Key Takeaways

- Blockbuster biologics launches and strong pipeline performance position revenue and margin growth to outpace expectations, benefiting from rapid geographic expansion and operational leverage.

- Strategic reinvestment, portfolio optimization, and advanced digital health integration bolster flexibility, innovation, and sustained profitability above consensus forecasts.

- Expiring patents, pricing pressures, high spending, and dependence on few new products expose UCB to earnings volatility, margin compression, and increased risk from industry changes.

Catalysts

About UCB- A biopharmaceutical company, develops products and solutions for people with neurology and immunology diseases worldwide.

- Analyst consensus recognizes the strong €1.3 billion platform from recent product launches and above-industry R&D success rates, but the market underestimates the speed and breadth at which UCB's pipeline can deliver blockbuster launches, especially as BIMZELX's uptake in multiple indications and geographies has already outpaced initial expectations, positioning revenue growth to materially exceed current forecasts.

- While analysts broadly expect margin improvement from operational leverage and scale, the impact of high-margin innovative biologics and ongoing geographic expansion into markets with increasing healthcare access could drive net margins and earnings growth significantly above consensus, accelerating value creation well into the decade.

- UCB's leadership in next-generation antibody engineering-including bispecific therapies in atopic dermatitis-positions the company to be a transformative player in large, fast-growing and underserved patient markets as the aging global population drives ongoing increases in demand for advanced biologics, directly benefitting both topline and operating margins over the long-term.

- The company's focused reinvestment of robust free cash flow and disciplined capital allocation-supported by recent systematic portfolio optimization and successful divestiture of non-core mature assets-provides UCB with significant flexibility to pursue earlier-stage acquisitions and platform technologies, enhancing revenue resilience and future pipeline optionality.

- UCB's convergence of advanced digital health, precision medicine initiatives, and expanded biologics manufacturing capacity will unlock harmonized operational efficiencies and enable tailored therapy delivery at scale, creating the potential for accelerating profitability through sustained gross margin expansion beyond current consensus expectations.

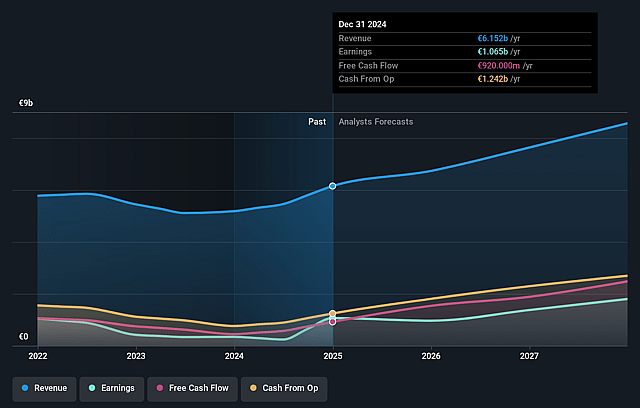

UCB Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on UCB compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming UCB's revenue will grow by 17.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 17.3% today to 25.5% in 3 years time.

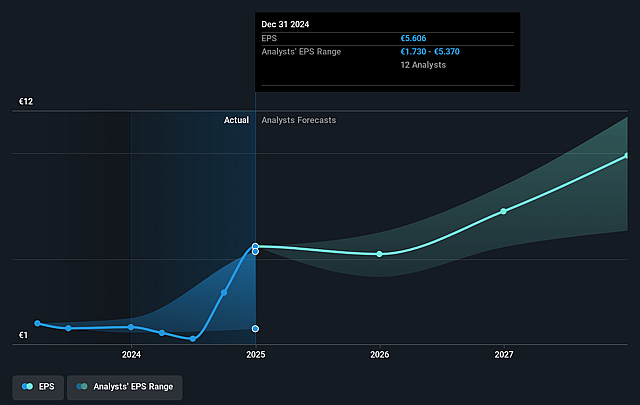

- The bullish analysts expect earnings to reach €2.6 billion (and earnings per share of €12.77) by about July 2028, up from €1.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 22.1x on those 2028 earnings, down from 31.7x today. This future PE is lower than the current PE for the GB Pharmaceuticals industry at 49.0x.

- Analysts expect the number of shares outstanding to grow by 0.17% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.86%, as per the Simply Wall St company report.

UCB Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing global drug pricing pressures, particularly in the U.S. and Europe, are already causing UCB's key drugs like CIMZIA to face price erosion that more than offsets volume growth, threatening long-term revenue growth and operating margins.

- Expiry of patents for major legacy assets such as CIMZIA and forthcoming loss of exclusivity for BRIVIACT in key markets like the U.S. will open these products to generic and biosimilar competition, resulting in significant declines in revenue and increased earnings volatility.

- The company's high marketing and R&D spend-driven by costly global launches, continued investment in biologics manufacturing, and an above-industry R&D ratio-may fail to generate sufficient incremental revenue if new products underperform or regulatory burdens raise costs further, squeezing net margins.

- UCB remains heavily reliant on a concentrated set of pipeline and newly launched assets (such as BIMZELX, RYSTIGGO, and FINTEPLA), so any regulatory, commercial, or clinical setbacks (for example, failed late-stage trials or poorer-than-expected payer access) would elevate earnings risk and destabilize cash flows.

- The rapid emergence of value-based care, outcome-based pharmaceutical pricing models, and technological disruption from digital health and non-traditional competitors could undermine UCB's traditional revenue models and pricing power over the long term, risking sustained pressure on revenue and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for UCB is €250.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of UCB's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €250.0, and the most bearish reporting a price target of just €135.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €10.1 billion, earnings will come to €2.6 billion, and it would be trading on a PE ratio of 22.1x, assuming you use a discount rate of 5.9%.

- Given the current share price of €177.85, the bullish analyst price target of €250.0 is 28.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.