Key Takeaways

- Decarbonization trends, material recycling, and alternative materials threaten long-term demand, potentially undermining Barrick's growth, revenue, and project viability.

- Reliance on high-risk regions and tightening ESG regulations exposes Barrick to heightened operational, compliance, and cost pressures that may erode margins and cash flow.

- Expanded high-grade assets, operational efficiency gains, disciplined capital allocation, and portfolio optimization are driving strong profitability, stable earnings, and sustainable growth.

Catalysts

About Barrick Mining- Engages in the exploration, development, production, and sale of mineral properties.

- The push for global decarbonization and renewables may severely erode future demand for both gold and copper, undermining Barrick's core long-term growth assumptions and putting sustained pressure on revenues, especially as investor appetite for metals as stores of value or electrification inputs diminishes.

- The company's increasing reliance on projects and expansions located in politically unstable or high-risk jurisdictions, such as Mali and Pakistan, exposes Barrick to heightened risks of expropriation, project delays, and new resource nationalism measures, which may materially disrupt production flows, raise development costs, and lead to permanent asset impairments impacting net earnings.

- Intensifying global ESG regulations and stakeholder expectations will likely force Barrick to absorb escalating compliance costs, delayed permitting, and potentially higher sustaining and development CapEx, which could squeeze operating margins and blunt the cash flow improvements the company currently highlights.

- Long-term risks from accelerating advances in recycling technologies and alternative materials threaten to undercut global primary metal demand, making large brownfield expansions and greenfield projects less economically viable and potentially leading to stranded assets or declining returns on invested capital.

- Depleting average ore grades and maturing flagship mines may mean Barrick faces a structurally higher cost base over the next decade, requiring ever-greater investments to merely sustain current production levels, which could drive margin compression and erode free cash flow despite management's current focus on cost reductions.

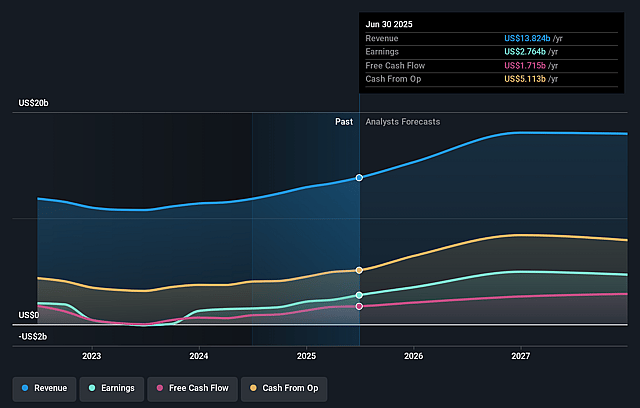

Barrick Mining Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Barrick Mining compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Barrick Mining's revenue will grow by 2.9% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 20.0% today to 18.4% in 3 years time.

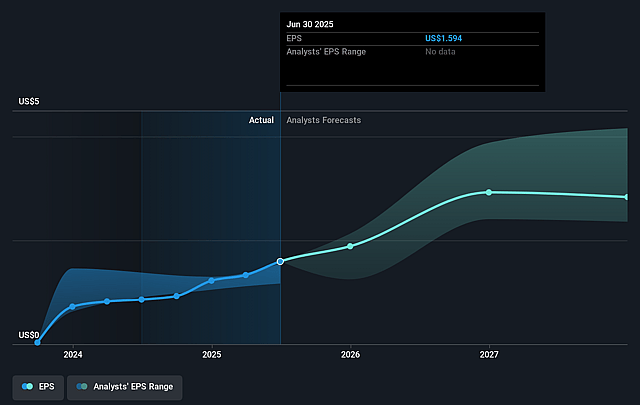

- The bearish analysts expect earnings to remain at the same level they are now, that being $2.8 billion (with an earnings per share of $2.58). The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 15.7x on those 2028 earnings, down from 16.8x today. This future PE is lower than the current PE for the CA Metals and Mining industry at 17.8x.

- Analysts expect the number of shares outstanding to decline by 2.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.61%, as per the Simply Wall St company report.

Barrick Mining Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The discovery and ongoing definition of the massive, high-grade Fourmile orebody in Nevada-potentially doubling current resources and lowering unit costs-could meaningfully increase Barrick's gold production and improve net margins for years to come.

- The successful ramp-up and expansion projects at Pueblo Viejo, Lumwana, and the Reko Diq copper-gold project signal a clear pipeline of long-life, low-cost Tier 1 assets that enhance revenue growth, extend mine life, and deliver improved earnings stability.

- Strong year-over-year and quarter-on-quarter improvements in operational efficiency, with sustained reductions in all-in sustaining costs and robust production increases, point to strengthening profitability and resilience in both net earnings and free cash flow.

- A highly disciplined capital allocation strategy, including active share buybacks, significant dividend payments, and a robust net-cash balance sheet, positions Barrick to boost shareholder returns and stabilize long-term earnings even during commodity cycles.

- Strategic portfolio optimization-rationalizing non-core assets while continually replacing and expanding reserves through organic growth and exploration success-supports a sustainable growth trajectory and provides visibility to rising long-term revenues and cash flows.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Barrick Mining is CA$31.15, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Barrick Mining's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$50.15, and the most bearish reporting a price target of just CA$31.15.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $15.0 billion, earnings will come to $2.8 billion, and it would be trading on a PE ratio of 15.7x, assuming you use a discount rate of 6.6%.

- Given the current share price of CA$37.43, the bearish analyst price target of CA$31.15 is 20.2% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.