Key Takeaways

- Ongoing investments in AI and platform innovation are boosting organic client growth and expanding both revenue and profit margins despite perceived margin pressures.

- International diversification and successful scaling of new products, including crypto and neobanking, are increasing market reach and earnings stability.

- Rising regulation, market dependence, fintech competition, crypto volatility, and limited progress in wealth management threaten Swissquote's margin stability, earnings consistency, and long-term growth.

Catalysts

About Swissquote Group Holding- Provides online financial services to retail investors, affluent investors, and professional and institutional customers worldwide.

- Analyst consensus expects growth in net new money to moderate, but Swissquote has consistently exceeded its own conservative targets, bringing in CHF 8.3 billion in net new money in 2024 versus a target of CHF 7 billion, with high-quality clients supporting a long-term uptrend in revenue and recurring fee income.

- The consensus sees technology investment as a margin headwind, but Swissquote's proactive investment in AI and platform innovation has already enabled strong organic client acquisition and improved operational leverage, supporting structural expansion of both revenues and net margins.

- The accelerated shift toward digital and self-directed investing continues to expand Swissquote's addressable market, with client account growth of 13.2 percent in 2024 and a growing share of high-value customers, laying the groundwork for sustained high single-digit to double-digit annual revenue growth.

- The company is increasingly benefiting from international diversification, with rapid asset growth outside Switzerland and successful scaling in core European markets such as Luxembourg, France, Germany, and Benelux, which is expected to drive incremental revenue and earnings resilience as geographic mix improves.

- New product launches and cross-platform integration-notably in crypto-assets, fractional trading, and neobanking (including the scaling of Yuh)-are capturing demand for alternative assets and modern investment tools, driving higher transaction volume, assets under custody, and fee-based earnings over the coming years.

Swissquote Group Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Swissquote Group Holding compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Swissquote Group Holding's revenue will grow by 7.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 42.2% today to 47.4% in 3 years time.

- The bullish analysts expect earnings to reach CHF 429.4 million (and earnings per share of CHF 28.58) by about September 2028, up from CHF 307.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 23.4x on those 2028 earnings, down from 25.7x today. This future PE is greater than the current PE for the GB Capital Markets industry at 16.6x.

- Analysts expect the number of shares outstanding to decline by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.05%, as per the Simply Wall St company report.

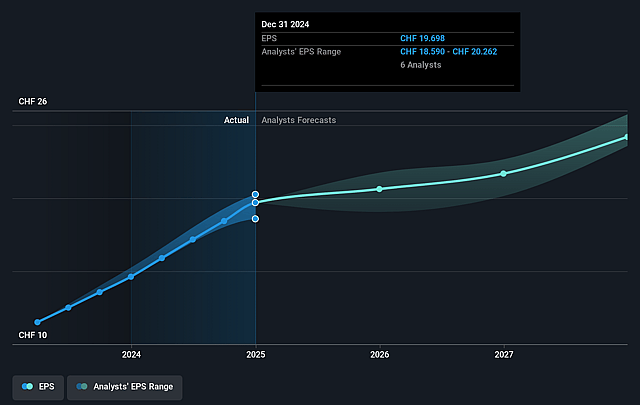

Swissquote Group Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increasing regulatory scrutiny and compliance costs in Europe and Switzerland are cited as limiting growth in divisions like eForex, and will require Swissquote to keep expanding investments in technology and risk management, leading to ongoing upward pressure on operating costs and potentially eroding net margins over time.

- Revenue from trading and transaction-based activities remains a major component of the business, exposing Swissquote to market cycles, lower retail investor participation due to aging demographics, and longer-term secular declines in trading activity, thereby increasing the risk of revenue and earnings volatility if client activity or market volumes fall.

- Swissquote's substantial growth in crypto brokerage (with crypto asset revenue up 350% in 2024 and 13% of total revenue) exposes profits and client acquisition to global regulatory pushback, changing sentiment, and potential declines in crypto trading volumes, as already reflected in management's more cautious and reduced guidance for crypto contributions in 2025, which could materially impact future revenues.

- Intensifying competition from fintechs, neobanks, and global brokers (including zero-commission trading models), combined with industry-wide fee compression and the commoditization of online investment services, forces Swissquote to balance margin sacrifices or high technology spend, putting long-term net margins and stable earnings growth at risk as competitors increase capabilities and market share.

- Despite organic growth, Swissquote continues to highlight challenges in moving beyond a strong B2C base to substantially expand its wealth management and institutional business, limiting its ability to increase high-quality, recurring fee income and reduce reliance on cyclical, lower-margin transaction activity, which threatens the stability of long-term revenues and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Swissquote Group Holding is CHF620.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Swissquote Group Holding's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF620.0, and the most bearish reporting a price target of just CHF258.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be CHF906.4 million, earnings will come to CHF429.4 million, and it would be trading on a PE ratio of 23.4x, assuming you use a discount rate of 5.1%.

- Given the current share price of CHF528.5, the bullish analyst price target of CHF620.0 is 14.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.