Key Takeaways

- Margin pressure and reduced profitability are likely as Phoenix Mecano struggles with globalization, supply chain disruptions, and regulatory expense increases.

- Slow innovation and shifting industry trends toward software-centric solutions threaten the company's market share and revenue growth prospects.

- Strategic focus on profitable niches, innovation, operational agility, and digital transformation positions Phoenix Mecano for stable growth and improved margins despite short-term industry headwinds.

Catalysts

About Phoenix Mecano- Manufactures and sells components for industrial customers worldwide.

- Phoenix Mecano faces ongoing compression of pricing power and margins due to the intensifying impact of globalization and heightened competition from lower-cost manufacturing hubs, especially as global tariff regimes remain in flux and the company is forced to undertake costly rerouting and capacity expansions in Southeast Asia, which will pressure both net margins and profitability in coming years.

- Rapid advances in automation, robotics, and integrated digital manufacturing platforms risk outpacing the company's innovation cycle, resulting in loss of market share and stagnant or declining revenue as its core offering remains hardware-centric while industry demand shifts toward software-rich and turnkey solutions.

- Persistent delays in investment decisions from customers in key markets, particularly for industrial automation and smart furniture, combined with substantial volatility in customer order patterns, foreshadow an extended period of weak top-line growth, underutilized capacity, and prolonged earnings headwinds for Phoenix Mecano.

- Tariff-related uncertainty and new global trade frictions are already causing large end customers to defer or reduce inventory commitments, increasing cyclicality and unpredictability of the order book; this is likely to continue weighing on revenue visibility and could result in year-over-year declines in operating and net results.

- Higher compliance costs and capital expenditure requirements emanating from stricter global environmental regulations, coupled with the company's legacy exposure to slower-growing industrial segments, may hinder profitability and limit potential for margin recovery well beyond 2025.

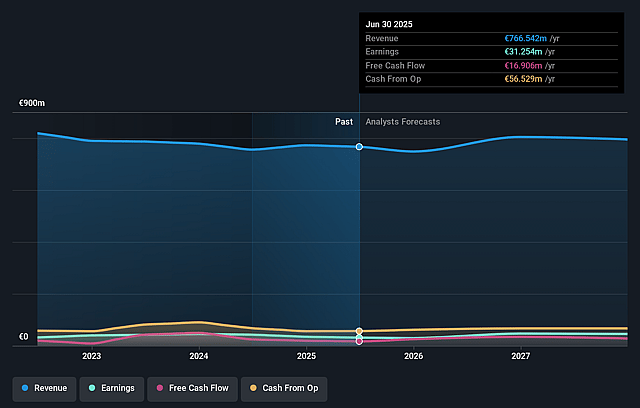

Phoenix Mecano Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Phoenix Mecano compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Phoenix Mecano's revenue will decrease by 0.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 4.1% today to 5.8% in 3 years time.

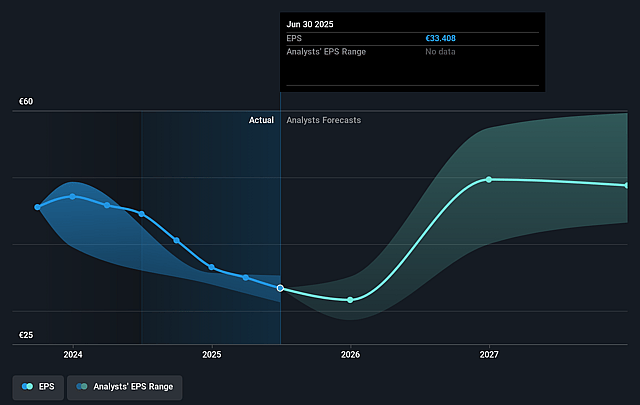

- The bearish analysts expect earnings to reach €44.0 million (and earnings per share of €48.15) by about August 2028, up from €31.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 0.0x on those 2028 earnings, down from 13.4x today. This future PE is lower than the current PE for the GB Electrical industry at 29.7x.

- Analysts expect the number of shares outstanding to decline by 1.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.48%, as per the Simply Wall St company report.

Phoenix Mecano Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's proactive pivot towards profitable niche markets, such as explosion-proof enclosures and structurally growing application areas like current measuring systems, demonstrates resilience and an ability to compensate for sluggish broader markets, which could support revenue and profit stability over the long term.

- Ongoing product innovation and success in winning new business for high-tech applications, such as current transducers for data centers, enclosures for hydrogen infrastructure, and smart drive systems for specialty furniture, position Phoenix Mecano to benefit from secular growth trends, potentially improving top-line growth and EBITDA in future periods.

- The early relocation of production from China to Southeast Asia, particularly Vietnam, for the DOT Group in response to tariffs and customer needs, reflects operational agility that may preserve margins and mitigate future supply chain disruptions, thus stabilizing gross profit and earnings.

- Strategic investments in digitalization and performance enhancement initiatives, combined with a transformation from a pure component supplier to a solution provider, indicate a focus on higher-margin activities and may enhance operating margins and support long-term EPS growth.

- Despite near-term volatility, management views the current slowdown as temporary and is capturing opportunities in strategic growth areas, suggesting that order intake could rebound strongly once customer destocking ends and end-market confidence returns, ultimately lifting revenue and EBIT in the medium to long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Phoenix Mecano is CHF441.05, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Phoenix Mecano's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF580.83, and the most bearish reporting a price target of just CHF441.05.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €759.8 million, earnings will come to €44.0 million, and it would be trading on a PE ratio of 0.0x, assuming you use a discount rate of 6.5%.

- Given the current share price of CHF422.0, the bearish analyst price target of CHF441.05 is 4.3% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.