Key Takeaways

- Early plant expansion success and exploration breakthroughs signal potential for significant increases in production, margins, and long-term resource expansion.

- Strong financial flexibility, rising investor demand, and ESG leadership enhance appeal to yield-seeking and sustainability-focused shareholders.

- Heavy reliance on a single mine, volatile gold prices, delayed expansion, rising costs, and regulatory risks threaten Lundin Gold's long-term growth and profitability.

Catalysts

About Lundin Gold- Operates as a mining company in Canada.

- While analyst consensus expects incremental gains in throughput and recoveries from the plant expansion, actual early results already show step-change improvements with recovery rates reaching 92% and throughput trending toward 5,500 tonnes per day, suggesting material upside to both production volumes and net margins even above current guidance.

- Analysts broadly agree on the exploration upside, but the scale and pace of discoveries at FDNS, Bonza Sur, and especially the newly identified Trancaloma porphyry-including an 850-meter intersection of copper-gold mineralization-could drive a multi-asset district-scale mining operation, transforming the company's resource base and substantially increasing long-term production and earnings power.

- Lundin Gold's debt-free balance sheet and a flexible, progressive dividend policy-now including variable and special dividends-position the company as a capital returns leader, making it structurally more attractive to yield-oriented investors and supporting higher valuation through lower cost of capital and enhanced earnings per share.

- Robust cash flow generation, operational discipline, and aggressive plant optimization initiatives set Lundin Gold up to achieve industry-leading all-in sustaining costs and profit margins, especially as future processing improvements and scale-provided efficiencies compound over time.

- Supported by surging institutional demand for gold as both a geopolitical and inflation hedge, and Lundin Gold's visible commitment to transparency and sustainability, the company stands to capture further market share among ESG-focused investors, potentially driving multiple expansion and stronger revenue growth as global gold prices remain elevated.

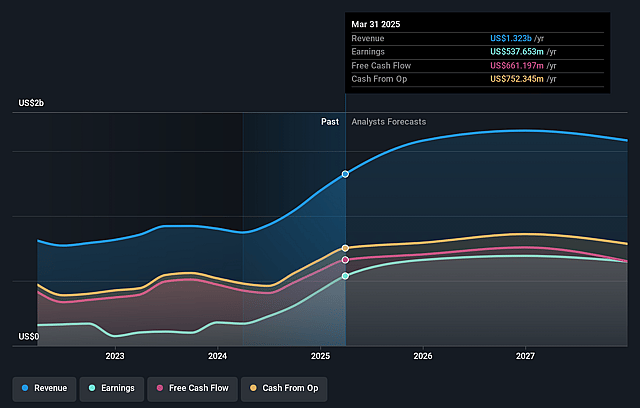

Lundin Gold Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Lundin Gold compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Lundin Gold's revenue will grow by 9.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 40.6% today to 47.4% in 3 years time.

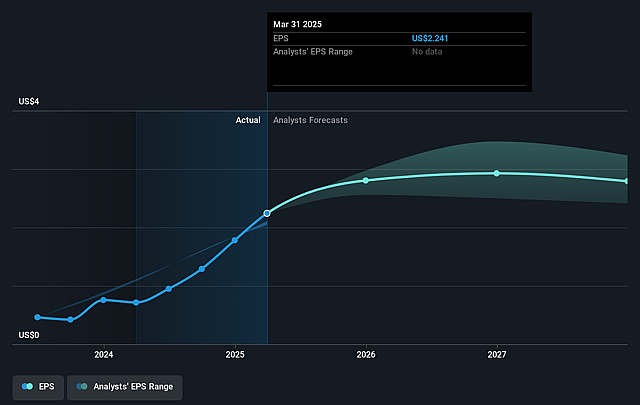

- The bullish analysts expect earnings to reach $815.0 million (and earnings per share of $3.43) by about July 2028, up from $537.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 22.7x on those 2028 earnings, up from 21.8x today. This future PE is greater than the current PE for the CA Metals and Mining industry at 17.5x.

- Analysts expect the number of shares outstanding to grow by 0.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.56%, as per the Simply Wall St company report.

Lundin Gold Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Lundin Gold's high dependence on the Fruta del Norte mine introduces significant concentration risk, so any operational, regulatory, or geological challenge at this single asset could severely disrupt production, leading to a direct hit on long-term revenue and earnings.

- The company's recent strong financial performance is heavily tied to record-high gold prices, which they readily acknowledge are outside management's control; a reversal in gold prices due to global shifts in reserve strategies, decarbonization, or reduced investor demand could sharply compress net margins and diminish free cash flow.

- While the company is expanding its exploration program in Ecuador, resource estimates and mine expansions such as Bonza Sur and Trancaloma remain years away from production and face geological complexity, unresolved timeline uncertainty, and potential permitting delays, making production growth and revenue sustainability vulnerable beyond the current life-of-mine plan.

- With all-in sustaining costs guided to increase with the gold price and further possible cost pressures from labor, deeper mining, and energy inputs, the company's cost structure could deteriorate over time, eroding net profitability especially if gold prices weaken.

- Intensifying ESG scrutiny, stricter environmental regulations, and potential shifts toward resource nationalism in Ecuador or Latin American markets may force higher capital requirements, delayed project approvals, or increased taxes and royalties, directly reducing Lundin Gold's free cash flow and earnings over the longer term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Lundin Gold is CA$85.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Lundin Gold's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$85.0, and the most bearish reporting a price target of just CA$43.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.7 billion, earnings will come to $815.0 million, and it would be trading on a PE ratio of 22.7x, assuming you use a discount rate of 6.6%.

- Given the current share price of CA$66.08, the bullish analyst price target of CA$85.0 is 22.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.