Last Update 14 Dec 25

Fair value Decreased 12%SPB: Share Buybacks Will Balance Cautious Sentiment And Execution Risks

Analysts have trimmed their average price target on Superior Plus by about C$1.00 per share. This reflects more conservative assumptions for revenue growth and valuation multiples despite relatively stable margin expectations.

Analyst Commentary

Recent Street research on Superior Plus shows a mixed but increasingly cautious tone, with several bearish analysts trimming price targets and reassessing the risk reward profile. While there are still instances of supportive ratings, the overall direction of target changes has been downward.

Several firms have reduced their fair value estimates on the stock, citing a combination of softer near term growth expectations and heightened execution risk, particularly in more competitive business lines. At the same time, select upgrades and modest target raises suggest that some market participants still see upside if management can stabilize operations and deliver on cost and integration plans.

Importantly, analysts appear focused on how ongoing pricing pressure and slower growth could cap valuation multiples, limiting the potential for multiple expansion even if earnings remain relatively resilient. This dynamic underpins the more conservative stance embedded in the latest batch of Street estimates.

Bearish Takeaways

- Bearish analysts have lowered price targets to a range around C$8.50 to C$10 per share. This signals reduced confidence in Superior Plus achieving prior growth and margin assumptions and constrains near term valuation upside.

- The downgrade to a more neutral stance reflects concern that the risk reward is becoming less favorable, with softer fundamentals and competitive headwinds making it harder for the company to outperform expectations.

- Persistent pricing pressure in the Certarus CNG business is viewed as a structural challenge, raising questions about the sustainability of earnings and cash flow growth from that segment and, by extension, the consolidated group.

- Lowered targets from multiple bearish analysts underscore broader worries about execution risk and the possibility that continued pricing and volume challenges could prevent Superior Plus from re rating meaningfully higher in the medium term.

What's in the News

- The Board of Directors authorized a new share buyback plan on November 17, 2025, signaling continued capital returns to shareholders (Key Developments).

- Superior Plus announced a normal course issuer bid to repurchase up to 21,551,556 shares, or 9.67% of its issued share capital, with all repurchased shares to be cancelled; the program runs until November 18, 2026 (Key Developments).

- As of November 5, 2025, the company had 222,969,783 shares issued and outstanding, providing context for the scale of the new buyback authorization (Key Developments).

- Between July 1, 2025 and August 6, 2025, Superior Plus repurchased 1,817,330 shares for CAD 14 million, bringing total repurchases under the November 7, 2024 program to 24,117,330 shares, or 10.1% of outstanding shares, at a total cost of CAD 165.36 million (Key Developments).

Valuation Changes

- Fair Value: Reduced from CA$7.50 to approximately CA$6.63 per share, representing a meaningful downward revision in intrinsic value estimates.

- Discount Rate: Increased slightly from about 6.72% to 7.11%, implying a higher perceived risk profile and a steeper hurdle rate for future cash flows.

- Revenue Growth: Cut significantly from roughly 4.01% to 2.27%, reflecting a more subdued outlook for topline expansion.

- Net Profit Margin: Nudged up marginally from about 5.39% to 5.39%, indicating broadly stable margin expectations despite softer growth assumptions.

- Future P/E: Trimmed modestly from around 7.83x to 7.55x, suggesting slightly lower expectations for valuation multiples on forward earnings.

Key Takeaways

- Electrification, alternative heating, and urbanization trends threaten long-term propane demand, revenue growth, and core market stability.

- Reliance on fossil fuels exposes the company to regulatory risk, higher compliance costs, and pressure on net margins as energy standards tighten.

- Accelerating electrification, regulatory pressure, and balance sheet risks threaten Superior Plus's traditional fuel businesses, margin stability, and long-term growth amid market and customer attrition challenges.

Catalysts

About Superior Plus- Distributes propane, compressed natural gas, and renewable energy and related products and services in the United States and Canada.

- While Superior Plus is benefiting from short-term volume and efficiency gains spurred by the transformation efforts in its propane and CNG divisions, the company faces ongoing structural headwinds as ongoing electrification and adoption of alternative heating technologies threaten to steadily erode long-term propane demand, which could restrict both revenue growth and margin expansion beyond the next several years.

- Although the company is actively optimizing delivery logistics and investing in digital transformation to lift net margins and bolster customer retention, continued reliance on fossil fuels leaves it susceptible to stricter environmental regulations and higher compliance costs over time, which may ultimately curb net earnings and compress operating margins as energy standards tighten across North America.

- While population growth and suburbanization continue to support a stable market for propane in rural and off-grid regions, demographic trends toward urbanization and increasing penetration of electric heating solutions could gradually diminish Superior Plus's addressable residential and commercial customer base, capping long-term volume growth and future revenues in its core propane segment.

