Key Takeaways

- Structural growth in renewable energy and infrastructure, plus innovation in sustainable materials, positions Bekaert for sustained revenue and margin expansion.

- Geographic diversification and efficiency measures enhance resilience, enabling market share gains and future earnings growth as global demand rebounds.

- Intensifying competition, cost pressures, delayed growth in new markets, and structural demand weakness threaten long-term profitability and revenue stability across core and specialty segments.

Catalysts

About NV Bekaert- Provides steel wire transformation and coating technologies worldwide.

- Structural momentum in infrastructure and energy investments globally, particularly demand for steel wire in renewable energy projects (wind, solar, grid buildouts), positions Bekaert for long-term revenue growth as these sectors accelerate after current market uncertainty subsides.

- Continued innovation in sustainable construction materials (e.g., Dramix Loop using recycled tire cord, Flexofibers acquisition) aligns with increasing industry and regulatory demand for sustainability and circularity, supporting future revenue growth and enhancing operating margins through premium offerings.

- Ongoing expansion and sales growth in emerging markets (notably China, India, Middle East, and Latin America), where demand for infrastructure and automotive products remains robust or is recovering, reduces dependency on slower-growing mature markets and underpins future topline and earnings resilience.

- Significant cost reduction and digitalization efforts (overhead cuts, footprint rightsizing, process automation, supply chain optimization) are structurally improving efficiency, which should enable rapid margin expansion and EBITDA growth as end-market volumes rebound.

- Strong balance sheet and disciplined capital allocation (lower capex in current conditions; flexible to accelerate growth investments/M&A when demand recovers), coupled with proven tariff pass-through, position Bekaert to capture operating leverage and market share gains, supporting future earnings growth and margin improvement.

NV Bekaert Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming NV Bekaert's revenue will grow by 1.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.5% today to 7.9% in 3 years time.

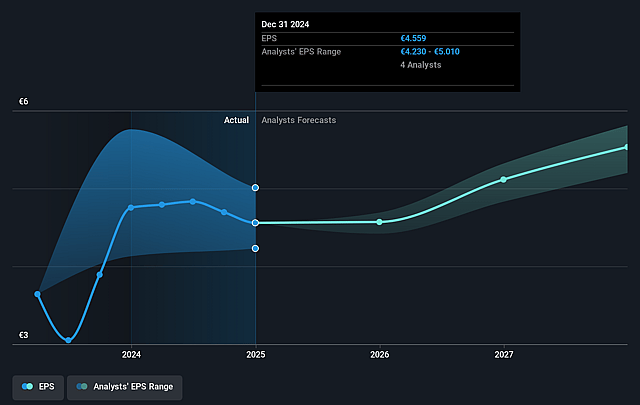

- Analysts expect earnings to reach €320.6 million (and earnings per share of €5.39) by about September 2028, up from €173.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.8x on those 2028 earnings, down from 11.0x today. This future PE is lower than the current PE for the GB Metals and Mining industry at 9.9x.

- Analysts expect the number of shares outstanding to decline by 2.75% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.46%, as per the Simply Wall St company report.

NV Bekaert Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent global overcapacity in steel and especially in tire cord (notably in China, with new entrants like Zenith) creates continued price pressure and intensifies competition, which may suppress long-term margins and revenue growth, particularly in core tire reinforcement businesses.

- Secular shift in end markets (such as slower adoption/timing of energy transition platforms and delayed growth in hydrogen) is now explicitly acknowledged by management; this delays targeted growth trajectories and pushes back profitability ambitions (10% profit margin target postponed), thus dampening longer-term earnings growth expectations.

- Ongoing difficulty fully passing through steep input cost increases, import duties, and tariffs-especially the recent move to 50% steel tariffs-adds uncertainty regarding customer demand elasticity; if end markets cannot absorb higher finished goods costs, future volumes and revenues could decline.

- Structural demand weakness and more pronounced volume declines in Europe and North America, particularly in specialties and sustainable construction, combined with increasing competition in flooring (EU, Australia) and new threats from entrants like Sika, raises risk of durable revenue erosion in key segments.

- Currency headwinds (particularly weaker USD and CNY vs EUR), coupled with the effects of plant closures, disposals, and increasing regional supply chain fragmentation, reduce the company's top-line and earnings resilience while heightening the risk of volatility in reported revenue and net margins over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €43.7 for NV Bekaert based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €55.0, and the most bearish reporting a price target of just €32.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €4.1 billion, earnings will come to €320.6 million, and it would be trading on a PE ratio of 7.8x, assuming you use a discount rate of 7.5%.

- Given the current share price of €38.0, the analyst price target of €43.7 is 13.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.