Key Takeaways

- Declining demand for steel products, combined with slow innovation and digital lag, threatens future growth and risks losing market share to more agile competitors.

- Heightened regulatory costs, operational disruptions, and economic volatility expose margins and revenue to persistent uncertainty and increased risk across markets.

- Strong pricing power, cost controls, strategic innovation, and geographic diversification position Bekaert for resilient margins, growth, and upside amid evolving market and sustainability trends.

Catalysts

About NV Bekaert- Provides steel wire transformation and coating technologies worldwide.

- Structural overcapacity in core steel wire markets, combined with the accelerating substitution of steel products by advanced composites in key end-use industries, will constrain volume growth and could lead to persistent revenue headwinds over the next several years.

- Rising compliance costs and operational disruptions from increasingly strict global decarbonization policies and environmental regulations are likely to erode net margins, especially as Bekaert faces higher hurdles to remain competitively low-carbon amid tightening standards.

- Over-reliance on cyclical automotive, construction, and energy sectors exposes the company to amplified swings in demand; with continued macro uncertainty and government-driven volatility (such as tariffs and uneven green subsidies), revenue stability and long-term earnings visibility remain at risk.

- Slow pace of innovation relative to faster-moving competitors in wire and specialty materials, combined with the risk of digitalization and automation lag, could lead to future margin compression and potential market share loss if Bekaert fails to adequately invest in next-generation products.

- Foreign exchange pressures and instability in emerging markets, coupled with geopolitical risks from the company's globally dispersed footprint, elevate the risk of supply chain disruptions, localized cost inflation, and unpredictable impacts on both revenue and profitability.

NV Bekaert Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on NV Bekaert compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming NV Bekaert's revenue will grow by 1.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 4.5% today to 7.5% in 3 years time.

- The bearish analysts expect earnings to reach €303.8 million (and earnings per share of €5.52) by about September 2028, up from €173.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 6.0x on those 2028 earnings, down from 11.0x today. This future PE is lower than the current PE for the GB Metals and Mining industry at 9.8x.

- Analysts expect the number of shares outstanding to decline by 2.75% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.46%, as per the Simply Wall St company report.

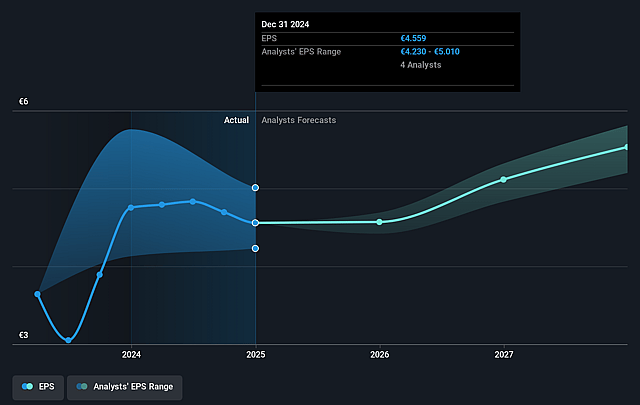

NV Bekaert Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company has demonstrated strong ability to manage and pass on significant steel and aluminum tariffs to its customers, which has largely protected its revenue and margins despite a challenging market environment. This ability to adjust pricing could continue to support both revenue and net margins going forward.

- Strict cost control, overhead reduction, and targeted capacity rightsizing-particularly evidenced by €21 million in overhead cost cuts and improved inventory management-have made Bekaert more cost competitive than in the past. This enhances operational leverage and positions earnings to rebound quickly with any volume recovery.

- The business has shown resilience through diversification across geographies and end-markets, with particularly robust growth in China across multiple segments and stable or improving margins in North American and Brazilian operations. This geographic spread reduces the risk of steep revenue declines from weakness in any one region.

- Bekaert's long-term strategic pivot towards higher-value, specialty, and recycled products (such as innovations in sustainable construction with Dramix Loop and the Flexofibers acquisition) positions the company to benefit from growing trends in sustainability, circularity, and higher-margin specialty applications, which could structurally lift average selling prices and improve net profitability.

- The company maintains a healthy balance sheet, strong cash flows, and continues its share buyback program, while preserving the capacity and willingness to invest in accretive M&A or growth projects as market conditions improve. This financial strength mitigates downside risk to earnings and supports potential upward re-rating of the share price.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for NV Bekaert is €32.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of NV Bekaert's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €55.0, and the most bearish reporting a price target of just €32.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be €4.0 billion, earnings will come to €303.8 million, and it would be trading on a PE ratio of 6.0x, assuming you use a discount rate of 7.5%.

- Given the current share price of €38.0, the bearish analyst price target of €32.0 is 18.8% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.