Key Takeaways

- Strong order revival in growth regions and supply chain adaptation set the stage for outpacing industrial peers in revenue rebound and market share gains.

- Efficiency drives, digital investments, and strategic end-market expansion boost margin prospects and recurring revenues, supporting higher long-term growth expectations.

- Legacy product obsolescence, intensified price competition, supply chain disruptions, regulatory burdens, and cyclical market exposure threaten margins, revenue stability, and long-term growth prospects.

Catalysts

About Phoenix Mecano- Manufactures and sells components for industrial customers worldwide.

- Analyst consensus acknowledges Phoenix Mecano's resilience in core industrial end markets, but the rapid revival now evident in their order intake, especially following increased demand in growing regions like India, the Middle East, and Southeast Asia, suggests a much sharper and earlier top-line rebound than expected, positioning the company to outgrow industrial peers in revenue recovery.

- While analysts broadly agree that Phoenix Mecano's efficiency initiatives and digitalization investments will slowly bolster margins, these actions-including one-off restructuring charges-have already paved the way for immediate and substantial margin expansion as capacity utilization normalizes and cost synergies from recent bolt-on acquisitions accelerate, leading to a much stronger earnings rebound.

- Phoenix Mecano's early and decisive shift of smart furniture production from China to Vietnam and broader Southeast Asia places it ahead of industry peers in supply chain adaptation, minimizing tariff risk and allowing for significant market share gains and sales growth as global supply chains stabilize.

- Demand surges in advanced measuring technology for data centers, smart grids, and high-voltage direct current transmission-areas where Phoenix Mecano already holds first-mover advantage and has secured strategic contracts-will drive a structural uplift in recurring revenues tied to global digitalization and energy transition.

- The company's ability to capture emerging, high-growth end markets such as hydrogen infrastructure, LNG terminals, and advanced medical technology, coupled with a shift toward becoming an integrated solutions provider, positions Phoenix Mecano to benefit from premium product mix and recurring solution-based sales, supporting a re-rating of both revenue growth expectations and sustainable net margins.

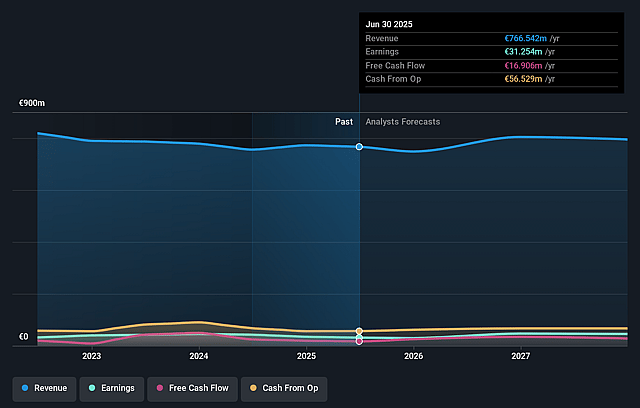

Phoenix Mecano Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Phoenix Mecano compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Phoenix Mecano's revenue will grow by 3.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.1% today to 7.4% in 3 years time.

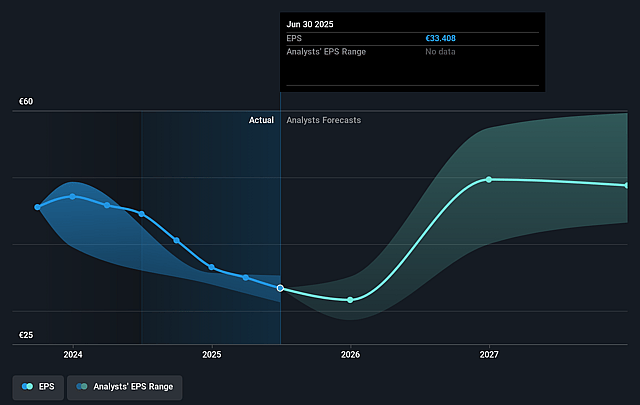

- The bullish analysts expect earnings to reach €63.5 million (and earnings per share of €67.06) by about September 2028, up from €31.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 0.0x on those 2028 earnings, down from 13.4x today. This future PE is lower than the current PE for the GB Electrical industry at 30.3x.

- Analysts expect the number of shares outstanding to decline by 1.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.46%, as per the Simply Wall St company report.

Phoenix Mecano Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating pace of automation and digitalization risks rendering some of Phoenix Mecano's legacy electromechanical solutions outdated, leading to declining demand for traditional product lines and putting pressure on long-term revenue growth.

- The company faces intense price competition in core offerings like enclosure systems and industrial components, which combined with low product differentiation, could result in margin compression as commoditization intensifies and pricing power erodes.

- Ongoing supply chain volatility, including localization and nearshoring trends in key markets, may undercut Phoenix Mecano's ability to maintain cost advantages, especially as shifts from China to Southeast Asia remain in progress, thereby negatively impacting net earnings through increased operational costs.

- Rising ESG standards and stricter regulatory requirements, particularly regarding energy efficiency and permissible materials, risk driving up compliance costs and operational expenses, potentially squeezing margins if the company's R&D investment in sustainable innovation continues to lag behind larger industry peers.

- Heavy exposure to cyclical industrial automation and mechanical engineering end-markets, compounded by delayed customer investments and high market unpredictability-as indicated by fluctuating book-to-bill ratios and subdued incoming orders-could extend periods of subdued revenues and operating profits well beyond the current downturn.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Phoenix Mecano is CHF580.06, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Phoenix Mecano's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF580.06, and the most bearish reporting a price target of just CHF440.46.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €859.1 million, earnings will come to €63.5 million, and it would be trading on a PE ratio of 0.0x, assuming you use a discount rate of 6.5%.

- Given the current share price of CHF423.0, the bullish analyst price target of CHF580.06 is 27.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.