Key Takeaways

- Mounting regulatory and cybersecurity demands are set to raise compliance and technology costs, eroding profitability and heightening risks of customer attrition.

- Intensifying pricing competition and dependence on volatile trading revenues and cryptocurrencies expose the company to fee compression and growth challenges.

- Broad-based client and asset growth, innovation in digital banking, and focus on affluent segments support durable revenue expansion, margin improvement, and strengthened shareholder returns.

Catalysts

About Swissquote Group Holding- Provides online financial services to retail investors, affluent investors, and professional and institutional customers worldwide.

- Rapidly increasing regulatory pressures on fintech platforms are expected to significantly escalate Swissquote's compliance expenses in coming years, likely leading to persistent net margin erosion, especially as the company expands internationally and faces more complex jurisdictional requirements.

- Intensifying cybersecurity threats, coupled with the proliferation of high-profile breaches across financial services, are poised to raise operational costs for Swissquote as it must make ongoing heavy investments in technological safeguards, thereby reducing profitability and risking customer attrition that would limit both revenue and asset growth.

- The shift toward zero-commission trading models and aggressive pricing competition from global online brokers and neobanks threatens to compress Swissquote's fee income, undermining its ability to maintain current revenue growth rates and forcing it to sacrifice margins to retain or attract clients.

- Swissquote's business is increasingly exposed to volatile and unpredictable revenue streams due to its growing reliance on trading activity and alternative assets like cryptocurrencies; in times of low market volatility or bear markets, this overreliance exposes the company to sharp declines in both top-line revenue and earnings.

- Demographic shifts suggesting declining engagement from younger investors in conventional markets, together with the rise of decentralized finance and blockchain-based trading that bypasses intermediaries, pose a long-term threat to Swissquote's customer base and fee-generating capabilities, ultimately stifling future growth in client assets and diminishing sustainable earnings power.

Swissquote Group Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Swissquote Group Holding compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Swissquote Group Holding's revenue will grow by 4.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 42.2% today to 44.8% in 3 years time.

- The bearish analysts expect earnings to reach CHF 376.0 million (and earnings per share of CHF 24.92) by about September 2028, up from CHF 307.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 11.1x on those 2028 earnings, down from 25.7x today. This future PE is lower than the current PE for the GB Capital Markets industry at 16.6x.

- Analysts expect the number of shares outstanding to decline by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.05%, as per the Simply Wall St company report.

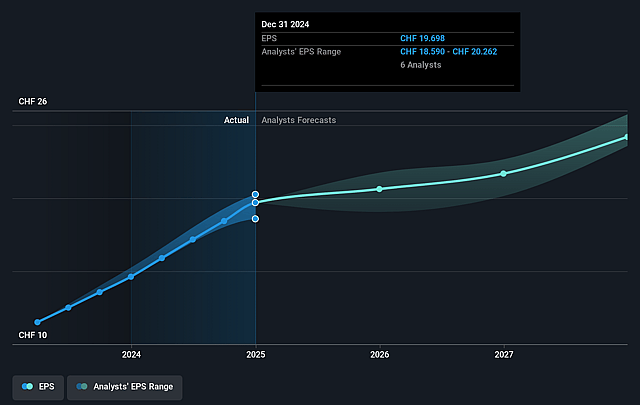

Swissquote Group Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent and accelerating organic client and asset growth, with record net new money and robust client acquisition, suggests sustained momentum that could continue to drive revenues and pre-tax earnings higher in the coming years.

- Demonstrated ability to grow and successfully monetize new product lines, especially in digital banking, AI-driven financial tools, and joint ventures such as Yuh, increases diversification and could result in a broader and more resilient revenue base and higher net income.

- Maintained technological leadership with strong investment in AI, platform enhancements, and product innovation positions Swissquote to capitalize on digital adoption trends and improve operational efficiency, which may support net margin expansion.

- Long-term strategic focus on high-quality, affluent client segments (mass-affluent and digitally savvy) in Switzerland and key European countries enables Swissquote to command higher average balances, supporting asset growth and a premium-fee model that can help sustain net interest and fee income.

- Strong and growing excess capital buffer combined with prudent capital management and potential for bolt-on acquisitions could accelerate inorganic growth and offer upside to revenue and profit projections, while a steady dividend payout and potential increases enhance shareholder returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Swissquote Group Holding is CHF258.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Swissquote Group Holding's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF620.0, and the most bearish reporting a price target of just CHF258.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be CHF838.9 million, earnings will come to CHF376.0 million, and it would be trading on a PE ratio of 11.1x, assuming you use a discount rate of 5.1%.

- Given the current share price of CHF528.5, the bearish analyst price target of CHF258.0 is 104.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Swissquote Group Holding?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.