Key Takeaways

- Rapid adoption of innovative therapies and expanded indications position UCB for sustained, above-industry revenue and earnings growth amid rising global demand for specialty treatments.

- Ongoing digitalization, operational leverage, and a shift to higher-margin products are boosting profitability, setting the stage for continued margin expansion and market share gains.

- UCB's revenue growth and profitability face sustained threats from pricing pressures, patent expirations, heavy investment, intense competition, and uncertainty around future drug launches.

Catalysts

About UCB- A biopharmaceutical company, develops products and solutions for people with neurology and immunology diseases worldwide.

- Analysts broadly agree that UCB's pipeline of recently launched products and upcoming indications is fueling a "decade of growth," but current data suggests that the acceleration has been underestimated-growth drivers have already delivered more than double last year's revenue in the first half alone and rapid new patient onboarding, especially in the U.S., sets the stage for recurring, compounding revenue outperformance and powerful top-line upside.

- Analyst consensus highlights the potential for margin expansion from new launches and economies of scale, but recent financial results already show operating leverage kicking in faster than expected-UCB's adjusted EBITDA margin rose by nearly 700 basis points year-over-year with a mix shift into higher-margin indications and clear evidence that continued revenue growth will drive even stronger net margin and earnings gains in coming years.

- UCB's leadership in dual IL-17A/F inhibition (BIMZELX) and push into multiple high-unmet-need indications is winning rapid adoption, and with major diseases like hidradenitis suppurativa and palmoplantar pustulosis set for explosive biologics penetration over the next decade, UCB is uniquely positioned to capture outsized market share and sustainable revenue streams as treatment standards shift toward advanced biologics.

- The global aging population and rising prevalence of chronic neurological and autoimmune diseases continue to expand the addressable patient pool for UCB's differentiated therapies, ensuring not just robust demand, but the potential for long-term, above-industry growth in both revenues and durability of earnings as more markets gain access to these specialty treatments.

- Accelerating digitalization and data-driven drug R&D at UCB, enabled by increased investment and organizational focus, is already shortening development timelines and enabling faster, more cost-effective launches-this positions UCB for persistent gross margin widening and sustained double-digit earnings per share growth through continued pipeline productivity and operational efficiency.

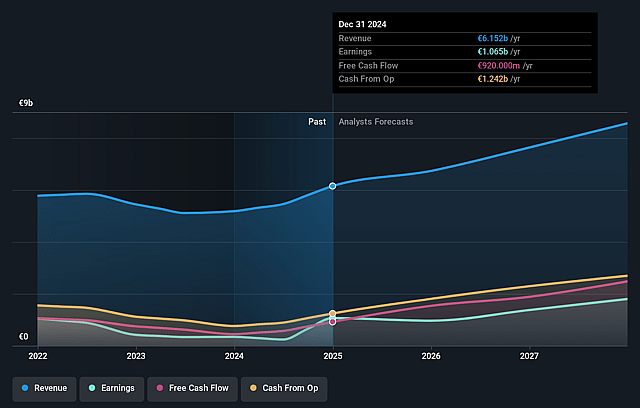

UCB Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on UCB compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming UCB's revenue will grow by 16.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 19.5% today to 25.0% in 3 years time.

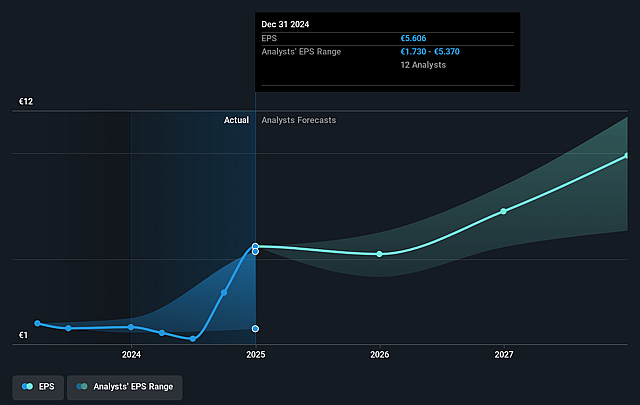

- The bullish analysts expect earnings to reach €2.7 billion (and earnings per share of €14.17) by about September 2028, up from €1.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 21.3x on those 2028 earnings, down from 29.7x today. This future PE is lower than the current PE for the GB Pharmaceuticals industry at 55.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.97%, as per the Simply Wall St company report.

UCB Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- UCB faces significant, ongoing pricing pressure in key markets like the U.S. and Europe, including rising rebates, payer restrictions, and potential regulatory actions such as price caps, which are likely to erode net pricing and limit top-line revenue growth and profitability over the long term.

- The company is highly dependent on continued success of BIMZELX and a small number of new launch products, but faces mounting competition from existing biologics, emerging biosimilars, and potential oral entrants, raising risk of market share loss and future revenue declines as exclusivity periods narrow.

- The narrative points to heavy, sustained R&D and sales and marketing investment-especially with large-scale global launches and clinical trial expansions-that could outpace the growth in net sales if pipeline assets underperform or if market adoption lags, putting downward pressure on future net margins and overall earnings.

- UCB acknowledges upcoming major patent expirations for revenue-driving drugs (Cimzia, Vimpat, Keppra), and while pipeline progress is highlighted, there is considerable uncertainty about the timing and commercial viability of late-stage assets, which could result in unpredictable and volatile revenue and earnings.

- Structural shifts such as the global pivot to value-based care and outcome-based pricing, plus increasing scrutiny of drug affordability by payers, governments, and patient groups, threaten to undermine reimbursement rates and the profitability of both existing and pipeline products over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for UCB is €255.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of UCB's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €255.0, and the most bearish reporting a price target of just €160.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €10.8 billion, earnings will come to €2.7 billion, and it would be trading on a PE ratio of 21.3x, assuming you use a discount rate of 6.0%.

- Given the current share price of €208.4, the bullish analyst price target of €255.0 is 18.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.