Key Takeaways

- Reliance on cyclical industries and evolving technology trends could lead to unpredictable revenues and limit long-term growth opportunities.

- High capital needs, potential rising costs, and competitive pressures threaten profitability and could erode market advantage over time.

- High capital intensity, margin pressures, cyclical sector dependence, and digital disruption risks threaten profitability, cash flow, and long-term growth as U.S. expansion lags.

Catalysts

About Zedcor- Provides turnkey and customized mobile surveillance and live monitoring solutions in Canada and the United States.

- While Zedcor is benefiting from strong demand for mobile surveillance solutions driven by increasing theft and asset protection concerns, the company's rapid expansion and customer wins are heavily concentrated in cyclical industries such as construction and logistics. This dependence exposes Zedcor to significant revenue volatility in the event of an economic downturn or a slowdown in infrastructure spending, potentially limiting longer-term revenue predictability.

- Although automation and labor shortages are encouraging companies to adopt Zedcor's remote monitoring systems over traditional security guards, advances in artificial intelligence and digital project management could eventually reduce the need for physical, on-site surveillance. This shift may weaken both the total addressable market and Zedcor's long-term growth ceiling, placing pressure on future revenue streams.

- Despite the positive momentum in expanding its recurring, contract-based revenue-which enhances margin visibility-the company's ongoing capital-intensive investments in tower manufacturing and fleet expansion raise risks of escalating maintenance and replacement costs over time. As the equipment fleet ages and requires servicing or replacement, there is a risk that net margins will compress if growth or pricing power does not compensate for rising expenditures.

- While Zedcor's integration of AI into its surveillance solutions and pursuit of SOC 2 compliance are meant to enhance its value proposition and unlock new national accounts, there is a danger that rapid technological advancement across the security industry could erode this competitive edge. New entrants with superior technology or software-centric offerings may capture market share, forcing Zedcor to invest further or lower prices, which could negatively affect both earnings and gross margin.

- Even though Zedcor has avoided major supply chain disruptions so far and is gaining efficiencies in its manufacturing operations, the company remains vulnerable to global shortages or delays in key electronic components. Should persistent supply chain issues resurface, Zedcor could face higher costs, delayed project deployments, and reduced asset utilization, all of which would diminish profitability and constrain operating cash flow.

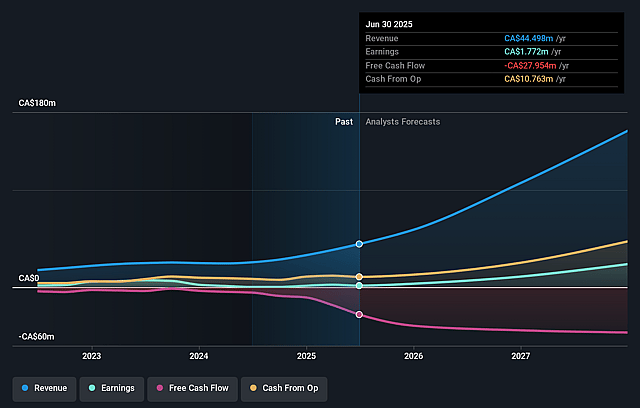

Zedcor Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Zedcor compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Zedcor's revenue will grow by 60.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 4.0% today to 19.6% in 3 years time.

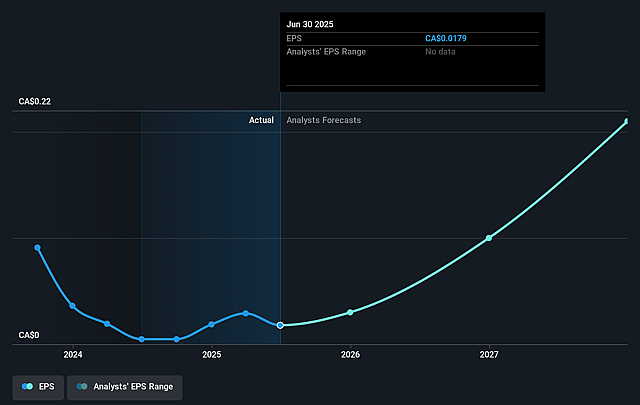

- The bearish analysts expect earnings to reach CA$35.7 million (and earnings per share of CA$0.28) by about September 2028, up from CA$1.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 22.0x on those 2028 earnings, down from 254.3x today. This future PE is greater than the current PE for the CA Trade Distributors industry at 14.4x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.08%, as per the Simply Wall St company report.

Zedcor Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's expansion into the U.S. is still in the early stages of achieving scale, and current EBITDA margins in the United States lag significantly behind those in Canada, suggesting that a longer-than-expected path to market density could suppress profitability and net margins in the medium term.

- Zedcor continues to require high capital expenditures to fund the growth of its tower fleet and new branch openings, which may increase leverage and interest obligations over time, ultimately constraining free cash flow available for reinvestment or debt repayment.

- While there are claims of limited direct competition in certain regions, management acknowledges some markets are highly competitive (notably Texas and California), raising the risk of pricing pressure and potential margin erosion if Zedcor is forced to adjust rates to maintain or grow market share, impacting gross profit and EBITDA.

- The company is highly reliant on the ongoing robust demand from cyclical sectors such as construction and logistics, and any downturns, industry-specific slowdowns, or regulatory tightening (for example, new ESG compliance in construction or oil and gas) could reduce project volumes and lead to revenue volatility.

- The business model's reliance on recurring revenue from physical equipment faces future risk from technological advances shifting security solutions from hardware-centric to integrated digital or software-based offerings, potentially lowering Zedcor's competitive positioning and impacting long-term revenue growth and gross margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Zedcor is CA$5.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Zedcor's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$7.0, and the most bearish reporting a price target of just CA$5.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be CA$182.2 million, earnings will come to CA$35.7 million, and it would be trading on a PE ratio of 22.0x, assuming you use a discount rate of 7.1%.

- Given the current share price of CA$4.28, the bearish analyst price target of CA$5.0 is 14.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Zedcor?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.