Last Update 16 Sep 25

Fair value Increased 1.18%Analysts have modestly raised their price target for Swissquote Group Holding to CHF475.33, reflecting confidence in continued operational strength and long-term growth despite some valuation concerns and belief that near-term optimism is largely priced in.

Analyst Commentary

- Bullish analysts expect continued operational strength, as reflected in raised price targets despite some downgrades.

- Premium valuation concerns have prompted more cautious stances among some analysts.

- The company's recent share price appreciation is leading some to believe that much of the near-term positive outlook is already priced in.

- Ongoing Buy ratings suggest confidence in longer-term growth, even with near-term moderation.

- Target reductions by some analysts indicate a slightly less optimistic outlook but still imply upside.

Valuation Changes

Summary of Valuation Changes for Swissquote Group Holding

- The Consensus Analyst Price Target remained effectively unchanged, moving only marginally from CHF469.78 to CHF475.33.

- The Consensus Revenue Growth forecasts for Swissquote Group Holding remained effectively unchanged, at 6.2% per annum.

- The Future P/E for Swissquote Group Holding remained effectively unchanged, moving only marginally from 19.29x to 19.48x.

Key Takeaways

- Anticipated revenue pressure from decreased interest rates and limited growth in competitive trading environments may constrain Swissquote's net margins and revenue growth.

- Planned technology investments and rising compliance costs could increase expenses, challenging Swissquote's profitability goals in a highly competitive market.

- Strong organic growth, strategic tech investments, and diversified revenue streams ensure Swissquote's robust stability and potential for sustained earnings and resilience in market challenges.

Catalysts

About Swissquote Group Holding- Provides online financial services to retail investors, affluent investors, and professional and institutional customers worldwide.

- Swissquote’s expectation of a decrease in net interest income due to anticipated interest rate reductions in currencies like the Swiss franc, USD, and euro in 2025 could lead to declines in revenue associated with interest income.

- The company anticipates a competitive environment in Europe, particularly in the eForex sector, could limit growth opportunities, potentially impacting trading revenue and keeping net margin growth constrained.

- Swissquote’s conservative forecast of net new money at CHF 7 billion in a competitive market suggests potential stagnation in growth rate when compared to previous years, which could affect overall revenue growth.

- The firm is planning technology investments, including AI and innovation, indicating potential for increased operating expenses and R&D costs, which could pressure net margins despite profitability goals.

- Swissquote anticipates that maintaining or expanding net margins might require absorbing increased compliance and risk-related staffing costs, impacting earnings amid regulatory pressures and a competitive landscape.

Swissquote Group Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Swissquote Group Holding's revenue will grow by 6.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 42.2% today to 45.2% in 3 years time.

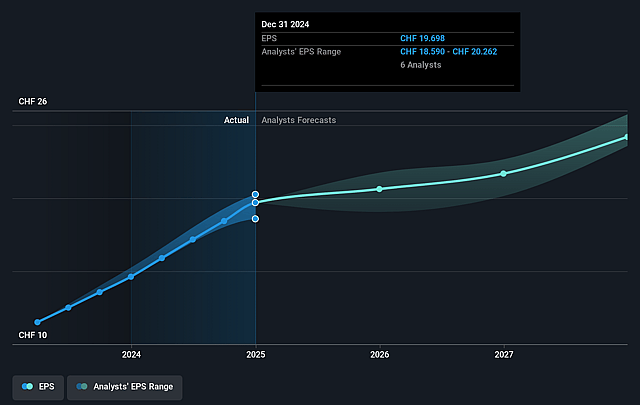

- Analysts expect earnings to reach CHF 394.9 million (and earnings per share of CHF 26.13) by about August 2028, up from CHF 307.8 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as CHF353.5 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.3x on those 2028 earnings, down from 25.6x today. This future PE is greater than the current PE for the GB Capital Markets industry at 17.3x.

- Analysts expect the number of shares outstanding to decline by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.02%, as per the Simply Wall St company report.

Swissquote Group Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strong organic growth demonstrated by the addition of 75,000 new accounts and CHF 8.3 billion in net new money in 2024 suggests a continued capability to increase revenue streams and profitability.

- Swissquote's technology-driven approach, combined with strategic investments in AI, positions the company advantageously to capitalize on future technological advancements, potentially improving its net margins and cost management.

- The company's highest ever pretax profit of CHF 345.6 million and a net profit margin of 52.3% reflect robust financial management and could forecast stable earnings, even in the face of interest rate challenges.

- Swissquote's diversified revenue streams, with significant revenue contributions from trading, crypto assets, and B2B services, provide resilience and potential for earnings growth despite fluctuations in any single sector.

- The company's cash-rich and liquid balance sheet, with a leverage ratio of 7.2% and a capital ratio of 23.5%, indicates strong financial stability that can support further growth initiatives or withstand market volatility, positively impacting future revenue capabilities.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CHF469.778 for Swissquote Group Holding based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF620.0, and the most bearish reporting a price target of just CHF258.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CHF873.0 million, earnings will come to CHF394.9 million, and it would be trading on a PE ratio of 19.3x, assuming you use a discount rate of 5.0%.

- Given the current share price of CHF527.0, the analyst price target of CHF469.78 is 12.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.