Key Takeaways

- Heavy reliance on mature and heavy oil assets, with limited global diversification, leaves Brava Energia highly exposed to climate policy shifts and renewable energy advances.

- Rising compliance costs, stranded asset risks, and funding constraints threaten margins, earnings quality, and the company's long-term ability to grow.

- Operational efficiency, financial discipline, and strategic asset management position Brava Energia for sustained revenue growth, margin expansion, and enhanced long-term resilience.

Catalysts

About Brava Energia- Engages in the exploration and production of oil and natural gas in Brazil.

- A rapid acceleration in climate policy and breakthrough renewables technology could severely diminish long-term demand for oil and gas, undermining Brava Energia's growth prospects as its deepwater and onshore projects come online, dragging down both future revenues and asset valuations.

- Intensifying global carbon pricing frameworks and regulatory scrutiny are poised to drive up compliance costs and increase the risk that Brava Energia's core assets-in particular mature basins and heavy oil onshore fields-become stranded, compressing operating margins and threatening long-run earnings quality.

- Brava Energia's high dependence on mature and heavy oil assets, alongside limited international diversification, leaves the company especially vulnerable to declining field yields, sustained capital expenditures to offset natural declines, and higher earnings volatility, which could erode free cash flow over time.

- The pace of improvement and cost reduction seen recently is unlikely to be sustainable as operational gains from efficiency projects and workover rig reductions normalize, meaning future margin expansion may stall and any unexpected production setbacks could drive disproportionately negative impacts on net income.

- Increasing competitiveness of alternative energy sources and mounting pressure from global investors to divest from fossil fuels are likely to raise Brava Energia's cost of capital, restrict financing for future upstream projects, and ultimately curtail the company's ability to grow earnings per share.

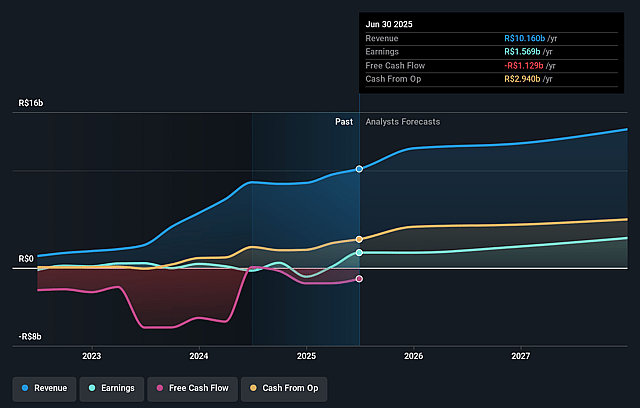

Brava Energia Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Brava Energia compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Brava Energia's revenue will grow by 8.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 1.6% today to 23.1% in 3 years time.

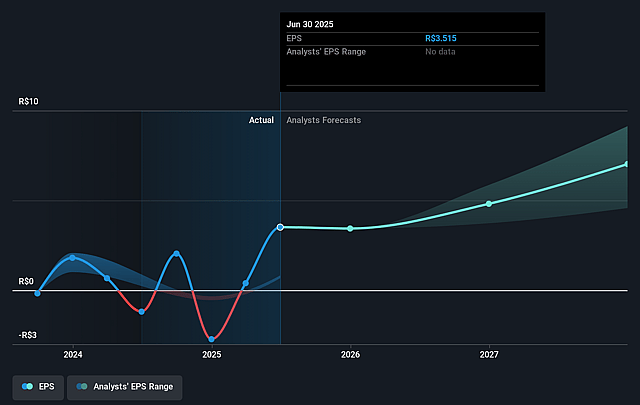

- The bearish analysts expect earnings to reach R$2.8 billion (and earnings per share of R$6.02) by about August 2028, up from R$155.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 6.0x on those 2028 earnings, down from 60.0x today. This future PE is lower than the current PE for the BR Oil and Gas industry at 7.8x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 18.01%, as per the Simply Wall St company report.

Brava Energia Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Brava Energia is benefiting from strong and stable production growth, driven by efficient offshore operations at assets like Atlanta and Papa-Terra, positioning the company for sustained or increasing revenues and cash flow over the longer term if these trends continue.

- The company is executing successful operational and digital efficiency improvements, including significant reductions in lifting costs and SG&A, which have resulted in expanding margins, potentially leading to improved profitability metrics such as higher net margins and earnings.

- Major capital projects, such as the timely and on-budget completion of Atlanta Phase 1, and the planned connection of additional wells by 2027, point toward future reserve and production growth, supporting long-term revenue and earnings per share growth.

- Robust financial management, including meaningful deleveraging, extension of debt maturities, and realization of substantial tax benefits, strengthens Brava Energia's balance sheet and liquidity, improving the company's resilience and potentially enabling higher free cash flow and dividend payouts.

- The company is actively optimizing its asset portfolio, integrating operations for synergies, and capitalizing on commercial opportunities in export and domestic markets, which can drive higher realized prices and further support revenue and cash flow growth in the medium to long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Brava Energia is R$18.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Brava Energia's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$35.0, and the most bearish reporting a price target of just R$18.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be R$12.1 billion, earnings will come to R$2.8 billion, and it would be trading on a PE ratio of 6.0x, assuming you use a discount rate of 18.0%.

- Given the current share price of R$20.05, the bearish analyst price target of R$18.0 is 11.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Brava Energia?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.