earnings will come to $14.9 billion, and it would be trading on a PE ratio of 13.4x, assuming you use a discount rate of 8.9%.

- Given the current share price of CHF31.93, the bullish analyst price target of CHF39.5 is 19.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.