Key Takeaways

- UCB's new product launches and high R&D success rate are driving anticipated revenue and margin growth across global markets.

- Expansion in therapeutic areas like Alzheimer's and dermatology aims to meet unmet needs and boost profitability.

- Heavy reliance on specific growth drivers, R&D investments, and external pressures could challenge UCB's revenue and profitability stability.

Catalysts

About UCB- A biopharmaceutical company, develops products and solutions for people with neurology and immunology diseases worldwide.

- UCB is entering a decade of growth, supported by several key product launches that have collectively reached over €1.3 billion in revenue, providing a strong platform for future revenue growth.

- UCB's R&D success rate is substantially higher than the industry average, and the recent filing of multiple new drug applications across geographies such as the U.S., Europe, and Japan is expected to drive future revenue growth and enhance net margins through increased scale.

- The company is focusing on expanding its presence in promising therapeutic areas, including bepranemab for Alzheimer's and galvokimig for atopic dermatitis, which could enhance future revenue and net margins due to their potential to address unmet medical needs in these fields.

- The successful launch of BIMZELX, with rapid uptake in the market, is expected to significantly drive revenue growth, particularly in dermatology and rheumatology, while improvements in reimbursement and expanded indications may further optimize net margins.

- UCB has indicated guidance for sustained revenue growth and considerable improvement in profitability by 2025, with a focus on superior execution and efficiency gains anticipated to substantially enhance EBITDA margins and earnings growth.

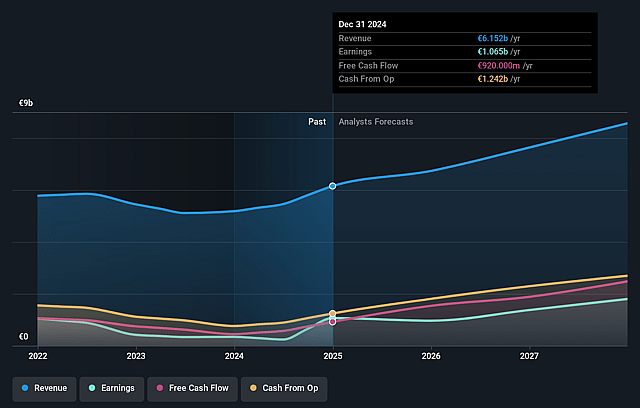

UCB Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming UCB's revenue will grow by 11.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 17.3% today to 21.2% in 3 years time.

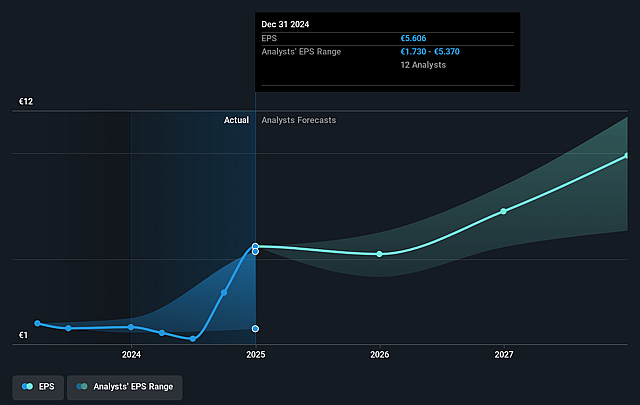

- Analysts expect earnings to reach €1.8 billion (and earnings per share of €9.75) by about July 2028, up from €1.1 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €2.3 billion in earnings, and the most bearish expecting €1.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.7x on those 2028 earnings, down from 33.1x today. This future PE is lower than the current PE for the GB Pharmaceuticals industry at 52.8x.

- Analysts expect the number of shares outstanding to grow by 0.17% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.86%, as per the Simply Wall St company report.

UCB Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- UCB experienced a decline in revenue by 6% in 2023, despite the subsequent recovery in 2024. This volatility could pose risks to sustainable revenue growth if similar declines were to occur again in the future.

- The company is significantly relying on five key growth drivers for future revenue streams, with high expectations for products like BIMZELX. Any underperformance or challenges in these areas due to competition or market conditions could impact revenue projections.

- The heavy investment in R&D (29% of revenue in 2024) could impact net margins if the associated products don’t achieve expected commercial success, thereby not justifying the high R&D expenditure.

- Potential pricing pressures on key income sources like CIMZIA might lead to net revenue declines, especially given the expected market erosion in the U.S. due to biosimilars and pricing pressures.

- External factors such as potential tariff changes on U.S. exports could also negatively impact UCB’s cost structures and profit margins, adding risk to earnings and profitability stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €214.833 for UCB based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €250.0, and the most bearish reporting a price target of just €135.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €8.6 billion, earnings will come to €1.8 billion, and it would be trading on a PE ratio of 26.7x, assuming you use a discount rate of 5.9%.

- Given the current share price of €185.4, the analyst price target of €214.83 is 13.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.