Key Takeaways

- Dependence on gold prices and a single asset exposes Lundin Gold to significant revenue and operational risks amid global decarbonization and regulatory changes.

- Rising ESG pressures and evolving local regulations threaten higher costs, restricted capital access, and challenges to sustaining dividends and growth initiatives.

- Exploration success, operational expansion, financial strength, and supportive political context position Lundin Gold for enhanced production, stable margins, and long-term shareholder value.

Catalysts

About Lundin Gold- Operates as a mining company in Canada.

- Lundin Gold is heavily reliant on high prevailing gold prices for its robust free cash flow, record earnings, and dividend payouts, but ongoing global decarbonization initiatives and rising momentum for electrification could erode investor demand for traditional gold miners, potentially weakening future gold prices and driving revenue volatility.

- Efforts to expand Fruta del Norte and pursue aggressive exploration in Ecuador increase exposure to the country's evolving political and regulatory environment, where possible changes to mining laws, taxes, or royalty structures threaten to raise operating costs and compress net margins over the long term.

- The company continues to face concentration risk, as both its current profitability and future production growth are tied to a single flagship asset in a region with complex geology and uncertain timelines for bringing new discoveries like Bonza Sur or Trancaloma to production, making quarterly and annual revenues vulnerable to operational disruptions or resource underperformance.

- The accelerating global shift toward ESG investing and heightened scrutiny of mining operations in environmentally sensitive jurisdictions may result in divestment, higher financing costs, and limited access to capital markets for Lundin Gold, which would negatively impact the company's ability to fund exploration or manage long-term debt, ultimately pressuring earnings and market valuation.

- Increasing costs associated with compliance, reclamation, community engagement, and new regulatory requirements for water, tailings, and emissions management are likely to result in a structurally higher cost base, which would constrain future free cash flow and limit the sustainability of the company's enhanced capital return program.

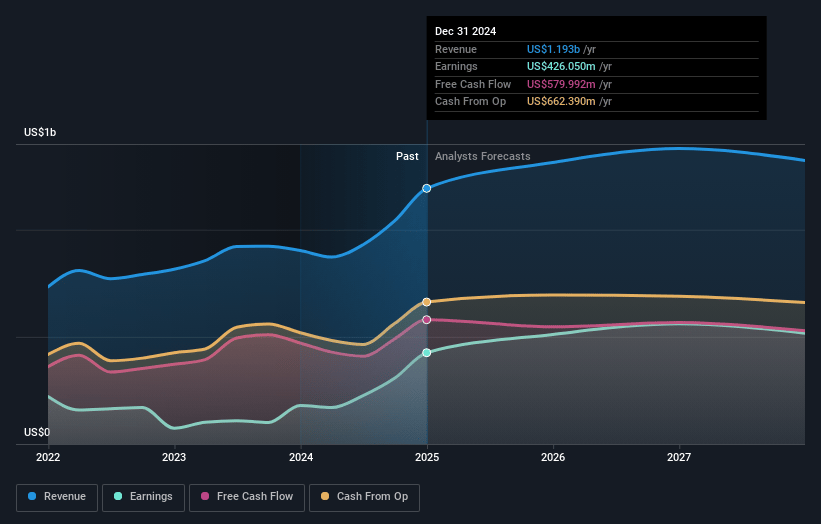

Lundin Gold Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Lundin Gold compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Lundin Gold's revenue will grow by 4.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 40.6% today to 40.7% in 3 years time.

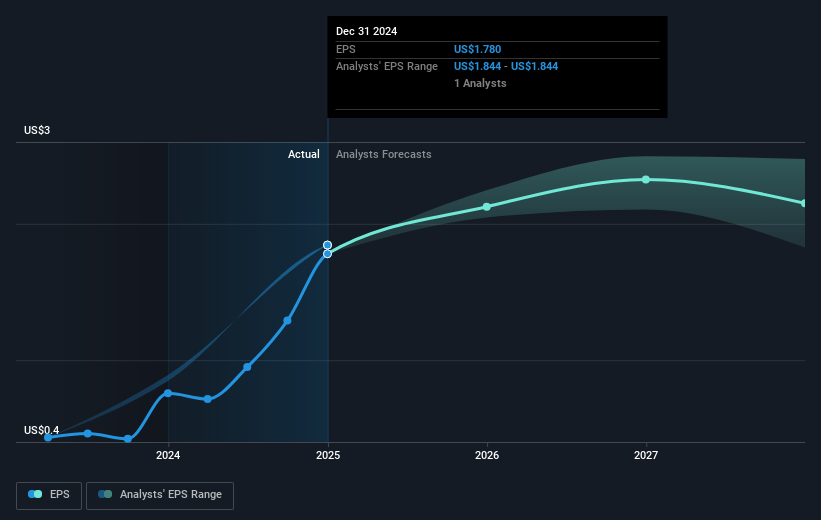

- The bearish analysts expect earnings to reach $616.6 million (and earnings per share of $2.56) by about July 2028, up from $537.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 15.1x on those 2028 earnings, down from 21.2x today. This future PE is lower than the current PE for the CA Metals and Mining industry at 17.2x.

- Analysts expect the number of shares outstanding to grow by 0.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.55%, as per the Simply Wall St company report.

Lundin Gold Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Accelerated exploration success in multiple high-grade and porphyry targets such as FDNS, Bonza Sur, and Trancaloma could significantly extend mine life and increase gold and potentially copper reserves, driving future revenue and long-term earnings growth.

- The successful expansion of the Fruta del Norte plant, leading to higher throughput and improved recoveries (as high as 92 percent in recent months), is likely to boost gold production volumes, reduce cost per ounce, and further enhance profit margins and free cash flow.

- Record financial results, robust dividend increases, and a debt-free balance sheet position Lundin Gold to continue returning significant capital to shareholders while maintaining ample flexibility to reinvest for expansion, supporting both net margin stability and improved shareholder value.

- Strong ongoing operational efficiency and cost optimization-seen in lower all-in sustaining cost per ounce and effective tax planning strategies-are likely to help maintain or grow net income and preserve margins even in fluctuating gold price environments.

- Supportive political developments in Ecuador, such as increased government stability and a stated focus on advancing the mining sector, could facilitate investment and project development, reducing political risk and contributing to predictable long-term revenue and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Lundin Gold is CA$43.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Lundin Gold's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$85.0, and the most bearish reporting a price target of just CA$43.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $1.5 billion, earnings will come to $616.6 million, and it would be trading on a PE ratio of 15.1x, assuming you use a discount rate of 6.6%.

- Given the current share price of CA$64.82, the bearish analyst price target of CA$43.0 is 50.7% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.