Key Takeaways

- Operational transformation and technology investment drive sustainable margin improvement, efficiency gains, and position the company to outpace industry growth trends.

- Expansion in renewables and innovative logistics enables resilience and future earnings growth amid the energy transition and evolving customer needs.

- Heavy reliance on propane amid the energy transition exposes Superior Plus to margin pressure, competitive threats, operational risks, and volatile earnings due to limited diversification.

Catalysts

About Superior Plus- Distributes propane, compressed natural gas, and renewable energy and related products and services in the United States and Canada.

- Analysts broadly agree Superior Delivers could unlock at least $20 million in EBITDA in 2025, but the initiative's sweeping changes to operational discipline, digitalization, and customer lifecycle management may drive even stronger step-changes in productivity and margin expansion, with compounding earnings benefits well beyond initial targets as the cultural and process transformation becomes embedded.

- The analyst consensus sees Certarus returning to growth by focusing on operational efficiency and cost control, but this may understate how quickly Certarus can capture market share and margin upside as competitors exit the CNG market and secular growth in renewables, hydrogen, and industrial segments accelerates-raising both revenue and free cash flow above expectations.

- The company's scale, strategic M&A track record, and investments in technology position it to dominate in distributed energy delivery as North America's electrification and decarbonization trends drive a multi-year surge in demand for propane and low/zero-carbon fuel logistics, sustaining superior revenue growth and operating leverage.

- Propane's critical role in supporting suburban and rural population growth, especially in regions lacking natural gas infrastructure, ensures enduring top-line resilience, with Superior Plus poised to capitalize through enhanced efficiency, route optimization, and targeted customer acquisition driving structurally higher recurring revenues and improved net margins.

- Superior's growing presence in renewable propane, specialty chemicals, and innovations like smart fleet technology position the company as a key beneficiary of the ongoing shift to energy security and environmentally-focused infrastructure, opening high-margin adjacent markets and supporting earnings stability and long-term upside beyond conventional propane distribution.

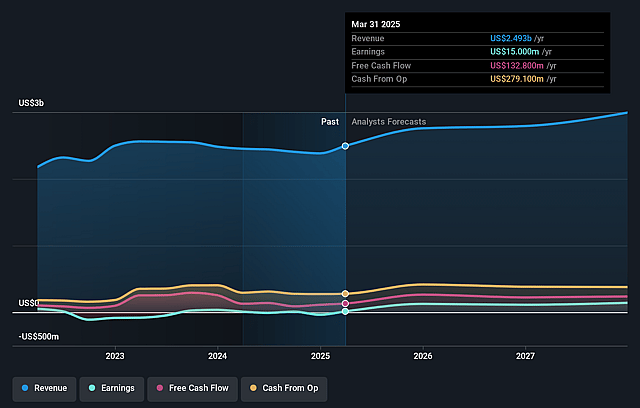

Superior Plus Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Superior Plus compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Superior Plus's revenue will grow by 4.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 1.7% today to 6.0% in 3 years time.

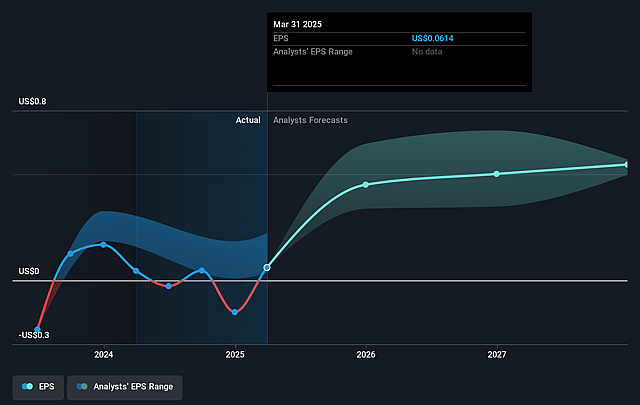

- The bullish analysts expect earnings to reach $172.1 million (and earnings per share of $0.8) by about September 2028, up from $43.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 11.0x on those 2028 earnings, down from 27.7x today. This future PE is lower than the current PE for the CA Gas Utilities industry at 16.0x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.77%, as per the Simply Wall St company report.

Superior Plus Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Superior Plus remains heavily exposed to long-term declines in propane demand caused by increasing adoption of electrification and renewable energy in both residential and industrial sectors, a shift that threatens to create sustained revenue headwinds as the energy transition accelerates and alternative solutions displace propane.

- Industry-wide decarbonization policies, increasing carbon pricing, and environmental regulations are expected to raise operating costs and shrink the addressable market for propane distributors, putting downward pressure on net margins and long-term profitability as governments continue to target net-zero alignment.

- The company's growth and transformation strategy relies in part on continued M&A and maintaining elevated leverage; this introduces balance sheet risk, higher interest expenses, and reduced financial flexibility in a rising rate or volatile credit environment, which could suppress net earnings and limit its ability to invest in necessary transition technologies.

- Superior Plus faces rising competition from electrification-focused utilities and new entrants in alternative fuels, and its slow pace of diversification into renewable gas or electrified solutions may result in loss of market share to more agile competitors, resulting in stagnant or declining revenue growth and eroding long-term margins.

- Regional and seasonal volatility remain high due to Superior Plus's concentration in North American propane distribution, leaving earnings increasingly susceptible to warmer winters, unpredictable weather, and cyclical industrial demand reductions, which will likely drive persistent earnings volatility and challenge the ability to consistently grow free cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Superior Plus is CA$12.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Superior Plus's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$12.0, and the most bearish reporting a price target of just CA$7.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $2.9 billion, earnings will come to $172.1 million, and it would be trading on a PE ratio of 11.0x, assuming you use a discount rate of 6.8%.

- Given the current share price of CA$7.48, the bullish analyst price target of CA$12.0 is 37.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.