Key Takeaways

- Transformative new discoveries and expansions are boosting Barrick's earnings power and positioning it as a leading player in both gold and copper amid rising global demand.

- Strong local partnerships, proven permitting success, and disciplined capital returns provide a sustainable competitive advantage and significant flexibility for shareholder rewards.

- Structural industry shifts, rising ESG pressures, operational cost inflation, geopolitical exposure, and competitive threats from recycling collectively threaten Barrick's long-term profitability and revenue growth.

Catalysts

About Barrick Mining- Engages in the exploration, development, production, and sale of mineral properties.

- Analysts broadly agree that Fourmile is a transformative discovery, but the magnitude of the resource and grade is likely still underestimated; ongoing drilling suggests resource doubling or more is imminent, with unit mining costs expected to be substantially lower and the potential to deliver world-class, ultra-high margin ounces, materially increasing Barrick's long-term earnings power.

- Analyst consensus expects Tier 1 expansions at Lumwana and Reko Diq to significantly enhance production, but recent execution suggests these assets are being delivered ahead of expectations, fully self-funded from internal cash flows, and will rapidly transform Barrick into a global copper major, positioning the company to aggressively capitalize on escalating copper prices driven by electrification and energy transition, leading to structurally higher future revenues and cash flows.

- Surging global demand for gold and copper due to ongoing geopolitical uncertainty, de-dollarization, and growth in emerging markets is likely to drive a multi-year secular tailwind for metal prices, which, when paired with Barrick's dominant reserves and operational leverage, sets the stage for outsized top-line growth and sustained margin expansion far above historic norms.

- Industry-wide permitting bottlenecks and persistent resource nationalism are heightening barriers to entry, but Barrick's multi-decade track record, deep local partnerships, and proven permitting success in complex jurisdictions such as the US (Nevada), Pakistan, and Zambia offer a durable competitive advantage that supports a premium reserve replacement rate, longer mine lives, and stable, high-quality cash flows.

- Barrick's highly disciplined capital return framework, underpinned by a fortress balance sheet and rapidly rising free cash flow, gives the company ample flexibility to accelerate buybacks and performance dividends at a time when shares remain deeply undervalued, directly boosting return on equity and driving meaningful per share earnings accretion.

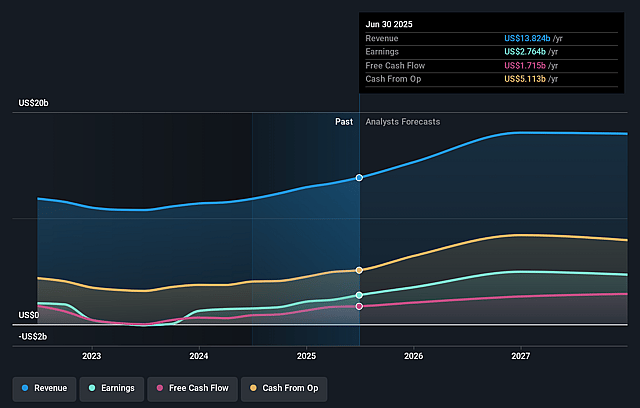

Barrick Mining Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Barrick Mining compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Barrick Mining's revenue will grow by 18.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 20.0% today to 29.5% in 3 years time.

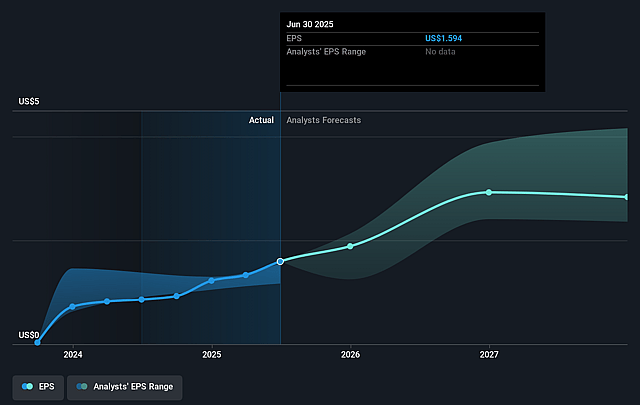

- The bullish analysts expect earnings to reach $6.8 billion (and earnings per share of $3.69) by about September 2028, up from $2.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 10.0x on those 2028 earnings, down from 18.0x today. This future PE is lower than the current PE for the CA Metals and Mining industry at 18.6x.

- Analysts expect the number of shares outstanding to decline by 2.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.69%, as per the Simply Wall St company report.

Barrick Mining Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerating global transition to renewable energy and electrification may decrease the traditional demand for gold as a reserve asset, which could depress long-term gold prices and directly reduce Barrick's future revenues and earnings.

- The industry is facing mounting environmental, social, and governance expectations from institutional investors, and Barrick's extensive mining footprint and ongoing permitting needs expose it to the risk of reduced access to capital and potentially higher operating costs, impacting net margins over time.

- Barrick's core operations in regions such as Africa and Latin America expose it to persistent geopolitical instability and abrupt regulatory changes, as seen with the deconsolidation of Loulo-Gounkoto following government intervention, undermining both revenue predictability and long-term earnings stability.

- As key assets like Pueblo Viejo and Turquoise Ridge rely increasingly on stockpiled ore and experience declining grades, the company faces structurally higher costs per ounce produced, threatening to erode future net margins even if current cost controls are effective in the short term.

- Industry-wide technological advances in gold extraction have plateaued, and Barrick faces intensifying competition from metals recycling and urban mining as well as potential increases in carbon-related regulatory costs, together compressing profitability and limiting revenue growth in the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Barrick Mining is CA$48.79, which represents two standard deviations above the consensus price target of CA$37.82. This valuation is based on what can be assumed as the expectations of Barrick Mining's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$49.96, and the most bearish reporting a price target of just CA$31.03.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $23.0 billion, earnings will come to $6.8 billion, and it would be trading on a PE ratio of 10.0x, assuming you use a discount rate of 6.7%.

- Given the current share price of CA$40.43, the bullish analyst price target of CA$48.79 is 17.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.