Last Update 06 Sep 25

With Superior Plus’s consensus price target unchanged at CA$9.62, the notable rise in its future P/E from 10.33x to 14.35x suggests investors anticipate slower earnings growth, while the discount rate held steady.

What's in the News

- Repurchased 7,400,000 shares (3.19%) for CAD 55.2 million between April and June 2025.

- Completed buyback program, totaling 22,300,000 shares (9.29%) for CAD 151.36 million under the program announced in November 2024.

Valuation Changes

Summary of Valuation Changes for Superior Plus

- The Consensus Analyst Price Target remained effectively unchanged, at CA$9.62.

- The Future P/E for Superior Plus has significantly risen from 10.33x to 14.35x.

- The Discount Rate for Superior Plus remained effectively unchanged, moving only marginally from 6.72% to 6.77%.

Key Takeaways

- Operational transformation, technology investments, and strategic M&A are driving higher margins, improved efficiency, and sustained earnings growth.

- Expansion into renewable fuels and distributed energy positions the company to benefit from energy transition trends and increasing demand for reliable alternatives.

- Long-term risks from decarbonization, overreliance on propane, regulatory costs, commodity volatility, and customer attrition threaten Superior Plus's growth and earnings stability.

Catalysts

About Superior Plus- Distributes propane, compressed natural gas, and renewable energy and related products and services in the United States and Canada.

- Superior Plus is executing a multiyear operational transformation through the Superior Delivers program, focused on delivery and route optimization, advanced analytics for churn and pricing, and cost-to-serve initiatives; these are expected to expand margins and improve EBITDA, particularly in high-demand Q4 and Q1 periods, supporting improved long-term earnings and free cash flow generation.

- The company is actively benefiting from increased North American demand for distributed energy and backup fuel solutions due to grid instability and electrification challenges, positioning its propane and RNG business to capture stable or growing revenues as broader energy transition and infrastructure limitations persist.

- Strategic investments in technology and operational efficiencies (such as Smart Fleet for Certarus and delivery scheduling for propane) are expected to boost asset utilization and customer retention while reducing delivery costs, directly supporting incremental margin expansion and higher net earnings.

- Expansion into renewable propane, RNG, hydrogen, and industrial distributed energy segments aligns with policy and customer priorities for lower-carbon solutions, broadening Superior Plus's addressable market and diversifying future revenue streams, especially as commercial adoption of clean transitional fuels accelerates.

- Ongoing consolidation and M&A in the fragmented propane and CNG markets, combined with significant financial flexibility from extended credit facilities and strong cash flow, support further scale advantages and revenue growth, with the potential for both improved net margin and EPS as integration synergies are realized.

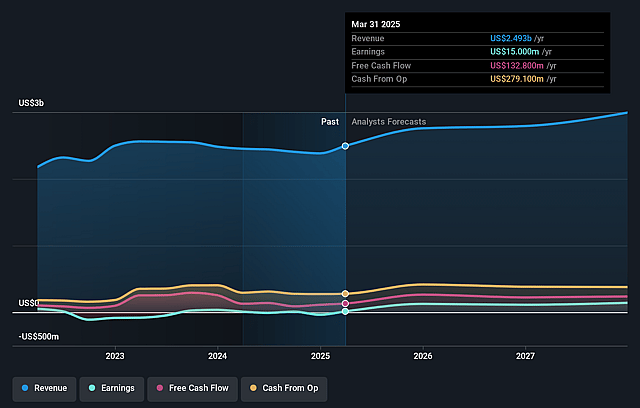

Superior Plus Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Superior Plus's revenue will grow by 3.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.7% today to 5.3% in 3 years time.

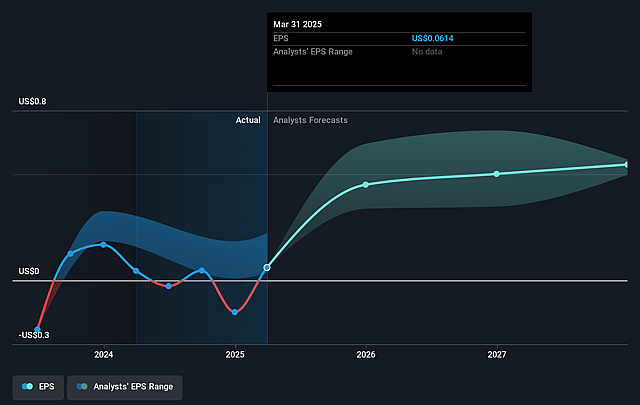

- Analysts expect earnings to reach $146.9 million (and earnings per share of $0.66) by about September 2028, up from $43.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.3x on those 2028 earnings, down from 27.5x today. This future PE is lower than the current PE for the CA Gas Utilities industry at 15.8x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.72%, as per the Simply Wall St company report.

Superior Plus Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing shift toward global decarbonization and electrification – including regulatory pressures, substitution to heat pumps, and bans on fossil fuel heating – represents a long-term secular risk that could reduce the overall addressable market for propane and CNG, potentially depressing Superior Plus's core revenues and future earnings growth as structural demand for its main products gradually erodes.

- Superior Plus remains highly exposed to the mature and potentially stagnant-to-declining North American propane market; this overreliance, in combination with only modest growth in industrial and renewable segments, creates a risk of top-line stagnation, limiting the company's ability to drive sustainable long-term revenue or margin growth.

- Intensifying environmental scrutiny and aging infrastructure could result in rising costs for compliance, maintenance, or legal remediation, requiring higher capital expenditures and eroding net margins and long-term returns for energy distributors like Superior Plus.

- Volatility in commodity pricing, as witnessed with the refinery outage and the cyclical nature of oil and gas end markets in the CNG division, exposes Superior Plus to unpredictable swings in both input costs and service volumes, creating potential for margin compression and less predictable earnings.

- Persistent customer churn in the U.S. propane segment – even if attributed in part to past behaviors – alongside a lengthy implementation timeline for retention and acquisition initiatives, could undermine recurring revenue, especially if further electrification or alternative fuels adoption accelerates before Superior Plus can fully offset attrition or achieve projected transformation efficiencies.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$9.625 for Superior Plus based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$12.0, and the most bearish reporting a price target of just CA$7.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.8 billion, earnings will come to $146.9 million, and it would be trading on a PE ratio of 10.3x, assuming you use a discount rate of 6.7%.

- Given the current share price of CA$7.38, the analyst price target of CA$9.62 is 23.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.