Key Takeaways

- Expansion into new verticals and rapid U.S. growth are expected to drive significant earnings acceleration and improved operational margins.

- Manufacturing agility and industry-leading technology underpin long-term customer retention, revenue visibility, and substantial free cash flow generation potential.

- Vulnerability to technological disruption, high capital demands, customer concentration, rising labor costs, and industry commoditization threaten Zedcor's revenue stability and profitability.

Catalysts

About Zedcor- Provides turnkey and customized mobile surveillance and live monitoring solutions in Canada and the United States.

- Analyst consensus anticipates that U.S. margins will gradually approach Canadian levels as scale improves, but with the current pace of network expansion, strategic branch placement, and operational efficiency gains, U.S. EBITDA margins are likely to exceed Canadian margins within 18 months, driving outsized earnings growth from the American footprint.

- While analysts broadly agree that Zedcor's diversification into verticals like retail and logistics de-risks revenues, the large-scale national accounts in both U.S. and Canada could unlock superlinear, step-function revenue growth as clients rapidly ramp deployments from handfuls to several hundred towers per contract, vastly accelerating both top line and recurring service revenue.

- Zedcor's aggressive manufacturing expansion, with flexible facilities capable of tripling output, positions the company not only to meet fast-growing demand but to quickly capture outsized share during an industry supply/demand imbalance, leading to sustained gross margin outperformance for multiple years.

- As IoT adoption and regulatory requirements for security accelerate, Zedcor's leadership in AI-driven, live-verified monitoring and rapid deployment service has set a new industry standard, creating customer lock-in and long-term contract durations, which should meaningfully improve revenue visibility and lower churn risk.

- With ultra-low maintenance capital expenditure per tower and a business model that is rapidly shifting toward software, data, and monitoring fees, Zedcor's free cash flow conversion is poised to sharply outpace consensus estimates, enabling acquisition-driven growth or shareholder returns at a far faster rate than currently forecast.

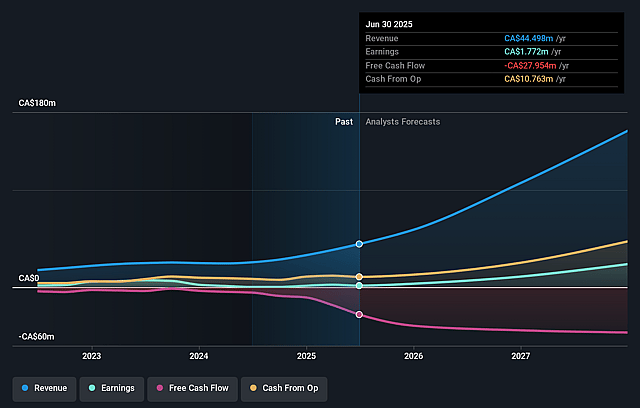

Zedcor Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Zedcor compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Zedcor's revenue will grow by 70.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 4.0% today to 16.4% in 3 years time.

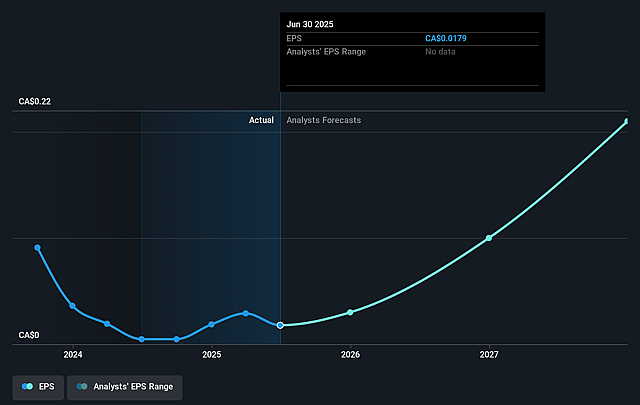

- The bullish analysts expect earnings to reach CA$36.1 million (and earnings per share of CA$0.28) by about September 2028, up from CA$1.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 30.7x on those 2028 earnings, down from 246.7x today. This future PE is greater than the current PE for the CA Trade Distributors industry at 14.3x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.09%, as per the Simply Wall St company report.

Zedcor Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rapid advancements in automation and AI may reduce demand for Zedcor's labor

- and equipment-intensive security solutions, making their core offering vulnerable to technology disruption and likely eroding future revenues and market share.

- Zedcor's ongoing expansion strategy is highly capital-intensive, as seen in the significant increase in PP&E to $62.7 million and continued heavy investments in fleet growth; this may constrain free cash flow and suppress net margins if future demand growth slows or utilization falters.

- Zedcor's customer concentration risk remains acute, with expansion still largely driven by existing verticals in construction and logistics, as well as regional dependence in Western Canada; any sustained downturn in these sectors or loss of major accounts could sharply impact revenue stability and overall earnings.

- Rising labor costs and challenges in hiring qualified back-office and accounting talent, as acknowledged in management's remarks, could lead to escalating operating expenses across the business, resulting in margin compression and reduced profitability if not offset by pricing power.

- The security industry's ongoing consolidation and proliferation of direct-to-customer technology and DIY security products may accelerate price competition, further commoditize Zedcor's offerings, and increase the risk of declining contract volumes, leading to downward pressure on both revenues and earnings over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Zedcor is CA$7.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Zedcor's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$7.0, and the most bearish reporting a price target of just CA$5.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be CA$220.0 million, earnings will come to CA$36.1 million, and it would be trading on a PE ratio of 30.7x, assuming you use a discount rate of 7.1%.

- Given the current share price of CA$4.15, the bullish analyst price target of CA$7.0 is 40.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.