Last Update 07 Nov 25

Fair value Decreased 5.69%BRAV3: Future Production Will Unlock Value For Long-Term Gains

Narrative Update: Brava Energia Analyst Price Target Revision

Analysts have revised Brava Energia's fair value price target downward by approximately $1.50. This change reflects more cautious expectations for revenue growth and profit margins going forward.

Valuation Changes

- Fair Value Price Target has decreased from R$26.36 to R$24.86, reflecting a reduction of about R$1.50.

- Discount Rate has declined slightly from 23.19% to 22.78%.

- Revenue Growth estimate has fallen significantly from 12.86% to 9.89%.

- Net Profit Margin projection has decreased from 22.48% to 19.29%.

- Future P/E Ratio has increased from 7.0x to 8.2x. This indicates a higher expected valuation multiple.

Key Takeaways

- Increased production, cost reductions, and efficient capital allocation enhance Brava Energia's profitability, resilience, and ability to generate steady free cash flow.

- Diversification into natural gas and export-oriented strategies positions the company to capture global energy demand shifts and benefit from favorable market dynamics.

- Exposure to declining fossil fuel demand, operational risks, regulatory pressures, and oil price volatility threaten profitability, asset value, and long-term financial stability.

Catalysts

About Brava Energia- Engages in the exploration and production of oil and natural gas in Brazil.

- Sustained increases in production from key assets (notably Atlanta and Papa-Terra), driven by new wells coming online and higher operational efficiency, position Brava to capitalize on rising energy demand in emerging markets and support potential export revenue growth; this directly benefits future revenues and EBITDA.

- Continuous reductions in lifting and operating costs-via technology adoption, asset integration, and strong operational execution-are structurally improving Brava's net margins and enabling steady free cash flow generation even in variable pricing environments.

- Optimized capital allocation (with a sharp focus on deleveraging, disciplined CapEx, and capturing synergies from recent mergers) strengthens balance sheet resilience and lowers net financial expenses, ensuring greater earnings stability and supporting future dividend capacity.

- Expansion into natural gas processing and partnerships (e.g., with PetroReconcavo and improved access to Manati capacity) aligns the company with the global movement toward cleaner transitional fuels, safeguarding long-term demand and diversifying revenue streams as hydrocarbon consumption patterns evolve.

- Enhanced capability for flexible, export-oriented commercial strategies (greater autonomy over sales contracts, improved pricing spreads, and ability to access multiple markets) allows Brava to benefit from tightening global supply and persistent underinvestment in upstream oil & gas, increasing the likelihood of structurally higher realized prices and stronger profitability.

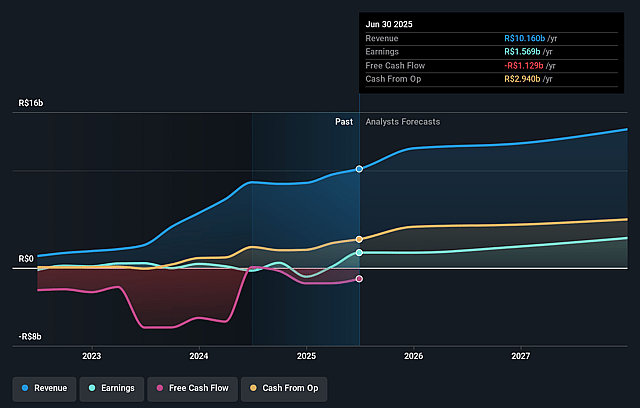

Brava Energia Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Brava Energia's revenue will grow by 12.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.4% today to 22.5% in 3 years time.

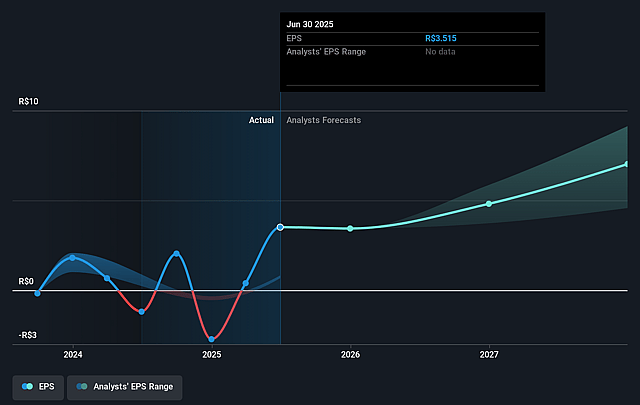

- Analysts expect earnings to reach R$3.3 billion (and earnings per share of R$6.64) by about September 2028, up from R$1.6 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting R$4.5 billion in earnings, and the most bearish expecting R$2.1 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.0x on those 2028 earnings, up from 5.7x today. This future PE is greater than the current PE for the BR Oil and Gas industry at 5.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 23.19%, as per the Simply Wall St company report.

Brava Energia Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The energy transition and accelerating decarbonization policies globally could reduce long-term demand for fossil fuels, leaving Brava Energia exposed to declining hydrocarbon demand and potentially shrinking revenues and EBITDA in the coming decade.

- The company's asset base, particularly in mature onshore and offshore fields like Papa-Terra and Atlanta, remains vulnerable to natural depletion and production decline; despite current stability, any future unexpected decline could drive up lifting costs and erode net margins and earnings.

- Significant growth relies on successful execution of large, capital-intensive drilling campaigns and EOR projects; cost overruns, delays, or underperformance in these initiatives could compress free cash flow and reduce expected future profitability.

- Brava's business is highly sensitive to oil price volatility and relies on favorable spreads and hedges-market downturns, narrowing spreads, or policy-driven price pressure could quickly weaken revenues and operating cash flows.

- Increasing ESG constraints, regulatory and environmental compliance requirements, as well as the risk of higher future taxes or penalties specific to oil and gas in Brazil, could inflate costs, raise the cost of capital, and put sustained pressure on net income and overall share valuation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of R$26.358 for Brava Energia based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$35.0, and the most bearish reporting a price target of just R$16.8.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be R$14.6 billion, earnings will come to R$3.3 billion, and it would be trading on a PE ratio of 7.0x, assuming you use a discount rate of 23.2%.

- Given the current share price of R$19.3, the analyst price target of R$26.36 is 26.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.