Last Update 18 Dec 25

Fair value Increased 2.45%UCB: Expanding Late-Stage Pipeline And New Launches Will Drive Future Upside

UCB's analyst price target has been raised from EUR 258.33 to EUR 264.67 as analysts factor in slightly stronger revenue growth expectations, despite a modestly lower projected profit margin and only a small uptick in future valuation multiples.

Analyst Commentary

Recent price target increases signal that bullish analysts see a more attractive risk reward profile for UCB, driven by improving growth visibility and confidence in execution.

Bullish and cautious perspectives can be summarized as follows:

Bullish Takeaways

- Bullish analysts are lifting price targets into the high EUR 280s, indicating greater conviction that UCB's earnings growth can exceed prior expectations.

- Higher targets suggest improved confidence in the sustainability of top line momentum, with upside seen from pipeline assets and new product launches.

- Maintained Buy ratings point to the view that current valuation still does not fully reflect UCB's medium term growth and margin expansion potential.

- Upward revisions across multiple research houses imply a broadening consensus that management can deliver on execution milestones and capital allocation plans.

Bearish Takeaways

- The step up in target prices, while sizable, remains measured, signaling that some analysts still see execution risk around ramping newer therapies.

- Moderate upside to the revised price targets suggests caution regarding how quickly margins can improve given investment needs and competitive intensity.

- Despite positive revisions, the lack of rating upgrades beyond existing Buy stances indicates some residual uncertainty on long term earnings durability.

- Valuation sensitivity to clinical and regulatory outcomes leaves room for downside if key milestones are delayed or fall short of expectations.

What's in the News

- FDA approved KYGEVVI as the first treatment for thymidine kinase 2 deficiency in pediatric and adult patients with early symptom onset, supported by survival data showing an approximate 86% reduction in risk of death compared with matched untreated controls (Key Developments).

- Phase 3 GEMZ trial of adjunctive fenfluramine in CDKL5 deficiency disorder met its primary endpoint and two of three key secondary endpoints, delivering a 47.6 percent median reduction in motor seizure frequency versus 2.8 percent for placebo and positive safety findings (Key Developments).

- UCB reported three year data from BE HEARD studies showing BIMZELX delivers sustained improvements in skin pain and draining tunnels in moderate to severe hidradenitis suppurativa, with more than 60 percent of patients free of draining tunnels at three years in key analyses (Key Developments).

- New three year Phase 3 and real world data on BIMZELX in psoriatic arthritis and axial spondyloarthritis further support durable efficacy and reinforce UCB's strategy in immunology and rheumatology (Key Developments).

- Citizen Health and UCB entered a multi year strategic partnership to use AI driven patient insights and real world data in epilepsy and rare diseases, aiming to accelerate research and improve patient centric trial participation (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has risen slightly from €258.33 to €264.67, reflecting a modest uplift in estimated fair value.

- Discount Rate is unchanged at 6.16 percent, indicating no shift in the assumed risk profile or cost of capital.

- Revenue Growth has increased moderately from 13.16 percent to about 13.96 percent, pointing to slightly stronger top line expectations.

- Net Profit Margin has fallen slightly from 21.50 percent to about 21.10 percent, suggesting a small deterioration in projected profitability.

- Future P/E has edged up from 27.38x to about 27.99x, implying a marginally higher valuation multiple on forward earnings.

Key Takeaways

- Expansion into chronic and underserved conditions with innovative therapies and specialty biologics positions UCB for sustained growth and resilience against competitive pressures.

- Investments in manufacturing, digital R&D, and effective global market access enhance scalability, operational efficiency, and long-term margin expansion.

- Sustained pressures from pricing, patent expiries, changing reimbursement, R&D risks, and therapeutic alternatives threaten UCB's long-term growth, margins, and demand for core products.

Catalysts

About UCB- A biopharmaceutical company, develops products and solutions for people with neurology and immunology diseases worldwide.

- Strong demand drivers are in place due to the expansion of chronic disease prevalence in aging populations and increased global healthcare spending, especially in emerging markets; UCB's launch of BIMZELX and other late-stage therapies targeting underserved and chronic conditions positions the company to capture significant new revenue streams over the coming years.

- UCB's deep and advancing innovation pipeline, along with its focus on differentiated products in neurology and immunology, supports the ability to launch multiple new indications, address rare/orphan diseases, and leverage advances in personalized medicine, all of which underpin sustained long-term revenue growth and margin expansion.

- Effective global market access and rapid penetration-especially in the U.S., Europe, and Japan-with high conversion rates to paid scripts, broadening indications, and robust patient onboarding programs for key launches like BIMZELX are driving accelerating top-line growth and improved gross margin mix.

- Significant investments into manufacturing capacity (e.g., U.S. greenfield expansion) and digitalization of R&D are expected to support future scalability, operational efficiencies, and cost competitiveness, directly benefiting net margin and long-term earnings potential.

- Strategic focus on rare diseases and specialty biologics, where UCB already demonstrates strong expertise and growing market share, aligns with long-term industry trends toward higher pricing power and less competition, providing resilience against generic erosion and supporting durable high-margin revenue.

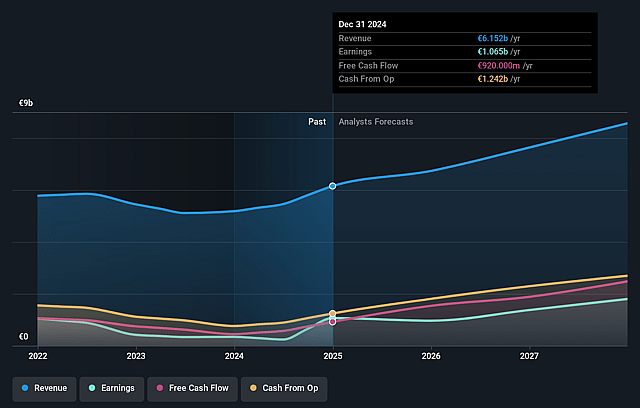

UCB Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming UCB's revenue will grow by 11.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 19.5% today to 21.7% in 3 years time.

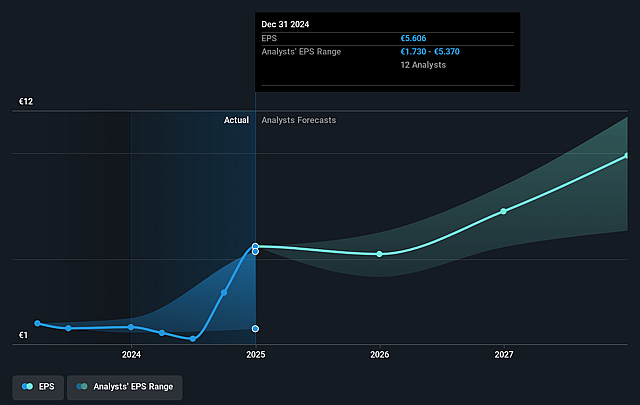

- Analysts expect earnings to reach €2.1 billion (and earnings per share of €10.98) by about September 2028, up from €1.3 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €2.4 billion in earnings, and the most bearish expecting €1.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.6x on those 2028 earnings, down from 28.8x today. This future PE is lower than the current PE for the GB Pharmaceuticals industry at 53.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.97%, as per the Simply Wall St company report.

UCB Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intense pricing pressure and increasing rebate rates in the U.S. market, especially for BIMZELX, are expected to continue as market access expands and payer negotiations intensify-this structural pricing erosion threatens UCB's long-term revenue growth and net margins.

- Patent expiries and biosimilar competition loom for key mature assets such as CIMZIA, as acknowledged with ongoing price erosion and normalization of U.S. buying patterns, putting significant pressure on both revenue and future earnings as exclusivity wanes.

- Rising global healthcare cost containment, payer scrutiny, and the potential implementation of U.S. tariffs could materially reduce reimbursement, increase supply chain costs, and create uncertainty around UCB's ability to sustain profitability, impacting both net margin and revenues over the long term.

- High R&D spending and pipeline concentration within neurology, immunology, and a few launch products (especially BIMZELX) increases vulnerability to late-stage clinical setbacks, regulatory hurdles, or competitive launches, risking volatility in R&D expenses and future earnings if approvals disappoint or therapeutic displacement occurs.

- Advancements in alternative modalities-such as efficacious oral therapies for chronic inflammatory diseases (e.g., Icotrokinra)-in combination with a general trend towards preventative medicine and digital health, may reduce long-term reliance on chronic biologic interventions and threaten sustained demand and revenue for UCB's cornerstone biologic products.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €225.0 for UCB based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €255.0, and the most bearish reporting a price target of just €160.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €9.4 billion, earnings will come to €2.1 billion, and it would be trading on a PE ratio of 24.6x, assuming you use a discount rate of 6.0%.

- Given the current share price of €202.0, the analyst price target of €225.0 is 10.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on UCB?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.