- Even as the CNG (Certarus) division sees robust expansion in industrial, RNG, and hydrogen business lines-reflecting successful diversification-the core well site CNG market remains highly cyclical and exposed to volatile oil and gas drilling activity, which introduces sustained unpredictability into segment EBITDA and challenges stable year-over-year earnings performance.

- Though Superior Plus's acquisition-driven consolidation strategy and operational improvements have yielded near-term scale and cost benefits, persistent execution risks in integrating acquired businesses, as well as the industry's ongoing shift away from fossil fuels, present material obstacles to achieving sustainable margin improvements and earnings growth over the longer term.

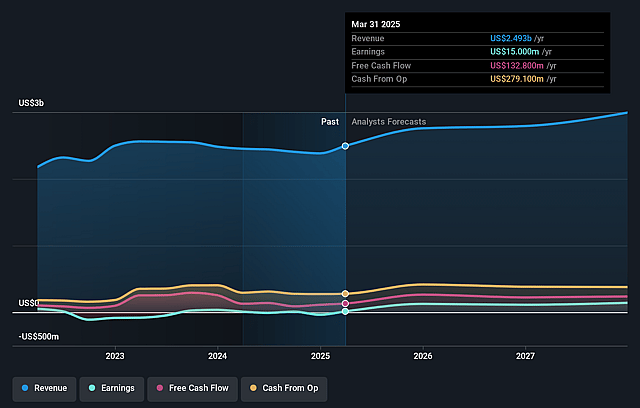

Superior Plus Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Superior Plus compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Superior Plus's revenue will grow by 4.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 1.7% today to 5.4% in 3 years time.

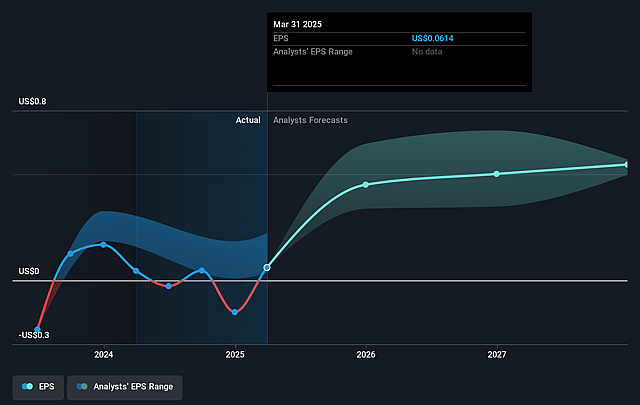

- The bearish analysts expect earnings to reach $151.1 million (and earnings per share of $0.56) by about September 2028, up from $43.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 7.8x on those 2028 earnings, down from 27.5x today. This future PE is lower than the current PE for the CA Gas Utilities industry at 16.1x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.72%, as per the Simply Wall St company report.

Superior Plus Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Superior Plus's core propane and CNG divisions are exposed to long-term demand erosion as electrification and decarbonization accelerate, with widespread adoption of heat pumps and electric solutions steadily reducing total addressable markets, negatively impacting revenue growth and margin stability.

- The company's acquisition-driven growth model, combined with leverage near 3.7 times EBITDA and ongoing share repurchases, risks overextending the balance sheet, which could lead to increased interest expense and reduced capacity for reinvestment, placing pressure on earnings in a rising rate or tightening credit environment.

- Increased customer attrition in key U.S. propane markets and anticipated ongoing churn, especially before the full rollout of customer retention and pricing optimization tools, may challenge organic volume growth, with risks to base revenues and potential for higher bad debt expense if engagement initiatives underdeliver.

- The CNG segment remains vulnerable to commodity-driven cycles and industry overcapacity, as indicated by idle trailer capacity, shrinking returns on new MSU deployments, and competitors exiting the market, raising the likelihood of margin compression and volatility in adjusted EBITDA if market conditions deteriorate further or industrial demand lags.

- Secular trends toward urbanization and regulatory scrutiny of greenhouse gas emissions from fossil fuels could accelerate customer migration away from propane and CNG, requiring heavier investment in lower-carbon alternatives and compliance, threatening long-term revenue streams and compressing net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Superior Plus is CA$7.5, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Superior Plus's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$12.0, and the most bearish reporting a price target of just CA$7.5.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $2.8 billion, earnings will come to $151.1 million, and it would be trading on a PE ratio of 7.8x, assuming you use a discount rate of 6.7%.

- Given the current share price of CA$7.38, the bearish analyst price target of CA$7.5 is 1.6% higher. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Superior Plus?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.