Key Takeaways

- Streamlined integration, tech investments, and rapid risk asset reduction are boosting UBS's margins, cost efficiency, and positioning for stronger earnings performance.

- Expansion in high-growth markets, alongside rising demand for bespoke and ESG solutions, supports potential outsize gains in recurring fees, AUM, and long-term profitability.

- Sustained integration, regulatory, and competitive pressures risk eroding profitability and stability, particularly given UBS's reliance on wealth management and exposure to global uncertainties.

Catalysts

About UBS Group- Provides financial advice and solutions to private, institutional, and corporate clients worldwide.

- While analyst consensus expects UBS to harvest cost synergies from the Credit Suisse integration, the accelerated decommissioning of legacy systems and rapid reduction of non-core risk-weighted assets suggests UBS could meaningfully outperform efficiency targets, driving upside in net margins and earnings faster than expected.

- Analysts broadly agree that robust net new asset inflows into Wealth and Asset Management will support revenue growth, but current momentum in fee-generating mandates and alternative investments, especially in APAC and the Americas, points to the potential for a step-change increase in UBS's recurring fee income and operating leverage, elevating long-term profitability.

- UBS's dominant position as a leading global wealth manager-combined with rapid expansion into high-growth markets such as India via strategic partnerships and scaling in APAC-uniquely positions the bank to capture outsized revenue and AUM gains from the accelerating global creation of high-net-worth individuals, directly boosting top-line growth.

- The group's ability to deliver differentiated ESG, alternative, and bespoke structured solutions-driven by early investments in unified platforms and global alternatives units-puts UBS at the forefront of fast-rising client demand for sustainable and sophisticated investment products, enabling above-peer revenue growth and superior fee margins.

- UBS's technology investments, including leading-edge data integration and generative AI tools, are delivering measurable gains in client engagement, product personalization, and operational scalability; this digital advantage provides sustained cost reductions and creates a foundation for continued margin expansion and future earnings outperformance.

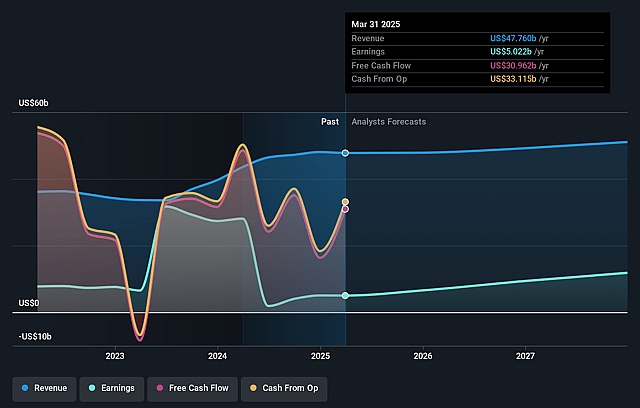

UBS Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on UBS Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming UBS Group's revenue will grow by 4.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 10.5% today to 27.9% in 3 years time.

- The bullish analysts expect earnings to reach $15.1 billion (and earnings per share of $5.29) by about July 2028, up from $5.0 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 12.1x on those 2028 earnings, down from 23.3x today. This future PE is lower than the current PE for the GB Capital Markets industry at 23.3x.

- Analysts expect the number of shares outstanding to decline by 0.45% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.08%, as per the Simply Wall St company report.

UBS Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Integration risk remains high following the Credit Suisse acquisition, with significant restructuring expenses, ongoing technology decommissioning, and the complexity of client migrations likely to weigh on net margins and prolong the return to pre-acquisition profitability.

- Heightened regulatory uncertainty and the potential for stricter capital requirements in Switzerland or globally could trigger increased compliance costs or constrain shareholder returns, placing sustained pressure on earnings and future capital return ambitions.

- The growing competition from fintechs and secular fee compression, as evidenced by margin declines and client rotation into lower-margin products in asset management, threaten to erode revenue growth and long-term profitability, especially in core wealth management.

- Over-reliance on wealth management exposes UBS to pronounced market volatility and shifts in client sentiment, resulting in potential instability in revenue and fee income during periods of uncertainty, as highlighted by client wait-and-see behavior and episodic spikes in activity.

- Persistent geopolitical tensions, trade policy unpredictability, and de-globalization risk undermining cross-border capital flows, while region-specific challenges and tariff disputes may restrain wealth management growth internationally, curbing revenue prospects in key markets.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for UBS Group is CHF37.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of UBS Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF37.0, and the most bearish reporting a price target of just CHF21.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $54.3 billion, earnings will come to $15.1 billion, and it would be trading on a PE ratio of 12.1x, assuming you use a discount rate of 9.1%.

- Given the current share price of CHF30.39, the bullish analyst price target of CHF37.0 is 17.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives