Key Takeaways

- Pricing pressures, loss of exclusivity on key drugs, and rising regulatory barriers threaten revenue growth, profitability, and UCB's ability to sustain its branded market share.

- Limited pipeline diversity and slow digital transformation increase vulnerability to clinical setbacks, shifting market trends, and diminished long-term competitiveness.

- Strong late-stage pipeline, global expansion, and innovative biologics together position UCB for sustained revenue growth, margin improvement, and resilience against market challenges.

Catalysts

About UCB- A biopharmaceutical company, develops products and solutions for people with neurology and immunology diseases worldwide.

- The company's future revenue growth is at risk due to intensifying global pricing pressures, including expected annual double-digit price cuts in the United States over the medium term for BIMZELX, compounded by upcoming rebate negotiations with payers and the growing bargaining power of payers and providers, which will erode top-line growth and diminish UCB's pricing leverage in key markets.

- The long-term financial outlook is severely threatened by the impending loss of exclusivity on legacy blockbusters such as Cimzia and Vimpat in the latter half of the decade, which will trigger the entry of biosimilars and generics, resulting in material revenue declines and significant net margin compression as UCB struggles to defend its branded product market share.

- Increasing scrutiny of pharmaceutical expenditures and rising regulatory hurdles for drug approvals-especially in the U.S. and Europe-will drive up R&D costs, lengthen timelines to market for UCB's pipeline assets, and hinder the company's ability to capitalize on new product launches, directly impacting both net earnings and operating margins in the years ahead.

- UCB's concentrated exposure in neurology and immunology heightens clinical and commercial risk, which, combined with a relatively narrower late-stage pipeline compared to larger industry peers, leaves the company especially vulnerable to clinical trial failures, regulatory setbacks, or shifts in treatment paradigms-further undermining long-term earnings growth and investor confidence.

- The digitalization of healthcare and accelerated adoption of data-driven personalized medicine are rapidly shifting industry standards, and UCB's current pace of digital investment and infrastructure development may be insufficient to maintain competitive positioning, threatening both future revenue streams and the company's ability to optimize operational efficiency and margin expansion over the long term.

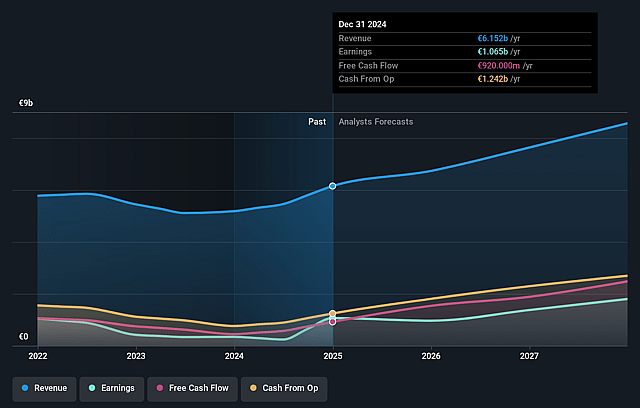

UCB Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on UCB compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming UCB's revenue will grow by 4.4% annually over the next 3 years.

- The bearish analysts are assuming UCB's profit margins will remain the same at 19.5% over the next 3 years.

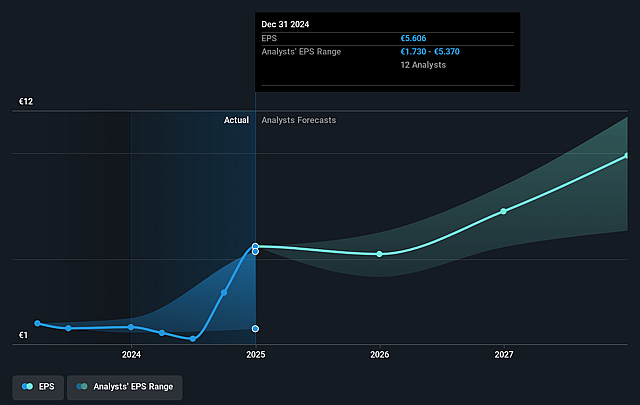

- The bearish analysts expect earnings to reach €1.5 billion (and earnings per share of €8.0) by about September 2028, up from €1.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 25.6x on those 2028 earnings, down from 29.7x today. This future PE is lower than the current PE for the GB Pharmaceuticals industry at 55.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.97%, as per the Simply Wall St company report.

UCB Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- UCB's robust late-stage pipeline and track record of 86% Phase III success, along with significant investment in new indications and biologics, positions the company for continued product launches and revenue growth over the long term.

- The rapidly expanding chronic disease markets in neurology and immunology, combined with an aging global population and increasing healthcare coverage, are expected to drive higher sustained demand and underpin UCB's topline.

- UCB's effective geographic expansion-especially strong access and rollout in the US and Asia-and targeted partnerships are delivering operational leverage, which may result in further margin expansion and earnings growth.

- Accelerating adoption of UCB's new launches, such as BIMZELX and FINTEPLA, with broadening indications and strong physician uptake, supports a powerful flywheel for recurring revenues and resilience even amid generic competition.

- Rising industry incentives for orphan drugs, regulatory tailwinds for advanced therapies, and UCB's focus on research-driven biologics and digital innovation provide a favorable environment for premium pricing, portfolio differentiation, and robust net margins in the medium to long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for UCB is €173.07, which represents two standard deviations below the consensus price target of €226.11. This valuation is based on what can be assumed as the expectations of UCB's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €255.0, and the most bearish reporting a price target of just €160.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €7.8 billion, earnings will come to €1.5 billion, and it would be trading on a PE ratio of 25.6x, assuming you use a discount rate of 6.0%.

- Given the current share price of €208.4, the bearish analyst price target of €173.07 is 20.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.