Key Takeaways

- Structural integration, operational excellence, and digital initiatives could deliver much greater margin expansion, free cash flow growth, and earnings resilience than analysts expect.

- Superior execution, monetization of undervalued assets, and optimized mature fields position Brava Energia for sustained high returns and long-term revenue growth.

- Heavy dependence on aging oil assets and lack of diversification heighten Brava Energia's long-term risk amid industry transition, regulatory pressures, and volatile market conditions.

Catalysts

About Brava Energia- Engages in the exploration and production of oil and natural gas in Brazil.

- While analyst consensus recognizes the benefits of post-merger synergies and early operational recovery, this may be significantly understated-ongoing structural integration (including shared tax shields, liability optimization, and technical best practice adoption) could drive not only lower costs and margin expansion but also unlock much faster EBITDA and free cash flow growth than currently forecast, enabling aggressive deleveraging and a step-change in return on capital.

- Analyst consensus expects higher future production and improved margins from the Atlanta Field ramp-up, but mounting evidence suggests Brava's technical execution and production stability at Atlanta and Papa-Terra could sustain volumes and cost reductions well above expectations, making possible a multi-year period of record-high net margins and revenue consistency rarely seen among regional peers.

- Brava Energia's accelerated adoption of digitalization, automation, and advanced data analytics in both offshore and onshore operations positions the company to deliver continuous structural reductions in lifting costs and OpEx, directly enhancing earnings predictability and margin resilience through cycles.

- Strategic control over logistics and trading, combined with advanced monetization of under-appreciated gas assets and flexibility in sales channels-especially after ending legacy third-party contracts-could enable systematic improvement in realized oil and gas prices and incremental, high-margin cash flows not in current models.

- With pre-salt and mature field optimization now proven and further enhanced oil recovery (EOR) projects scaling up, Brava is positioned to significantly over-deliver on production retention and extension in key basins, laying the groundwork for long-term revenue growth and higher return on invested capital, exactly as global demand for efficient, low-cost hydrocarbons remains structurally elevated.

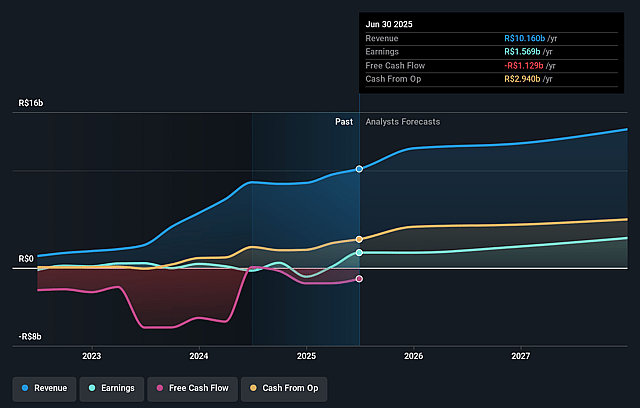

Brava Energia Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Brava Energia compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Brava Energia's revenue will grow by 22.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 15.4% today to 26.9% in 3 years time.

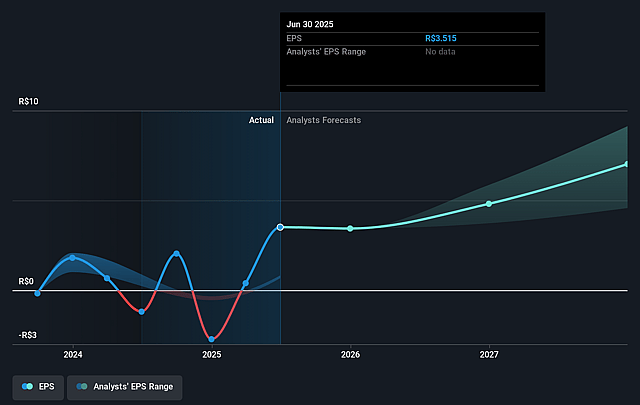

- The bullish analysts expect earnings to reach R$5.0 billion (and earnings per share of R$10.89) by about September 2028, up from R$1.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 6.0x on those 2028 earnings, up from 5.4x today. This future PE is greater than the current PE for the BR Oil and Gas industry at 5.6x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 23.76%, as per the Simply Wall St company report.

Brava Energia Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Brava Energia's core reliance on mature, high-decline oil fields such as Papa-Terra and legacy assets increases the risk of natural production declines over time, and if new reserves are not competitively discovered or acquired, future revenue growth and profitability could be jeopardized.

- The company remains heavily exposed to upstream oil and gas with little diversification into future-proof sectors such as renewables, leaving earnings vulnerable to global energy transition policies and the structural decline in oil demand from electric vehicles and energy efficiency, which may erode long-term revenue bases.

- Brava Energia's significant operational leverage and ongoing high CapEx requirements for field development and maintenance make the company especially sensitive to prolonged periods of low oil prices, which could compress margins and create volatility in earnings.

- Increased ESG scrutiny and shifting investor preferences toward low-carbon assets could raise the company's cost of capital and limit access to financing, thereby constraining investment capacity and the ability to pursue growth or even sustain current operations.

- Rising long-term regulatory and policy risks, such as new carbon taxes or stricter environmental requirements, could elevate operating costs across both onshore and offshore activities, negatively affecting net margins and cash flow generation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Brava Energia is R$34.26, which represents two standard deviations above the consensus price target of R$26.52. This valuation is based on what can be assumed as the expectations of Brava Energia's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$35.0, and the most bearish reporting a price target of just R$16.8.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be R$18.7 billion, earnings will come to R$5.0 billion, and it would be trading on a PE ratio of 6.0x, assuming you use a discount rate of 23.8%.

- Given the current share price of R$18.41, the bullish analyst price target of R$34.26 is 46.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Brava Energia?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.